CULA leverages Self Inspection to help credit unions & lessees

Image courtesy of Credit Union Leasing of America (CULA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Credit Union Leasing of America (CULA) recently partnered with Self Inspection, a startup specializing in artificial intelligence-powered inspections that gained $3 million in seed funding in February.

The initial fruit from that seed is CULA highlighting the success of a program already utilized by more than 11,000 lessees that has reduced lease-end vehicle turnaround times for credit unions by 50%.

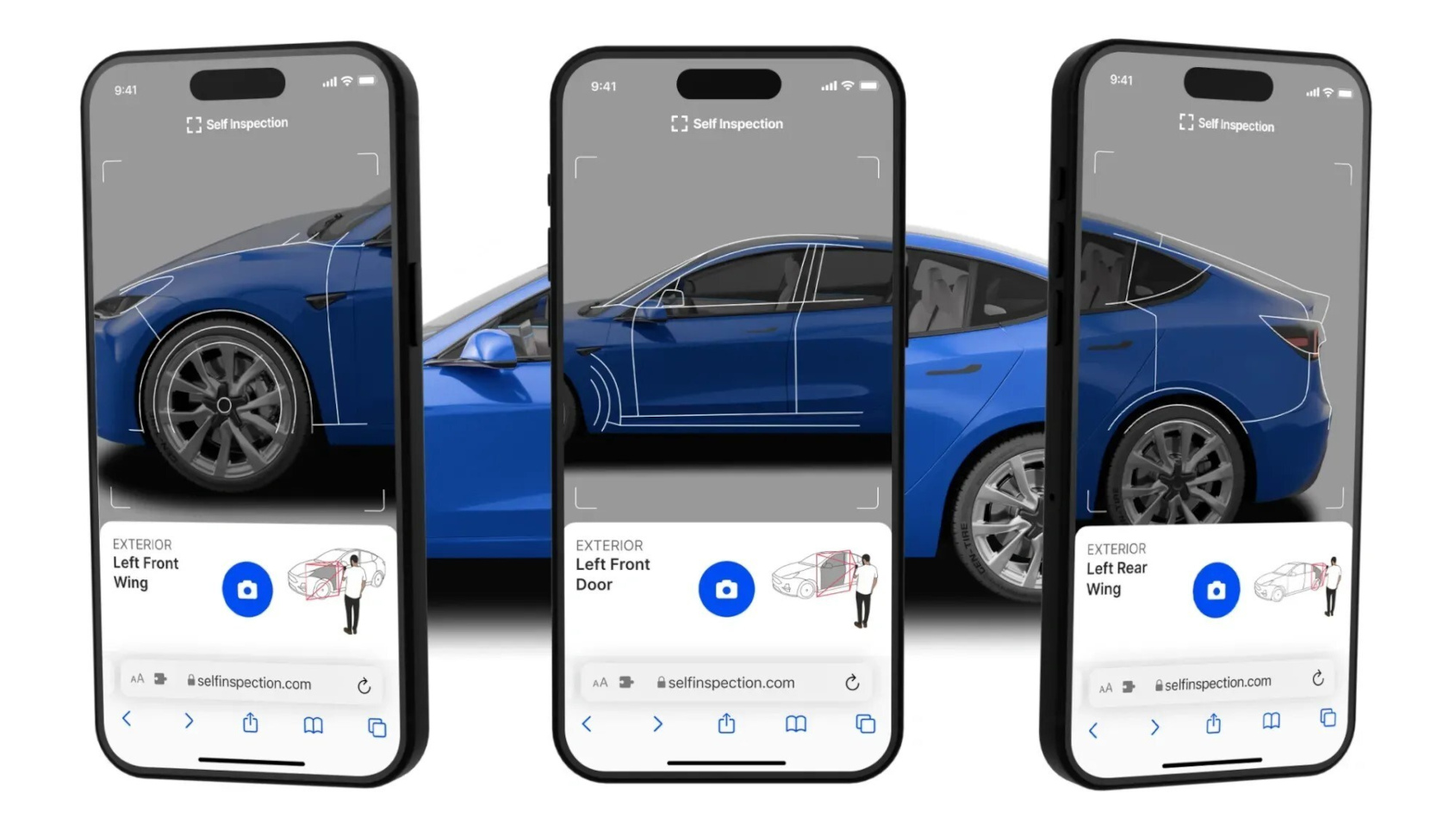

The program enables consumers to complete inspections at their convenience in just 10 minutes using a smartphone.

“By streamlining the inspection process, the program has reduced turnaround times and associated operational costs,” CULA president Ken Sopp said in a news release. “Self-inspections allow lessees to complete the process faster and receive condition reports more quickly, making it much more convenient – which is why 95% of lessees opt for self-inspection and home pickups at turn-in over traditional physical inspections. This is a win-win for credit unions and credit union members.”

CULA previously depended on physical inspectors who would visit the lessee’s home or office, often resulting in delays of up to two weeks due to appointment scheduling and processing times. Now, control is directly in the hands of lessees, allowing them to complete a full vehicle inspection with no additional software or third-party scheduling required.

The revamped process now consists of capturing a series of images documenting the vehicle’s condition and concludes with a 360-degree walk-around video for a comprehensive review. Lessees receive an inspection link immediately, and a comprehensive condition report within one to two days, enabling them to complete their lease return faster and without wait times.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“CULA is the first company to pilot AI-driven vehicle inspection services for lease-end processes, partnering with Self Inspection to revolutionize the traditional, time-consuming inspection methods,” Self Inspection CEO Constantine Yaremtso said in the news release. “Together, we developed a fully autonomous system that matches the quality of physical inspections, while leveraging the speed, consistency, and accuracy that only AI can provide.”

CULA and Self Inspection pointed out that an important benefit of the program’s AI-driven assessments is the improved accuracy and consistency of damage detection, which has resulted in a measurable reduction in disputes about wear-and-tear charges.

In addition, the companies said the program can deliver scalability and efficiency by allowing thousands of vehicles to be inspected simultaneously, preventing scheduling backlogs during peak lease return seasons and easing demand on third-party inspection vendors.

CULA and Self Inspection went on to note that the program’s consistent and detailed condition reporting is designed to strengthen trust between credit unions and their members, while supporting a more seamless and customer-friendly leasing experience.

“For over 35 years, CULA has led innovation in vehicle leasing, and today we continue to set the standard,” Sopp said. “By pioneering AI-driven vehicle inspections for credit unions, we have transformed the lease-end experience — accelerating turnaround times, enhancing customer satisfaction, and inspiring a new wave of innovation across the automotive leasing industry.”