New eLEND Solutions report highlights $4.7B financing opportunity for dealers

Charts courtesy of eLEND Solutions.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Imagine you’re this close to getting a car deal completed. Then, the potential buyer rears back and exclaims, “Wait! My monthly payment is going to be HOW much?”

The scene is why findings from a new report by eLEND Solutions might intrigue dealerships and lenders. The report detailed the negative impact that mismatches between initial quoted payment terms from dealers and lender fundable contract terms can have on sales and gross profits, while also revealing a significant opportunity for the auto retail industry.

If the problem is solved, eLEND Solutions estimated $515,000, on average, per dealership, per year could be generated.

The survey was fielded online among U.S. dealerships and F&I industry professionals to validate eLEND Solution’s recent analysis of thousands of consumer credit applications that compared initial finance terms offered to consumers by auto dealers to actual auto lender decisions received for the same customers.

Survey respondents resoundingly agreed with the findings that lender-approved monthly finance payments are, on average, at least $32 per month higher on new vehicles and $36 per month higher on used vehicles than original initial terms quoted to consumers by dealers.

And that figure does not include dealer mark-up or increased down-payment requirements, according to Pete MacInnis, founder and CEO of eLEND Solutions.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“With the vast majority reporting that lender terms come in much higher per month than the initial quote, it is not surprising that 60% of credit applications submitted to auto lenders do not receive credit approval decisions. Car buyers are receiving inaccurate initial information that is significantly undermining the customer experience,” said MacInnis, who is among the experts and executives set to appear during Used Car Week that begins on Nov. 17 in Las Vegas.

With affordability top of mind, MacInnis today’s car buyers are focused on payment terms as much as price, but their expectations are not being met because of gaps in quote-to-payment terms.

