CULA survey: Credit unions’ view of auto finance improves from 9 months ago

Chart courtesy of Credit Union Leasing of America (CULA) .

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

A lot can change in nine months. Just ask parents.

Similarly, a new survey from Credit Union Leasing of America (CULA) showed that credit unions are generally more optimistic about their auto finance portfolios than they were nine months ago.

In fact, the majority have seen an increase in auto financing compared to last year.

Nevertheless, CULA noticed the vast majority (85%) expect that President Trump’s tariffs will mean consumers delay vehicle purchases, with 65% of respondents anticipating that the tariffs will drive a decrease in vehicle sales.

Only 21% of participating credit unions expect Trump to soften his stance on tariffs and that the market will stabilize.

The survey was conducted among credit union professionals in late June through early August.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Key survey takeaways gathered among 119 credit union professionals included:

—65% of credit union professionals surveyed expect President Trump’s tariffs on autos to drive a decrease in sales

—71% say auto financing year-to-date has increased (58%) or stayed the same (13%), compared to last year; 29% have seen a decrease

—84% expect their auto finance portfolios to grow (53%) or remain stable (31%) in the next six months, compared to the previous six months; 16% expect a decline

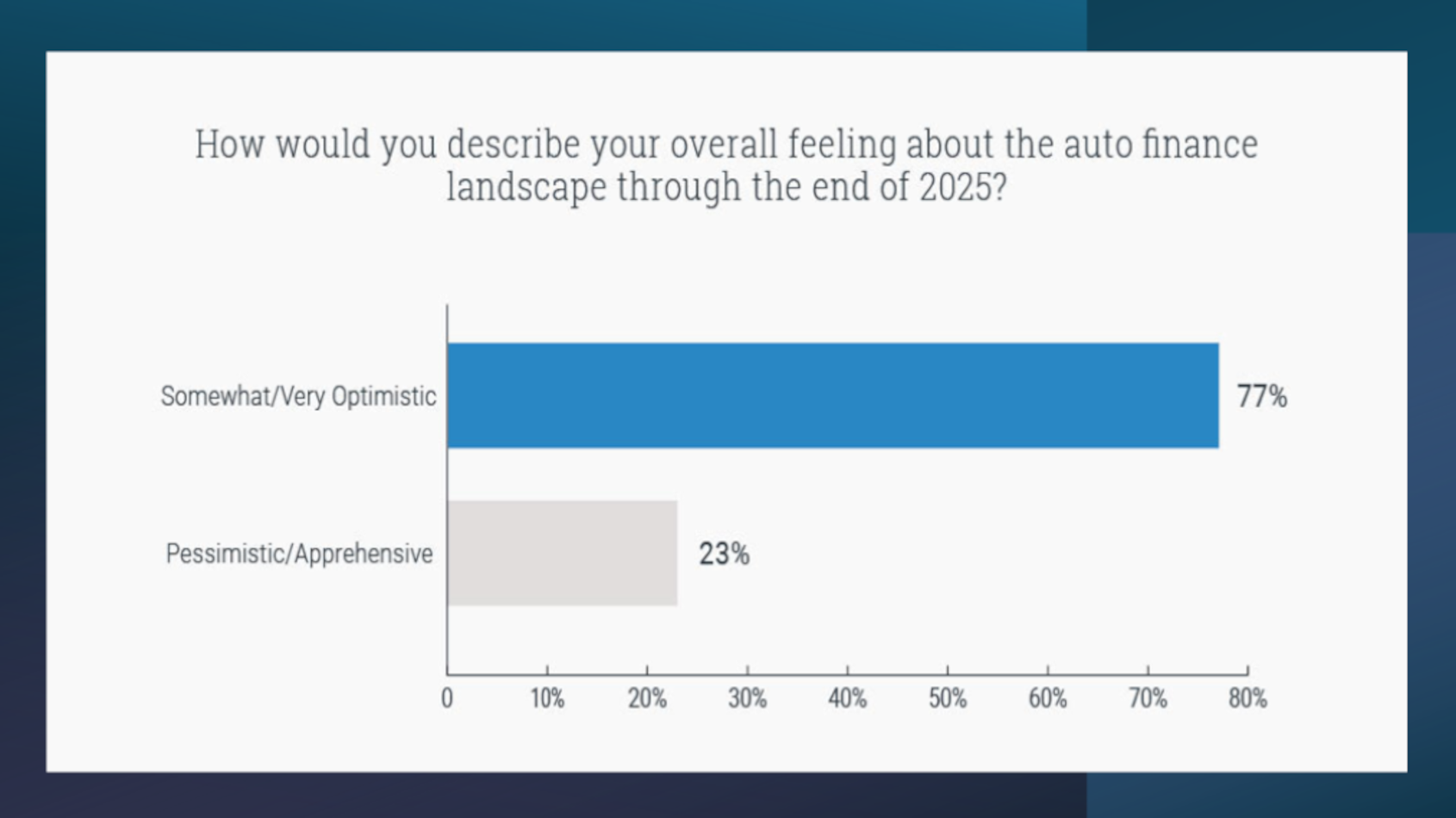

—77% describe their overall feeling about the auto finance landscape through the end of 2025 as optimistic, with 58% somewhat optimistic and 19% very optimistic

—For the 23% who are not optimistic about the auto finance landscape for the balance of the year, tariffs were the number one reason, with delinquencies, continuing inflation, and high interest rates scoring nearly as highly

—71% expect vehicle prices to increase over the next 12 months

—75% expect more consumers to choose leasing over loans over the next six months, with rising prices on consumer goods, leading to a rise in cost of living cited as the top reason

CULA pointed out that affordability being the key factor in consumers’ leasing vehicles reflected similar sentiment from its recent consumer survey.

“While credit unions’ positive outlook has increased, these survey results reveal that they also have concerns about the impact of tariffs on vehicle sales, as well as an expectation that vehicle prices will rise, creating affordability issues that, they expect, will drive more consumers to choose a vehicle lease in the next six months,” CULA president Ken Sopp said in a news release.

“This leasing increase is also reflected in the growth we are seeing in our business at CULA, as we help more credit unions offer their members the lower monthly payments and term flexibility vehicle leasing provides,” Sopp continued.

In spite of concerns about tariffs and rising vehicle prices, credit union professionals’ sentiment about auto finance is more positive than it was nine months ago, with 77% of respondents reporting that they are somewhat (58%), or very (19%), optimistic about the auto finance landscape through the end of 2025, versus only 57% who were somewhat or very optimistic in the third quarter of 2024.

Of the 23% who are not optimistic, tariffs were the No. 1 reason cited, with delinquencies, continuing inflation, and high interest rates scoring nearly as highly.

“The optimism expressed about their auto finance future by the majority of credit unions surveyed, even in the face of some market headwinds, is encouraging and typical of credit unions. After all, credit unions prioritize helping their members with financing options in good times and bad,” CULA director of business development Chris Harper said.

“Their expectation that their portfolios will grow in the next six months aligns with what we are seeing; and, as we partner with credit unions to help more of their members into vehicle leases, we are delighted to support that growth,” Harper went on to say.