J.D. Power: Captives trail banks when delivering exceptional digital experience

Charts courtesy of J.D. Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Automakers are certainly integrating sophisticated performance and safety technologies into vehicles.

But the technology fueling their captive finance companies isn’t quite to that level, according to the J.D. Power 2025 U.S. Automotive Finance Digital Experience Study.

Researchers found that automotive finance mobile app performance has improved industry-wide this year, but captive lenders are still “far behind” non-captive bank brands when it comes to delivering an exceptional digital experience.

“A great digital experience is becoming a crucial component of customer retention,” said Patrick Roosenberg, senior director of automotive finance intelligence at J.D. Power.

“As more vehicle shoppers start using artificial intelligence (AI) and other digital tools to shop for their next auto loan, it will be critical for lenders to have a meaningful digital connection with existing loan customers so they stay top-of-mind throughout that process,” Roosenberg continued in a news release. “Currently, the bank brands are outperforming captive lenders by virtue of the powerful digital tools they’ve developed across other parts of their businesses, but the playbook of best practices is starting to become much clearer and there are huge opportunities for improvement in this space.”

Here are some key findings of the 2025 study:

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—Non-captive mobile apps show significant improvement: Historically, auto lending mobile apps have trailed desktop sites in satisfaction and key metrics, J.D. Power said.

Researchers noticed that gap has closed among non-captive lenders, with an overall satisfaction score of 704 (on a 1,000-point scale) for mobile apps, which is two points higher than the overall satisfaction score for desktop websites.

In the captive lender segment, however, J.D. Power noticed desktop websites still outperform mobile apps, 703 vs. 684, respectively, a 19-point margin.

—Non-captive apps outperform captive apps: Overall satisfaction among customers using non-captive mobile apps is 704, which is 20 points higher than among those using captive mobile apps (684).

J.D. Power said captive app digital experiences also vary widely by brand.

“Non-captive lenders generally offer a more consistent user experience because they are developed using the bank’s mobile banking framework as a foundation,” researchers said.

—Positive digital experiences yield increased digital usage: Among lenders with overall satisfaction scores of 800 or higher, 91% of customers say they “definitely will” reuse their lender’s desktop website and 89% say they “definitely will” reuse their lender’s mobile app in the future.

“That intent to reuse digital channels is nearly halved among customers who say they had a poor experience with their lender’s website or app,” J.D. Power said.

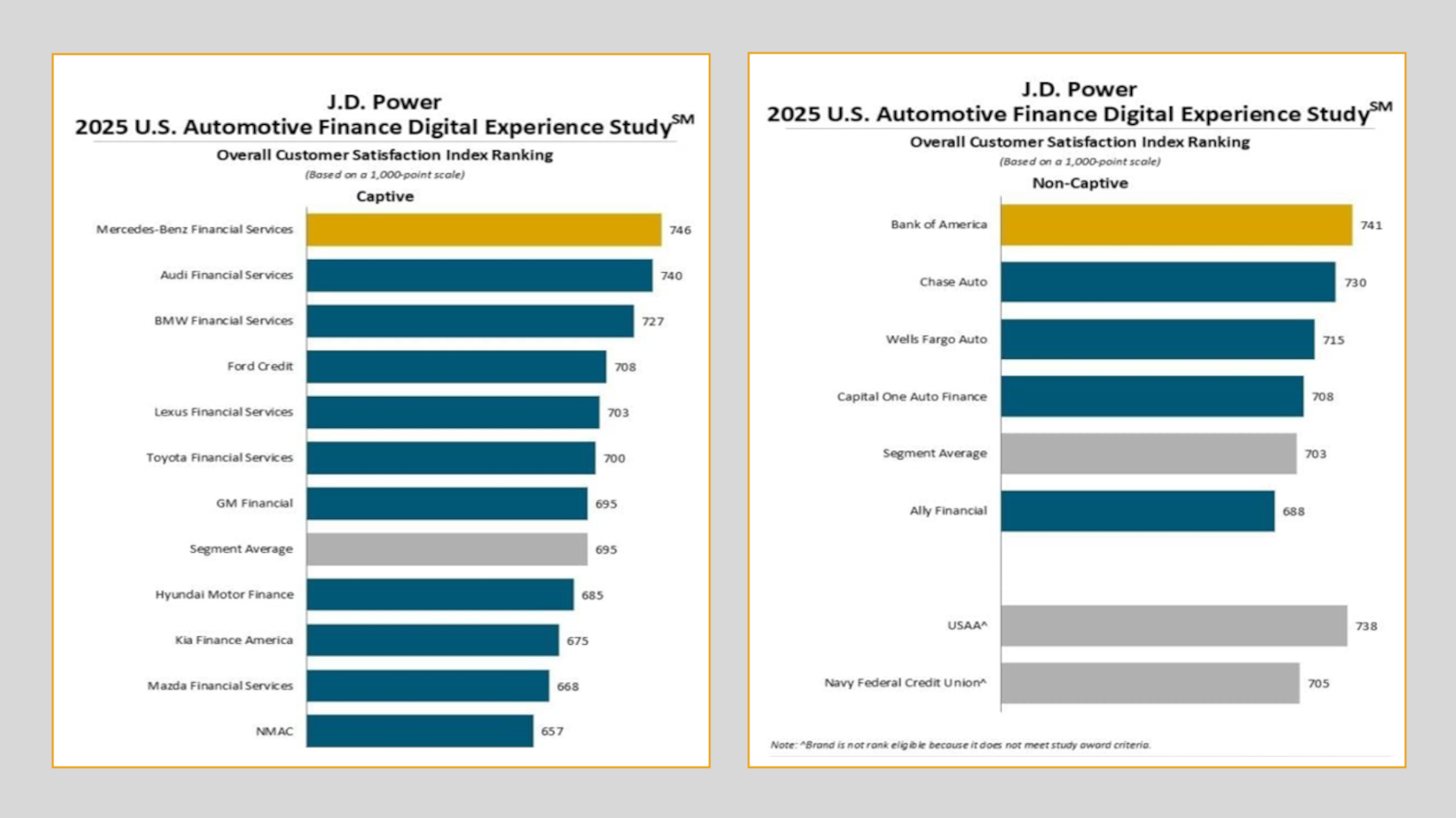

Turning to the study rankings, J.D. Power reported Mercedes-Benz Financial Services placed highest in digital experience satisfaction among captive lenders, with a score of 746.

Audi Financial Services (740) ranked second, and BMW Financial Services (727) came in third.

Bank of America came in first in digital experience satisfaction among non-captive lenders, with a score of 741.

Chase Auto (730) followed in second and Wells Fargo Auto (715) landed in third.

“Channel consistency is still the name of the game in any digital financial services user experience,” said Jon Sundberg, senior director of digital solutions at J.D. Power.

“Customers expect to have a seamless transition between websites, apps and offline communications, and brands that deliver that level of consistency and reliability are seeing steady improvement in their overall customer engagement, customer satisfaction and customer loyalty metrics,” Sunberg added.

The U.S. Automotive Finance Digital Experience Study, now in its third year, evaluates customer satisfaction with auto finance websites and apps used to manage their accounts based on four criteria (in order of importance):

—Visual appeal

—Information/content

—Navigation

—Speed

The 2025 study is based on responses from 6,470 automotive finance customers who used their lender’s desktop website or mobile app. It was fielded in August through October.