TransUnion rolls out 3 enhancements to boost Device Risk

Screenshot courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

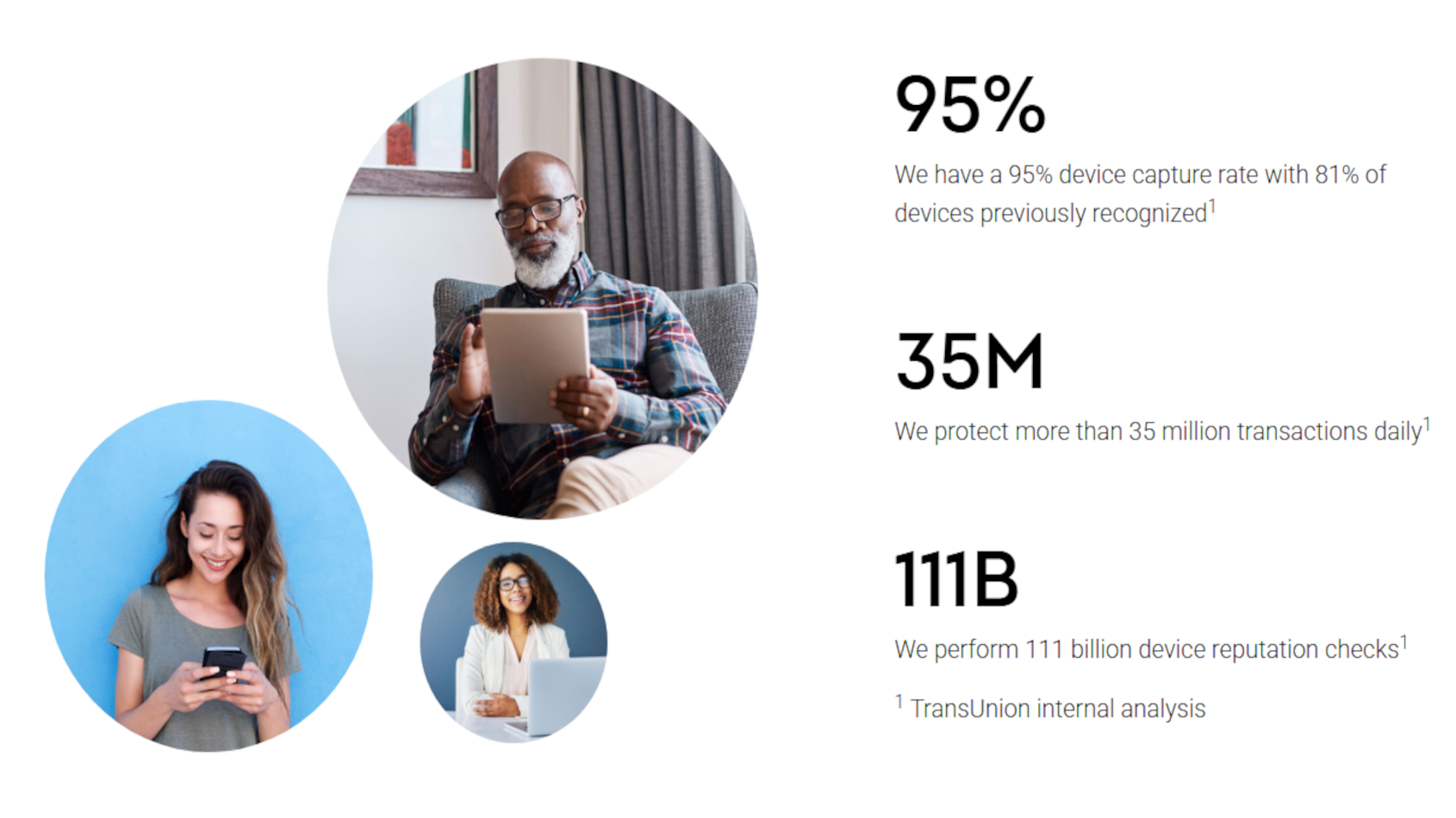

TransUnion reinforced one of its client tools on Tuesday to help reduce fraud.

The company introduced what it called “a major advancement” to Device Risk, delivering “next-level capabilities that redefine how businesses combat fraud.”

Key enhancements to Device Risk include:

—Cross-session device identification: Recognize and track devices across multiple sessions and platforms without relying on cookies, ensuring consistent identification even as privacy regulations evolve.

TransUnion explained this approach can reduce dependence on cookies while maintaining strong compliance with privacy standards and delivering reliable device recognition for fraud prevention.

—Adaptive machine learning (ML): Leverage advanced ML models and dynamic rule strategies that deliver significant performance improvements, boosting fraud detection rates by up to 50% compared to static device recognition alone.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

TransUnion said these models continuously adapt to evolving fraud patterns and incorporate feedback from confirmed fraud cases, ensuring your defenses remain agile and effective over time.

—Advanced anomaly and evasion detection: Detect and flag virtual environments, remote access tools, and automated bot activity while strengthening resistance to user manipulation techniques.

By making it harder for fraudsters to bypass detection, TransUnion indicated this capability can helps organizations proactively block suspicious behaviors and maintain trust in digital interactions.

Steve Yin, global head of fraud at TransUnion, pointed out that devices with risky attributes, suspicious histories or questionable associations often drive fraud losses. Yin said financial institutions including lenders, retail banks, fintechs, and others, struggle to identify new or unfamiliar devices that match known fraud patterns, making early detection a persistent challenge.

“Our Device Risk solution is a game-changer for organizations facing complex fraud challenges,” Yin said in a news release. “Whether it’s preventing account takeover in financial services, stopping synthetic identity fraud in e-commerce or blocking automated bot attacks on digital platforms, our enhanced capabilities give businesses the intelligence and agility they need to gain a clear picture of identity and protect customers and revenue.”

TransUnion mentioned its upgraded tools can analyze thousands of device attributes and behavioral signals in real time to generate a unique device fingerprint. IThey also can evaluate key risk indicators, including device integrity, behavioral patterns and environmental context.

By combining these insights with adaptive machine learning, TransUnion said the solutions can continuously refine risk scoring and fraud detection strategies. Businesses can integrate the solution into existing workflows via APIs, enabling instant decisions and seamless customer experiences.

When used in conjunction with TransUnion’s IP Intelligence, the company said customers can reduce potential risk for each transaction even further.

“Ultimately, Device Risk is particularly critical for industries where trust and security drive customer confidence,” Yin said. “It helps empower financial institutions, retailers, and digital platforms to protect users, transactions, and brand integrity.”

To learn more about TransUnion Device Risk, go to this website.