Wolters Kluwer Auto Finance Digital Transformation Index shows strong close to 2023

Chart courtesy of Wolters Kluwer.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

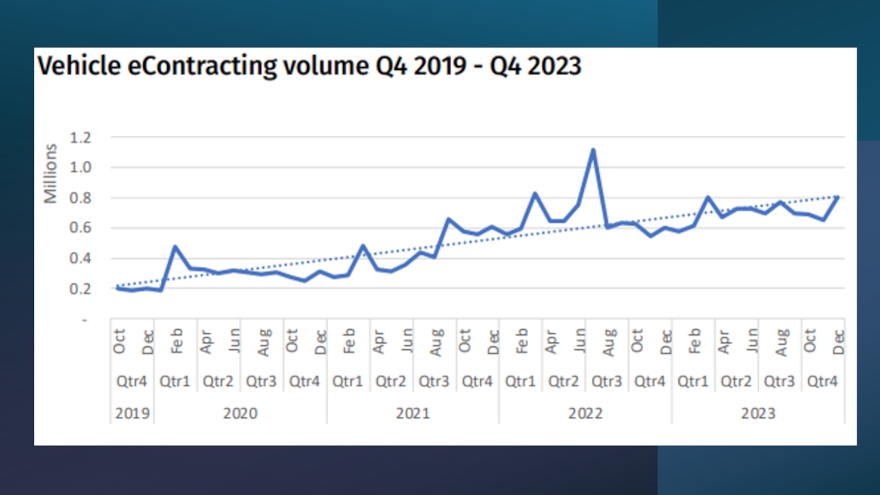

While anticipating that 2024 will be a busy year for auto finance companies, Wolters Kluwer announced fourth quarter and end-of-year results and analysis connected with its Auto Finance Digital Transformation Index.

The index tracks the rate at which dealers, service providers and finance companies are seeing growth in the evolution from paper-based finance back-office processes to digital.

According to the most recent Auto Finance Digital Transformation Index, the digital adoption rate in the fourth quarter compared to the previous quarter was mostly flat.

However, Wolters Kluwer saw its strongest December on record. And comparing year-over-year figures for fourth quarter activity, analysts saw a rise of 21% digital adoption compared to last year.

What’s more, Wolters Kluwer said the four-year trend of digital adoption is now up 129% dating back to the first quarter of 2020, indicating an industry that has significantly bought into the importance of digital adoption.

“As we reflect on the past year, the auto industry has demonstrated remarkable resilience and adaptability,” said Wolters Kluwer head of auto strategy Tim Yalich, who is among the speakers at Cherokee Media Group’s Auto Intel Summit + National Remarketing Conference, set for April 23-25 in Cary, N.C.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“The steadfast commitment to embracing digital workflow strategies has not only streamlined the operations of many in the industry, but has also become a driving force behind their success,” Yalich continued in a news release. “In parallel with the resilient activity in auto sales, our industry’s digital transformation has showcased unparalleled strength over the past few years.

“We continue to navigate challenges with agility, leveraging technology to propel us forward. This focus on innovation and efficiency reaffirms our position at the forefront of a dynamic and evolving macro-economic landscape,” he said.

Wolters Kluwer’s Q4 Auto Finance Digital Transformation Index also showed that the digitization adoption rate for securitization markets has continued over the past year.

The adoption rate of monetized digital auto installment contracts increased 325% in the fourth quarter year-over-year comparisons, and the fourth quarter saw another record high of digital volume.

Wolters Kluwer indicated the four-year trend of digital adoption shows an increase of 15%, the first time the four-year trend line has turned positive.

Yalich noted the monetization of digital auto paper in capital markets appears to be gaining strength and popularity to increase capital quickly, support growth and provide a mechanism for liquidity.

To learn more and to access additional data insights from the Wolters Kluwer Auto Finance Digital Transformation Index, go to this website.

Refinancing could rebound

Meanwhile, as the market watches for an anticipated drop in U.S. interest rates following recent Federal Reserve Board pronouncements, Yalich said auto finance professionals await the potential impacts lower rates will have on their business.

Yalich suggested the impact of high rates from the past year, together with the potential for lower rates this year, will likely lead to an increase in demand for auto refinancing.

According to Yalich, while originations will always be subject to the vagaries of the financial markets, auto finance companies are likely to handle a higher volume of contract this year.

“The pent-up demand from consumers waiting to buy a new car will likely release this year, with consumers who bought when rates were higher looking to refinance as rates lower,” Yalich said in another news release.

Yalich pointed out that while the traditional practice of refinancing installment contracts hasn’t been as popular in recent times, relatively low rates during the early 2020s led many finance companies to offer auto refinancing.

In any year in which loan volumes are higher, Yalich said it will be imperative for auto finance companies to be on the lookout for mistakes and inconsistencies in data.

A December 2023 Wolters Kluwer auto lending survey revealed that 77% of auto financiers who still rely on manual or paper processes acknowledge that their documents contain errors in a third or more of deals.

“Auto lenders will start to use artificial intelligence to increase their touchpoints with customers and to detect mistakes and fraud,” Yalich said. “Those who have digitized will find it easier to manage the influx of customers and make sure that they are in contact with customers along their lending journey.”

Respondents in that same Wolters Kluwer survey indicated they were looking to transition to digitized documents in the following areas:

—Processing and funding (31%)

—Credit application and decisioning (28%)

—Securitization or collateralization (24%)

“The industry has been focused on the consumer experience and making sure that it is digitized to match consumer buying habits,” Yalich said.

“What I believe we will see this year is an emphasis on prioritizing the back end of the lending process. This is a shift in the industry and a new point of focus that will minimize errors, create efficiencies, and keep pace with early adopters who prefer a fully digital lending experience,” Yalich said.