With dealers at center, Capital One survey reinforces value of in-person actions with digital tools

Graphic courtesy of Capital One.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

PLANO, Texas –

Capital One discovered that perhaps not everything about the financing and retailing of vehicles changed because of the pandemic.

While buyers are increasingly using digital tools to shop for a vehicle, Capital One compiled data that shows U.S. consumers say they still value the in-person experience at dealerships. That assertion came via Capital One’s inaugural Car Buying Outlook, what the bank called the first-ever survey of both consumer and dealer preferences, attitudes and behaviors around auto financing.

Capital One said 77% of respondents reported they will research financing options and pre-qualification online more than before as a result of COVID-19.

At the same time, Capital One indicated in-person dealer experiences like test driving and negotiations are still important, with 82% of respondents saying they will visit more than one dealership.

“For most Americans, buying a car is one of the biggest purchases they’ll ever make, so it’s not surprising that they want to see, feel and experience this investment for themselves in person, alongside a trusted dealer advisor,” said Sanjiv Yajnik, president of financial services at Capital One.

“The future of car buying requires embracing a model that marries digital tools with physical experience, empowering customers to have the car buying journey they want,” Yajnik continued in a news release.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Additional survey findings delved into three crucial topics.

Value of the in-person experience

Capital One discovered consumers value in-person elements of the vehicle-buying experience and visited the dealership even in the midst of COVID-19, reinforced by these data points:

— 94% of buyers are most comfortable purchasing a vehicle from a dealership.

— 92% of buyers say the test drive is an important part of the buying process.

— 82% of future buyers say they plan to visit more than one dealership.

— 43% of future buyers plan to have financing discussions at the dealership.

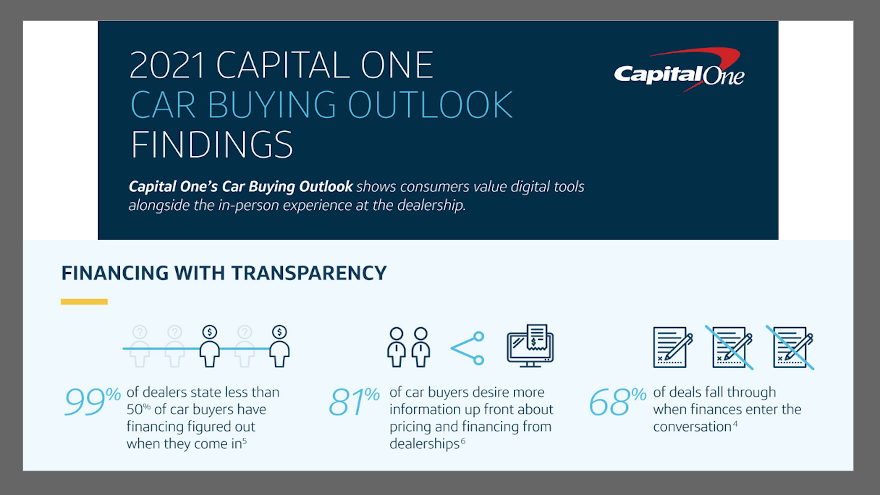

Financing with transparency

Capital One emphasized that dealers play an important role in how vehicle buyers understand their financing options as shown by:

— 68% of deals fall through when finances enter the conversation, according to both dealers and buyers.

— 99% of dealers state less than half of their consumers have their financing figured out when they arrive.

— 54% of buyers state they think about financing after settling on a vehicle, an increase from 43% in 2019.

— 81% of buyers say dealerships should provide more information up front about pricing and financing.

Dealers digitize to meet customer demands

Dealers are adopting digital tools to enhance customer engagement as more consumers turn online for shopping.

— 69% of dealers say the role of technology and digitization in dealer operations will be more important post-COVID-19.

— 56% of dealers have permanently increased their use of digital tools to combat business challenges brought on by COVID-19.

— 38% of dealers agree that the need to improve customers’ experience with technology has been accelerated by COVID-19.

Capital One’s Car Buying Outlook was compiled from findings from two surveys targeted to consumers and dealers.

The consumer survey of 1,000 U.S. adults ages 18 and older was conducted on behalf of Capital One Auto Finance using Ipsos. Of the 1,000, 348 have bought or leased a vehicle in the past 6 months and 652 self-reported that they’re planning to buy or lease a vehicle within the next two years.

The dealer survey of 401 current dealers was conducted on behalf of Capital One Auto Finance using Beresford. Of the 401 respondents, 132 were self-reported as owners, 133 as general managers, 30 as F&I directors, 83 as sales managers and 23 as internet managers.