J.D. Power: ‘One-size-fits-all’ no longer works well at lease end

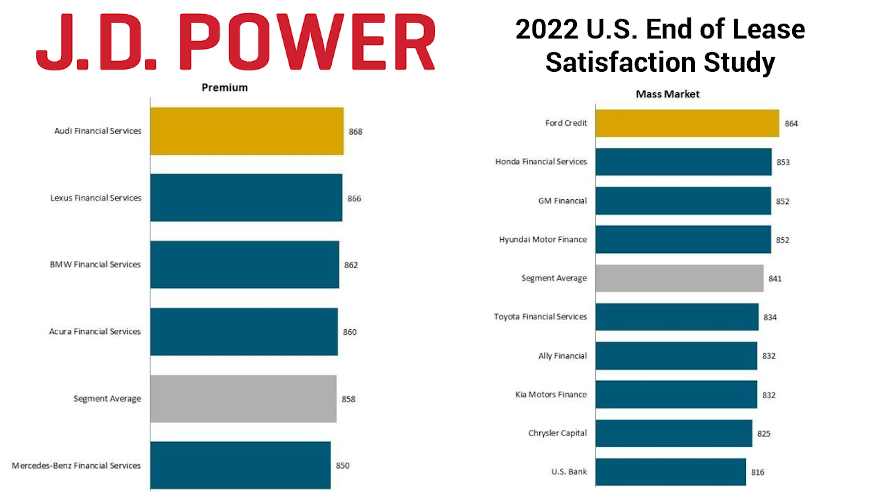

Charts courtesy of J.D. Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“One-size-fits-all” doesn’t work for jackets and shoes, and evidently not for the leasing of new vehicles, either.

J.D. Power said leasing volume now accounts for just 19% of total new-vehicle sales, prompting experts to say that finance companies and dealers need to be more targeted and purposeful than ever in their communication strategies to retain lessees and securing conquest opportunities.

According to the J.D. Power 2022 U.S. End of Lease Satisfaction Study released on Thursday, those experts also highlighted that highly personalized communications based on detailed lease journey analytics are essential to recapturing existing customers and winning new ones.

“The days of the one-size-fits-all lease loyalty strategy are long gone,” J.D. Power director of automotive finance intelligence Patrick Roosenberg said in a news release. “In this market, lenders, dealers and OEMs really need to understand the unique individual journeys of their customers and develop tailored, highly targeted outreach strategies creating the greatest opportunity to retain them.

“Ultimately, successful customer retention and conquest strategies are coming down to detailed analytics,” Roosenberg continued. “Lease providers need to understand the different customer journeys — whether it’s first-time lessees or returning lessees — and offer available incentives to the right customers, at the right moments, via the right communication channels to keep lease volumes flowing.”

So which captives already might be executing in the way Roosenberg suggested?

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

According to this J.D. Power study, Audi Financial Services ranked highest in end-of-lease satisfaction in the premium segment with a score of 868 (on a 1,000-point scale).

Lexus Financial Services (866) came in second, and BMW Financial Services (862) placed third.

J.D. Power said Ford Credit ranked highest in end-of-lease satisfaction in the mass market segment with a score of 864.

Honda Financial Services (853) came in second and GM Financial (852) finished third.

J.D. Power said the 2022 U.S. End of Lease Satisfaction Study identifies lease-end practices and timely marketing opportunities that optimize lease retention for the same brand and at the same dealer.

The company added its study is based on responses from 3,075 mass market and premium vehicle lease customers who are within six months of lease end. It was fielded in November and December.