Independent study by Forrester highlights three primary gains by clients using Experian Ascend Platform

Screenshot courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The top three findings from a recently commissioned total economic impact study of Experian’s global customers by Forrester illustrated what the company’s tools can do for clients.

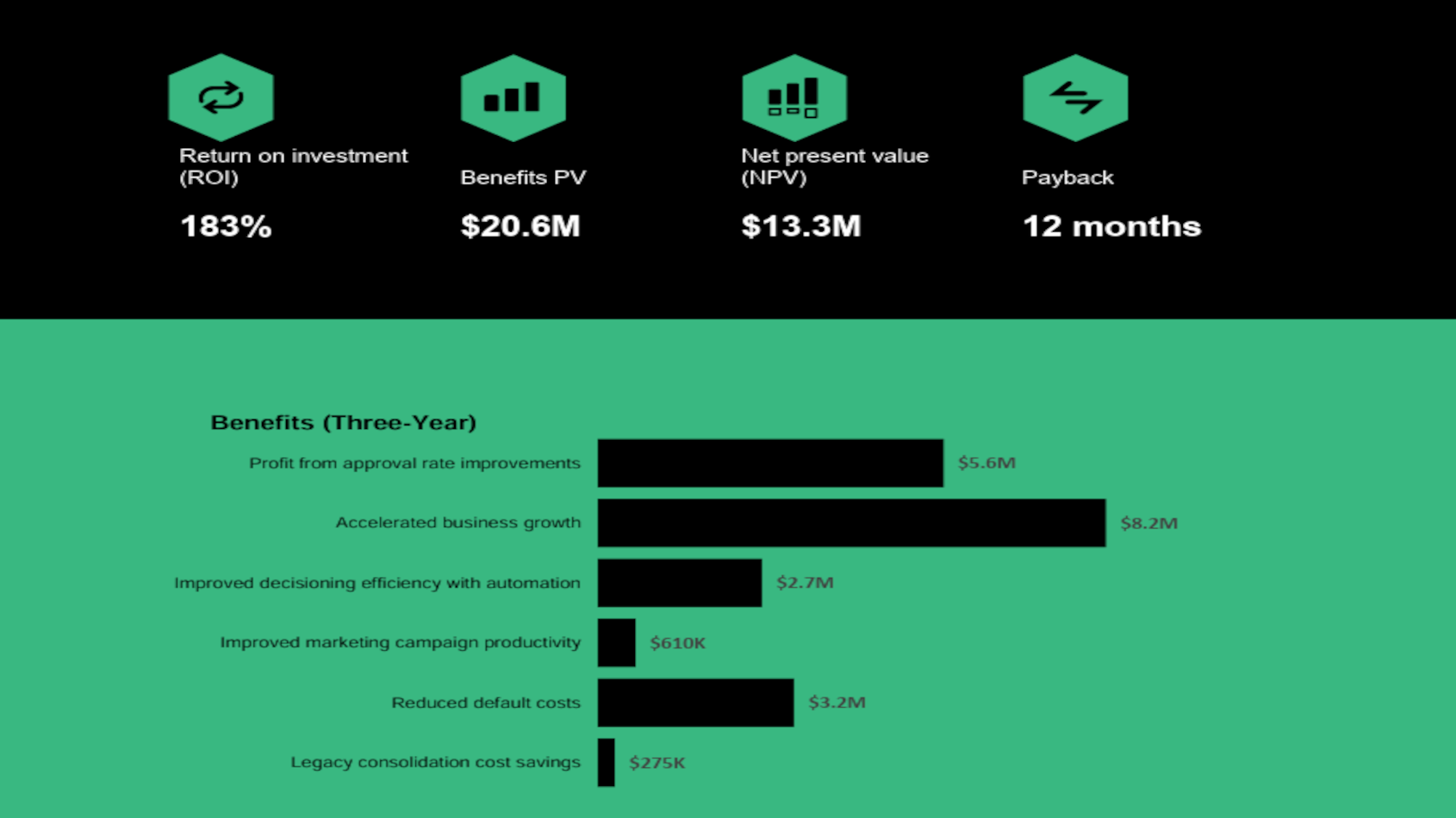

According to a news release from Experian, the study showed that the Experian Ascend Platform helps financial institutions improve credit and fraud decisions, offered a 183% return on investment (ROI) and paid for itself within 12 months.

Experian said its independent findings provide banks and lenders with a framework to evaluate the potential financial impact of the platform on their organizations.

According to the study, Experian’s global customers said that prior to using the platform, their organizations used a mix of fragmented on-premises credit decisioning solutions that required manual-heavy interventions at different stages of the review and approval processes.

As a result, the study showed the credit-decisioning process was lengthy, required staff to look at different data sources, and ultimately impacted response times.

Also, the absence of a consistent decisioning system introduced increased exposure to fraud and default, according to the Forrester project.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

After the investment in Experian Ascend Platform, Experian said those global customers had a unified platform that provided up-to-date consumer and commercial data in one view along with robust analytics, automated decisioning and enhanced fraud prevention.

Key results from deploying the platform included accelerated business growth, improved conversion rates, enhanced operational efficiencies for credit-decisioning and marketing teams, reduced default costs, faster response times, and improved data quality and verification processes.

Other unquantified benefits from the study included:

—Improved customer and broker experience through faster decisioning

—Reduced risk at origination

—Improved compliance and audit processes

—Reduced risk of regulatory fines

—Sustainability benefits through reduced physical documentation that lowered the customer’s carbon footprint.

Hosted in a secure, globally accessible hybrid-cloud environment, the Experian Ascend Platform offers customers worldwide a technology platform that equips them with AI-powered insights for decisioning across the credit lifecycle. As a result, they can stay ahead of rapidly changing market conditions and evolving consumer behaviors to remain competitive, maximize profitability and optimize operational efficiency.

“Experian Ascend Platform helps banks and lenders unlock the full potential of their data throughout the customer lifecycle, using advanced analytics and modeling for fraud and identity, and to explore new market opportunities,” said Keith Little, president of Experian Software Solutions.

“We believe Forrester’s findings underscore the tremendous value that the platform delivers our customers in vital business drivers such as approval rate optimization, business growth acceleration and cost reductions,” Little added.

Forrester interviewed six decision-makers from organizations located in the United States, the United Kingdom, Brazil, and South Africa with experience using Experian Ascend Platform.

For the purposes of the study, Forrester aggregated the customers’ experiences and combined the results into a single composite organization that is a lending institution with regional operations and based on characteristics of the customers’ organizations.

To access the Forrester study of the Experian Ascend Platform, visit https://us-go.experian.com/the-total-economic-impact-of-experian-ascend-platform.