Santander survey: Consumers accelerated car-buying plans in Q2

Chart courtesy of Santander.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

While some troubling findings surfaced, too, the Q2 2025 Paths to Prosperity report from Santander Holdings USA contains some upbeat information for dealerships and auto-finance providers.

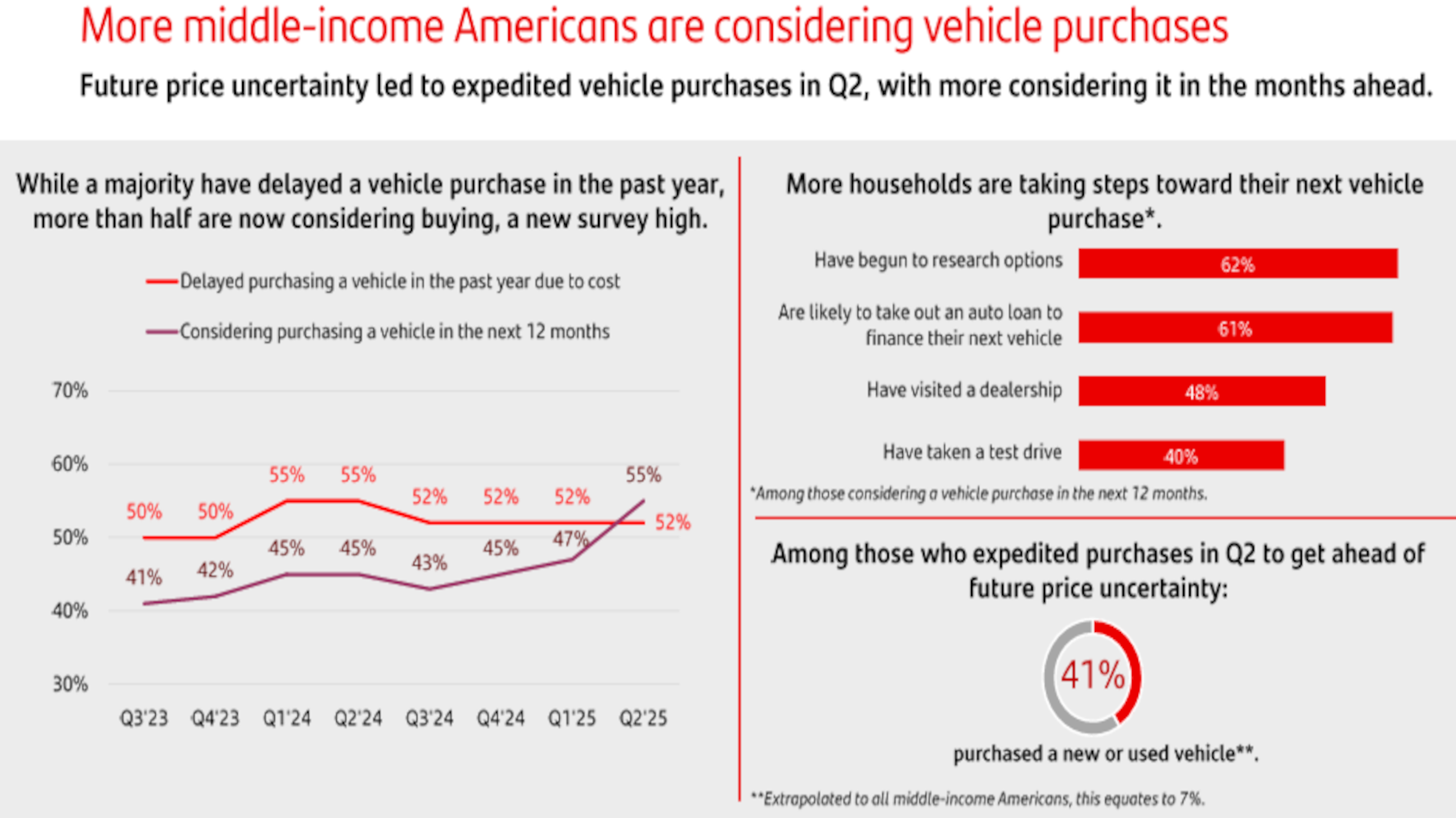

According to the bank’s research, 55% of middle-income Americans are considering buying a vehicle, a new survey high. That’s up from 47% in Q1.

Santander pointed out that 52% of consumers in this financial bracket had delayed a vehicle purchase over the past year due to cost.

For the first time in eight quarters of research, Santander discovered prospective buyers outnumber those delaying a purchase, indicating that pent-up demand may be transitioning to sales activity.

Additionally, researchers said 18% expedited key purchases in Q2 to get ahead of any price changes, with 41% of them buying a vehicle.

The Q2 Santander study, which builds upon nine quarters of research, looked at middle-income Americans’ current financial state and economic outlook. It examined how economic conditions and future price uncertainty are impacting these households, as well as demand for autos, utilization of banking products and more.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Santander highlighted this rising demand for autos comes at a time when most middle-income Americans (75%) still feel they are on the right financial track and acknowledge the importance of vehicle access for maintaining their prosperity.

For instance, nearly 9 in 10 (87%) said vehicles give them greater flexibility in how and where they live, and most (78%) rely on a vehicle to get to work. As such, consumers are closely watching how future price uncertainty could affect their purchasing plans, and they are adjusting expectations accordingly.

For example, Santander reported that 50% of prospective buyers say they are now more likely to take out an auto loan, 48% are more likely to purchase a used vehicle and 42% are more likely to transact in the next three months.

Prospective buyers have already begun to take steps toward purchasing, including 62% who have researched options and 48% who have visited a dealership, according to the report.

Consumers remain resilient despite ongoing concerns

Elsewhere in the report, Santander noted middle-income Americans’ optimism about their personal finances remains strong, as most are current on their bills (75%) and feel secure in their jobs (79%).

Analysts stressed those two factors are most closely tied to financial prosperity.

Additionally, more than half (52%) of survey participants said they are handling higher prices better than they were a year ago, up from 45% at the same time last year.

Santander acknowledged that concerns about inflation persist, with it remaining consumers’ top financial obstacle.

Furthermore, the report showed 86% of consumers expect prices on goods to continue rising in the coming months, and 65% worry they won’t be able to afford further increases.

Perhaps more stormy times still could be ahead, at least for recent homebuyers, which the report classified as ones who purchased since March 2020. Santander mentioned nearly three-quarters (74%) of those surveyed who were in that category report having to cut back on spending to keep up with expenses, up from 69% last quarter.

And maybe even more concerning for that swath of consumers is that 64% say they live paycheck to paycheck, an eight-point increase, according to Santander.

This research on financial prosperity, conducted by Morning Consult on behalf of Santander, surveyed 2,200 Americans who are bank and/or financial services customers, ages 18-76.

Survey participants are employed or looking for work, own/use at least one financial product and are the primary or shared decision-maker on household finances with household income in the “middle-income” range of approximately $53,000 to $161,000.

The Q2 study was orchestrated June 16-18 via interviews conducted online.