Working with lenders like NextGear Capital, SBS on track to complete more than 100K audits this year

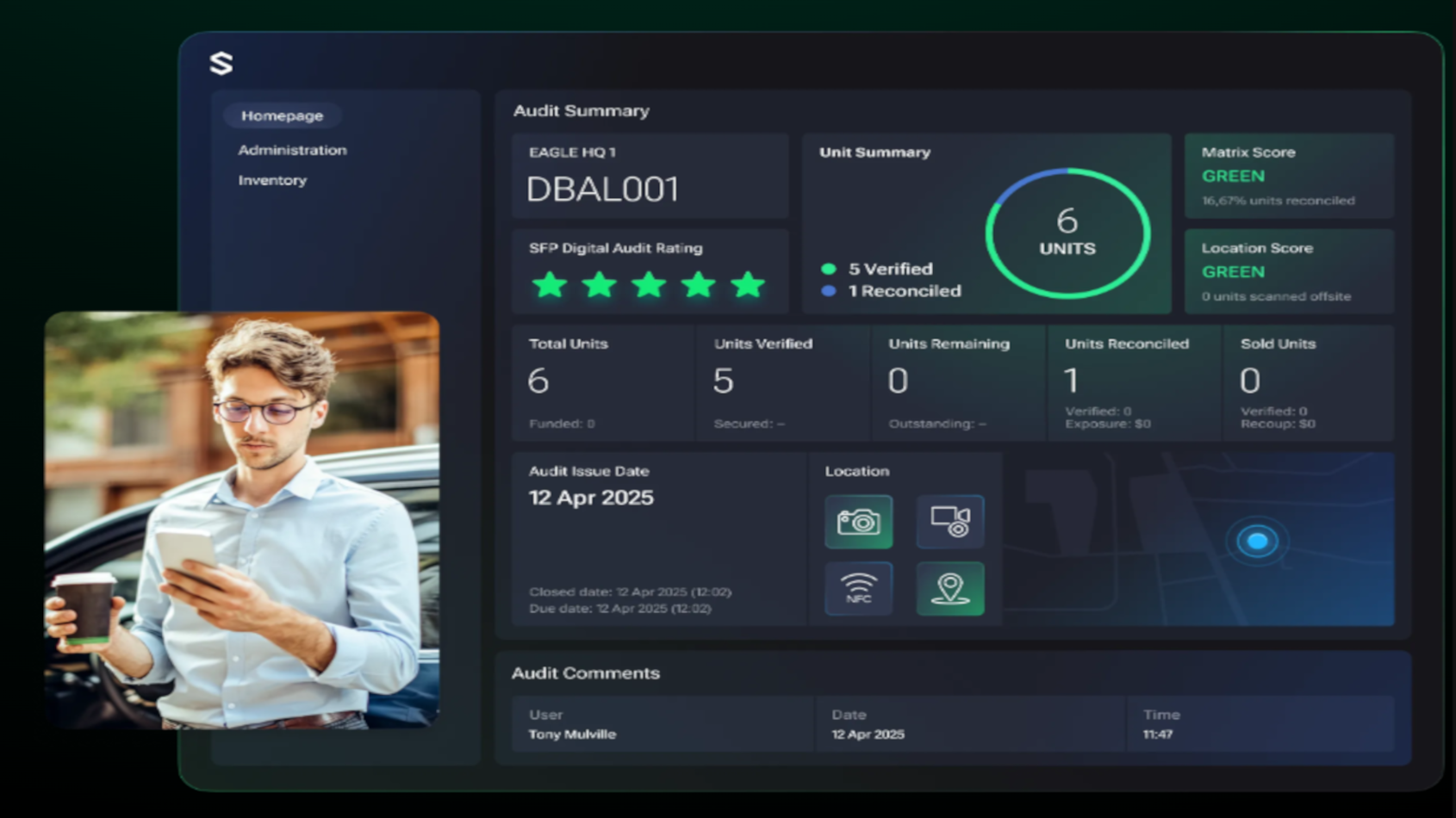

Screenshot courtesy of Sopra Banking Software (SBS).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Sopra Banking Software (SBS) said the global financial technology company is on track to complete more than 100,000 digital audits across the U.S. by the end of the year, allowing nearly 18,000 U.S. auto dealerships to benefit from its SBS Financing Platform (SFP) Digital Audit solution.

SBS highlighted that working with the country’s top floor plan lenders, including NextGear Capital and others, this large-scale rollout reflects floor plan lenders’ eagerness to embrace digital auditing and real-time data.

For auto and asset lenders, SBS acknowledged the process of monitoring and analyzing the floored inventory at dealerships has historically relied on sending auditors to dealerships to conduct physical, in-person audits of each floored vehicle.

But when working with thousands of dealerships nationwide, SBS pointed out the time, cost and energy associated with this model compound with each additional vehicle they finance.

Leaning into a digital solution increases the scale and speed of audits to improve client experience, according to SBS and floorplan providers.

“Providing independent dealers with efficient digital tools for managing their floor plans is incredibly important,” said Nicole Graham-Ponce, vice president of portfolio management at NextGear Capital.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Working alongside SBS, we’ve provided a self-audit solution that clients can access right inside our mobile app, which is a key step in our audit transformation journey,” Graham-Ponce continued in a news release from SBS.

SBS’s Digital Audit solution offers a scalable, centralized cloud-based system with an image-based verification process. SBS’s image verification service will have processed nearly 3 million images by the end of this year. That’s “a scale not realistically achieved by traditional auditing methods,” the company said.

SBS explained the intelligent auditing and low-cost-per-audit enables lenders to deploy inventory audits as often as they need to, across any geographic region.

“Traditional auditing processes have disproportionately stood in the way of the automotive industry’s ability to evolve and keep up with digital practices,” said James Powell, head of asset and consumer finance at SBS. “NextGear Capital has set the standard for the automotive industry’s independent inventory financing for years, and we’re honored to work alongside them on this journey.”

SFP-Digital Audit is part of the SBS Financing Platform (SFP), which also houses SFP Wholesale and SFP Portfolio Management.

The platform is geared to transform historically manual asset financing processes in digital-first, cloud-based functionalities.

“While transitioning from manual to digital operations has historically been a considerable undertaking for organizations, SBS offsets much of the upfront burden through its composable and cloud-based technology,” the company said. “Banks and lenders can now digitize individual processes and systems, one at a time.”