Informed.IQ survey: Deal jacket errors costing lenders millions

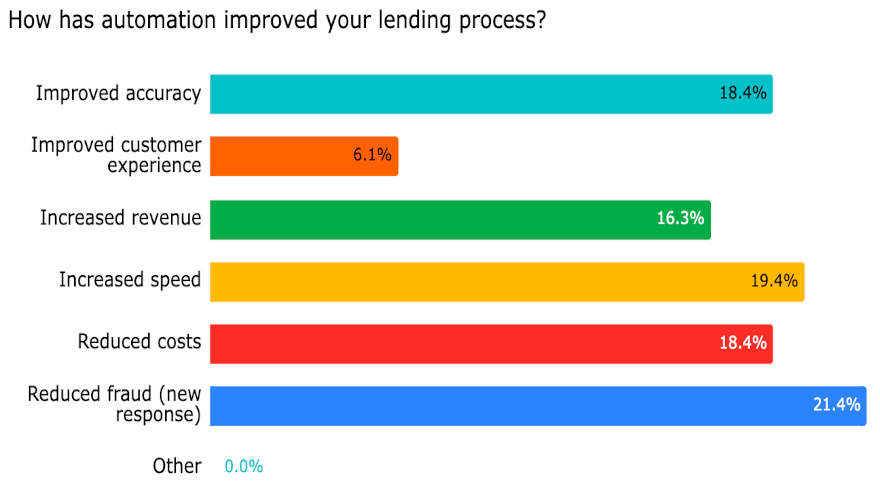

Graphic courtesy of Informed.IQ.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Deal jackets sometimes can prompt auto finance professionals to think they might need a straitjacket because of the frustrating pitfalls that can arise.

The quandaries created by deal jackets and other parts of building compliant and profitable portfolios were among the topics highlighted by Informed.IQ, which recently commissioned an industry-wide survey of auto finance executives.

Informed.IQ wanted to identify the key areas where finance companies are leveraging artificial intelligence (AI) and automation into their workflows and processes, taking their pulse on different areas where compliance issues are affecting them most, as well as the overall challenges they face in implementing automation.

The developer of AI-based software that can verify, streamline and optimize contract processing presented the online survey to more than 2,500 auto finance leaders in January.

Informed.IQ found that the majority of respondents said GAP refunds (25.3%), regulatory compliance (22%), delinquencies (21%), and fair lending (21%) were the topics most concerning to them entering 2024.

Nearly half of respondents (44%) said they haven’t incorporated AI into their lending because their C-Suite still hasn’t fully bought into the idea, and another 30% said they still aren’t operating in a fully digital environment.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Informed.IQ highlighted five key trends involving deal jackets and contract defects identified through the survey, including:

—The majority of respondents (31%) said they want to improve dealer satisfaction as a reason to adopt more automation or AI tools for deal jackets; followed by 26% saying they want to compete more aggressively with other lenders.

—Employer mismatch (26.3%), income mismatch (24.2%), and missing signatures (23.2%) represent the biggest challenges when it comes to documentation defects today.

—The majority of respondents (44%) said that less than 10% of their deal jackets had defects in 2023; roughly a quarter of respondents said 30% of their deal jackets.

—Another 44% said errors in their deal jackets in 2023 cost them an estimated $1 million in 2023; Nearly a third (30%) said deal jacket errors cost them between $1 million and $5 million in 2023.

—When it comes to the accuracy of deal jackets, 46% of respondents said they are most concerned about increasing the number of staff hours to scrutinize accuracy and/or rectify errors.

Informed.IQ said finance companies understand it is imperative to seek ways to build more efficiencies that streamline the underwriting processes.

“Automation is not just a convenience; it’s a strategic imperative in today’s fast-paced environment,” Informed.IQ said in a news release “By incorporating advanced automation into lending procedures, lenders can make more informed and timely decisions, reduce operational costs, and, most importantly, provide an unparalleled experience for their customers.”

So, are all of those processes easier said than done? Here’s what survey participants said:

—The majority of respondents (21%) said automation has reduced fraud in their financing process; following by 19% who said increased speed.

—Regarding the measurement of success of automation, most respondents (32%) said it has improved customer satisfaction; followed by 30% saying reduced turnaround time.

—42% said they plan to upgrade existing automation systems in their future plans; followed by 31% saying integrating with other systems.

—While 41% indicated budget concerns, another 35% said they are concerned about the lack of knowledge or expertise in making additional implementations.

“This survey and study show that we’re making progress in the industry, educating lenders on the opportunity and promise of everything AI and automation can do for workflows, deal jacket accuracy and customer improvements,” Informed.IQ CEO Justin Wickett said in the news release.

“The future of lending is rooted in data, accuracy, and customer satisfaction, and AI and automation are keys to unlocking that future. It’s not just about embracing innovation; it’s about leading the charge toward a more agile and responsive financial ecosystem,” Wickett went on to say.

To download the complete report, go to this website.