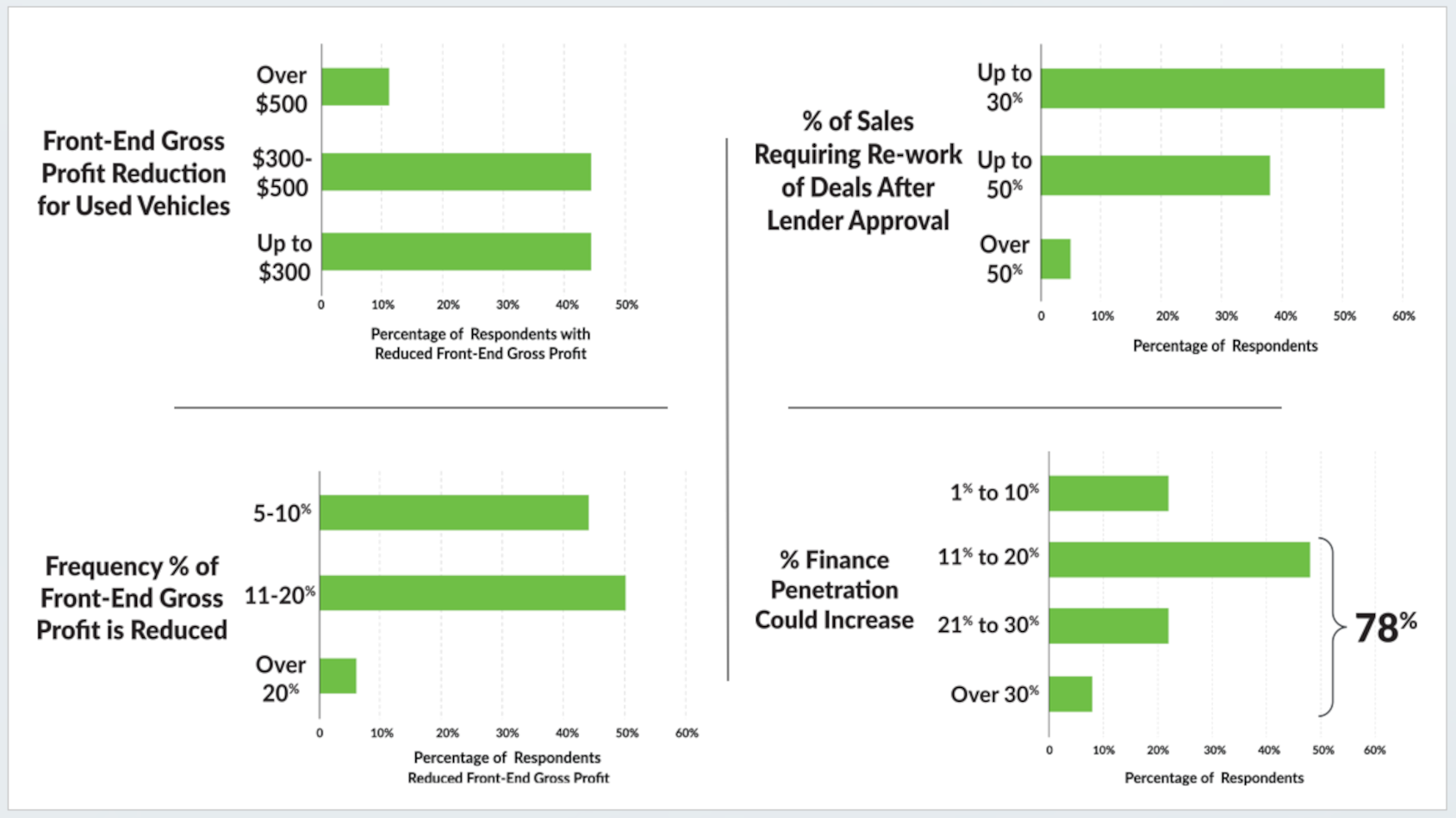

These disconnects, according to the survey, mean that up to 30%, or more, of new-vehicle sales have to be re-penciled, with the majority of respondents saying front-end gross profit is reduced in order to resolve friction.

“It is no wonder that 93% of those surveyed say sales are lost as a result of the quote-to-payment-terms gap, nor that front-end gross profits are diminished, time spent in F&I is increased and finance penetration is negatively impacted,” MacInnis said in a news release.

A key culprit to the quote-to-terms gap is identified in the survey: the majority of respondents estimate that over 50% of lenders no longer provide auto dealers with standard rate sheet bulletin guidance which offer FICO Credit Score tier as the single attribute to determine base loan pricing.

Without these bulletins, MacInnis said dealers are “flying blind” in quoting qualified payment terms during the sales negotiation.

And, according to MacInnis, this is a direct result of lenders evolving to an AI-based dynamic pricing down to the individual customer qualification level.

For example, MacInnis explained that a loan-pricing model provided by artificial intelligence might start with a combination of attributes such as credit score plus length of credit history, high credit, percent of revolving utilization, payment and debt-to-income ratios, stability factors and more to determine base loan pricing.

Then, MacInnis said the AI-based lender underwriting guidelines may adjust loan pricing based on year of vehicle, term, front and back-end advance, loan to value, mileage plus a limitless number of attributes in each lender’s AI-based black box loan decision engine.

“But every dark cloud has a silver lining,” MacInnis said. “If the issue can be solved, the opportunity is significant.”

Leveraging survey data and the credit application analysis, eLEND Solutions estimates the lost sales revenue opportunity per dealership, per year, could average $237,000, and the lost F&I revenue opportunity $278,000, equating to an average lost profit opportunity of more than $500,000 per dealer per year.

To recap, here are the key data highlights from the survey eLEND Solutions fielded in August:

—82% agreed that less than 40% of credit applications submitted to auto lenders receive credit approval decisions.

—83% agreed that lender finance approval decision monthly payments for new vehicles were on average $32 per month higher than the initial offer to the customer.

—88% agreed that lender finance approval decision monthly payments for used vehicles were on average $36 per month higher than the initial offer to the customer.

—87% of respondents say that front-end gross profit is reduced for used vehicles, when lender approval decisions are $36 higher than initial quote – by $300 or more say 56% of these.

—85% say that new vehicle deals have to be reworked because of initial quote to lender term mismatches. Of these, 2 in 5 say that 30% or more of total new vehicle sales have to be reworked

—87% say the number of lenders who have ceased providing standard rate sheet bulletins, has increased, with the majority (54%) estimating that over 50% of lenders have discontinued this practice.

—40% say resolving payment term discrepancies adds 31 to 45 minutes or more to the sales and finance process.

—78% estimate that finance penetration could increase by 11% or more if initial payment quotes matched lender decisions before getting to the F&I office.

“If lenders’ proprietary AI-based loan programs move forward in the sales negotiation process, so they integrate into a finance first (not last) process, the mismatch gap could end — to the tune of an estimated $4.7 billion annual opportunity for franchise auto dealers,” MacInnis said. “Isn’t it about time our industry came together to claim it?”