Lightico survey gauges how customers stand with their auto-finance commitments and preferences

Lightico conducted a customer survey this past weekend and found an overwhelming majority of its auto-finance users currently prefer digital or remote interaction with their provider stemming from the ongoing coronavirus pandemic. Courtesy of Lightico.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

NEW YORK –

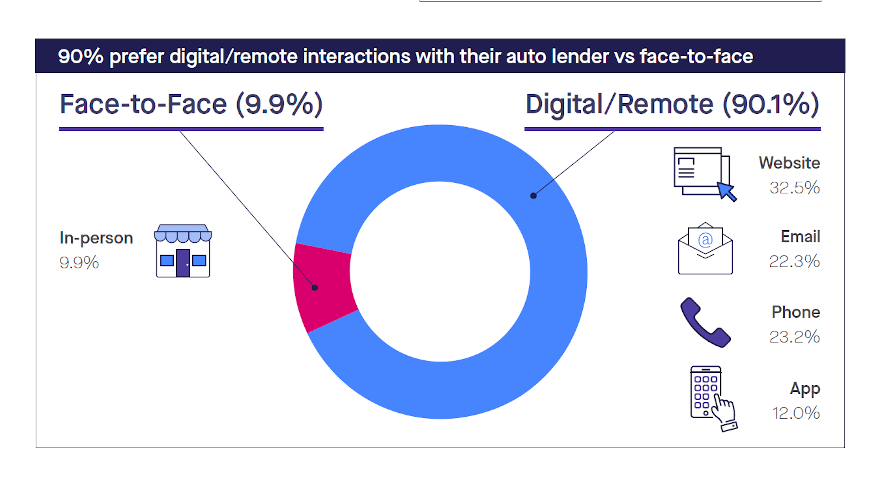

Lightico conducted a customer survey this past weekend and found an overwhelming majority of its auto-finance users — 90.1%, to be exact — currently prefer digital or remote interaction with their provider stemming from the ongoing coronavirus pandemic.

Meanwhile, Lightico also discovered that 40% of respondents either already have or are seeking modifications to their installment contracts through moves such as deferments, freezing payments or refinancing.

In the survey results, Lightico also further broke down how consumers are looking to connect with finance companies remotely. The findings included:

— Website: 32.5%

— Phone: 23.2%

— Email: 22.3%

— App: 12.0%

Lightico’s solution allows for finance companies to quickly, easily and digitally gather stipulations, e-signatures, payment and identification through an instant mobile interaction to significantly expedite loan origination and servicing.

In a separate blog post discussing the survey findings, Lightico said, “As was to be expected, a majority of consumers are concerned about the virus’ impact on their health and finances.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Respondents overwhelmingly expressed a need for digital and remote ways of getting things done, with two-thirds saying they are more inclined to try new digital offerings now than before,” the company continued.

“If businesses want to navigate this difficult period, they must keep a finger on the pulse of consumers’ new reality –– offer solutions (like e-signatures) that consider the impossibility of face to face interactions and create easy, remote and digital services,” Lightico went on say.

Other highlights of the Lightico survey of 1,000 customers included:

— Seventy-six percent are concerned about going to their local bank or auto dealer

— Seventy-one percent who were considering a car purchase over the coming three to six months months are now reconsidering

— Fifty percent have or will take steps because of their financial concerns

— Fifty-one percent are concerned about their ability to pay back their car loan over the coming months

— Sixty-three percent of consumers would set up a direct debit (ACH) for their loans if their lender gave them a discount or a deferment

— Only 30% of lenders have reached out to help with loan payments

“The data is in line with anecdotal evidence that loan originations are down but that consumers are open to and need to adjust their loans over the coming months to deal with the new reality before us,” Lightico said.