J.D. Power study connects affordability with lender satisfaction

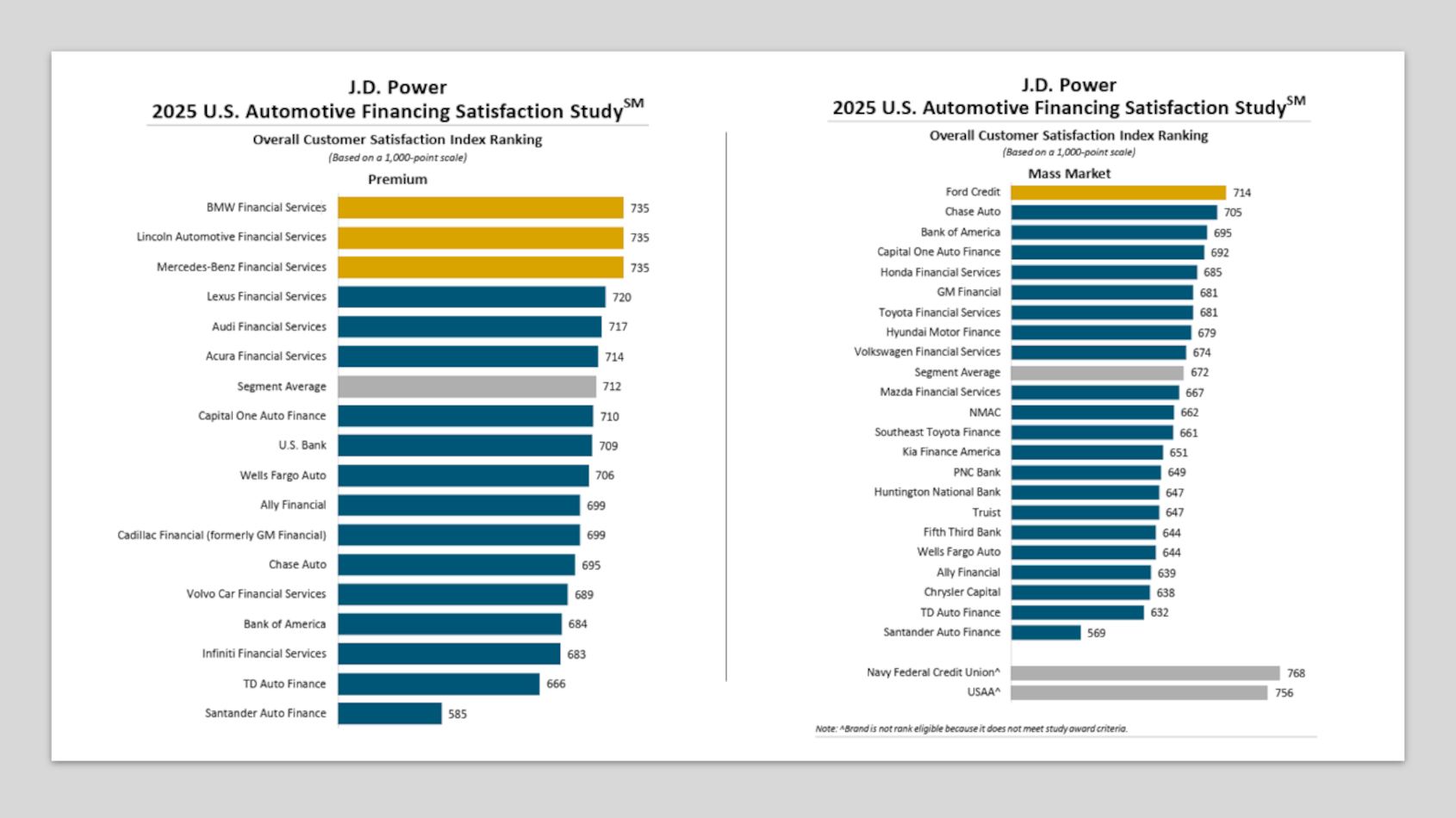

Charts courtesy of J.D. Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Auto-finance companies might have the latest technology and highly trained personnel to use it as designed.

But the contract holder’s personal finances might be the top determinant in how satisfied a consumer is with their lender.

According to the J.D. Power 2025 U.S. Automotive Financing Satisfaction Study, customer satisfaction with lenders is heavily influenced by consumer financial health as nearly one-third (29%) of borrowers are now categorized as financially vulnerable.

Those assertions came as J.D. Power data showed average monthly auto finance payments reached a record average high of $758 in October and loan terms now routinely extending to upwards of 84 months.

“Auto loan customers are having very different experiences based on their relative levels of financial health,” said Patrick Roosenberg, senior director of automotive finance intelligence at J.D. Power. “While financially healthy borrowers are experiencing historically high levels of overall customer satisfaction, those in the vulnerable, stressed and overextended categories are significantly less satisfied with the lending experience.

“As lenders continue to fine-tune their offerings for different customer segments, they really need to focus on proactive communication and targeted services that address a variety of borrower needs,” Roosenberg continued.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Three other key findings of the 2025 study included:

—Gaps in customer satisfaction based on financial health: The average overall satisfaction score for financially healthy automotive loan customers is 743 (on a 1,000-point scale). That score falls 150 points to 593 among financially vulnerable customers. Financially vulnerable customers also experience significantly lower levels of trust and brand advocacy.

—Education and onboarding at the dealership is critical: Financially healthy customers are considerably more likely to receive orientation information about their loan at the dealership while purchasing their vehicle. Fully 42% of financially healthy customers received orientation at the dealer, while just 25% of financially vulnerable customers received the same level of service. Slightly more than half (51%) of financially vulnerable customers received orientation information only after leaving the dealership.

—Bill payment pain points: Financially vulnerable customers are significantly more likely than financially healthy customers to pay their bills via their lender’s website or mobile app, while financially healthy customers are more likely to pay via ACH. Financially vulnerable customers are also significantly more likely to experience problems with their bill payment method.

In light of those trends, which finance companies did well in the J.D. Power study?

BMW Financial Services, Lincoln Automotive Financial Services and Mercedes-Benz Financial Services ranked highest in customer satisfaction among premium lenders in a three-way tie, each with a score of 735.

Ford Credit ranked highest among mass market lenders, with a score of 714. Chase Auto (705) came in second and Bank of America (695) landed in third.

The U.S. Automotive Financing Satisfaction Study, formerly known as the U.S. Consumer Financing Satisfaction Study, measures overall auto financing customer satisfaction across eight core dimensions (in order of importance):

—Level of trust with provider

—Loan/lease offering met needs

—Experience managing my loan/lease

—Keeps me informed about my loan/lease

—Experience obtaining loan/lease

—Makes it easy to do business with

—Digital channels

—People

This year’s study was fielded from September 2024 through September 2025 and is based on responses from 13,150 customers who financed a new or used vehicle through a loan or lease within the past three years.