TransUnion: Car-insurance shopping hits near-term peak during Q2

Chart courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The activity of consumers shopping for auto insurance has been just as intense as individuals’ efforts to find their next vehicle or affordable financing.

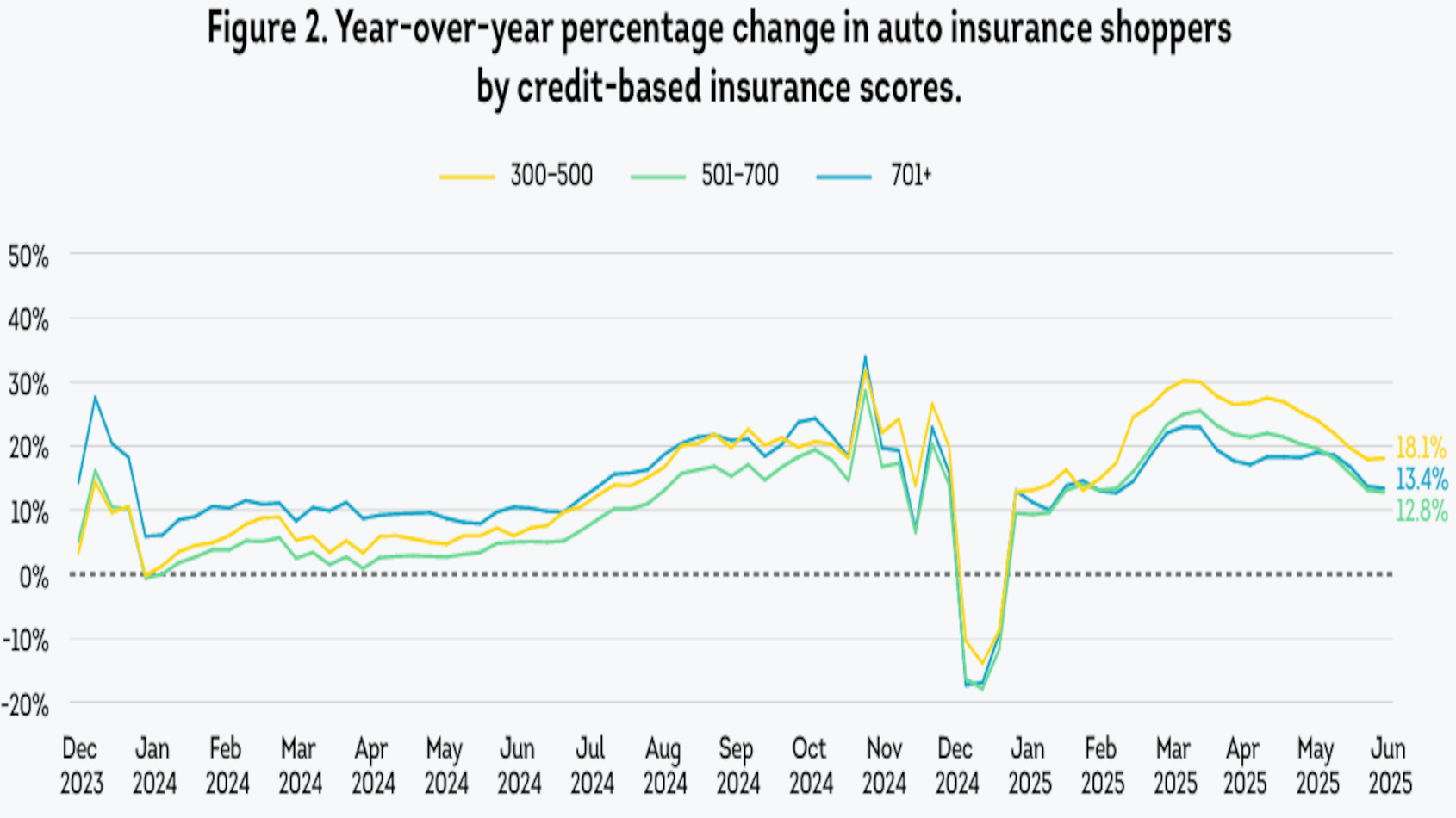

According to new TransUnion research released this week, auto insurance shopping during the second quarter increased 18% compared to the same period in 2024.

Looking at the first half of 2025, TransUnion said the year-over-year increase in auto insurance shopping activity reached a near-term peak in March and stayed at that level until May. These findings and more are included in TransUnion’s latest quarterly Insurance Personal Lines Trends and Perspectives Report, which is available online.

“It’s possible that we’ll see the growth in auto insurance shopping continue to decline as many consumers have already secured lower premiums,” said Patrick Foy, senior director of strategic planning for TransUnion’s insurance business.

“However, property insurance premiums continue to rise, so consumers will likely shop for less expensive alternatives,” Foy continued in a news release. “That may also prompt many to shop for auto insurance because for many customers, bundled policies remain key to overall savings.”

TransUnion’s latest consumer survey revealed 42% of auto insurance shoppers switched insurers in the past year and a half. A quarter of those who switched in the past six months indicated they had stayed with their previous insurers for more than six years.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Researchers found Gen Xers and Baby Boomers represented the largest share of this loyal yet increasingly mobile segment.

The report urged insurance carriers to rethink retention strategies and employ data-driven, personalized approaches to help anticipate life events — such as moving, marriage or shopping for a new car — that naturally create opportunities for engagement.

In addition, TransUnion explained knowing when a customer obtains a competitor insurance quote or if they’re shopping for an auto loan or mortgage loan, can also help carriers create and deliver meaningful customer interactions.

The report found carriers recognize the need for more engagement, with a 23% year-over-year increase in marketing spend across multiple channels, and an emphasis on direct mail.

TransUnion indicated branding campaigns are increasingly focused on deepening customer relationships by highlighting specialty lines — such as motorcycle, pet insurance, identity theft protection and recreational vehicles — to differentiate their value.

Ensuring these campaigns effectively and efficiently reach their target audience is a key to maximizing returns, according to TransUnion, which said this process begins with clean data, as illustrated by a recent TransUnion marketing client analysis.

The study worked with just two consumer characteristics (phone number and email) for 2.4 million individuals. After cleaning the data, the carrier realized an estimated $1 million per year in reduced direct mail costs and nearly $5 million in additional revenue.

In addition, a recent TransUnion study found marketing performance widens significantly when audiences are defined with multiple characteristics.

For example, using just two characteristics increased return on ad spend by up to 3.6 times compared to less refined targeting. However, as audience segmentation becomes more precise, the potential for both risk and reward increases.

“Marketing campaigns require a solid foundation of clean data to be effective,” Foy said. “With that, marketers can then unlock tremendous value with sophisticated audience targeting that presents consumers with the exact right insurance products for their current life stage.”