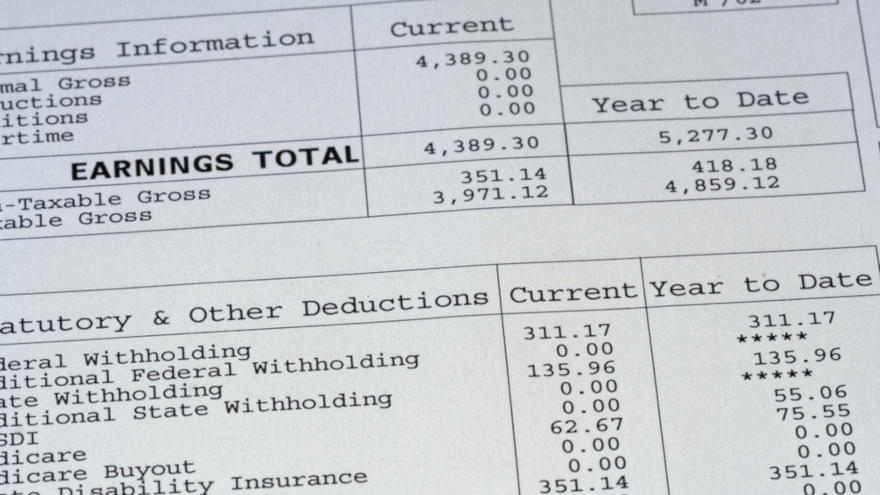

TurboPass PayStub Report now available nationwide

Image by Josh randall / Shutterstock.com

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The TurboPass PayStub report rolled out nationally this week.

According to a news release from TurboPass, dealerships in all 50 states now can experience faster funding, more down payments and fraud prevention on customers with payroll data.

Internal TurboPass research has found that more than 2 million people in the U.S. fake paystub documents every year using online resources.

And according to Point Predictive, the number of people falsifying documents to get approved for auto financing has increased 5% year-over-year, jumping to $7.7 billion in 2021.

“When I was running an independent dealership, we had been presented with many fake pay stubs from customers. In the later years, it became increasingly difficult to distinguish between those that were fake and those that were real. It was situations like this that led to the concept for TurboPass,” co-founder and chief operating officer Ken Jarman said.

TurboPass has been helping thousands of dealerships validate proof of employment, income and residence for the last four years, primarily through TurboPass Banking reports. In the last couple of years, dealers have requested over 200,000 banking reports.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Now that the PayStub Report is available, dealers and finance companies will have a tool for verifying W2 income as well.

Like the current TurboPass process, the first step in generating a PayStub report is for the dealer or finance company to send a TurboPass text to the vehicle buyer.

The link included this text message will allow the customer to credential themselves, thereby creating an easy-to-use TurboPass PayStub Report that includes data such as income, employer, job title, start date, employment status, PTI calculations and more.

“It’s been great having another verification tool at the dealership to help speed up and improve the customer experience. It’s made our funding process a lot faster,” stated Greg Skurkovich, dealer principal at URboss Auto, which operates five used-car centers and repair facilities in Illinois, Florida and Pennsylvania. “We require that TurboPass banking or PayStub reports are used on every car deal.”

TurboPass mentioned dealer and finance company partners such as Westlake Financial, Turner Acceptance, and MidAtlantic have tested the product for the last two months with great success, leading the way for other users to follow.

“Dealers, lenders, and consumers are going to experience a frictionless paper-free funding process when using these reports. I’m glad TurboPass is the first to market with their patented point of sale verification process. It’s innovations like this that keep our companies and our industry growing together,” said Kyle Dietrich, senior vice president of acquisitions at Westlake Financial.