A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

6 top executive moves at APCO Holdings

Tuesday, Feb. 24, 2026, 10:08 AM

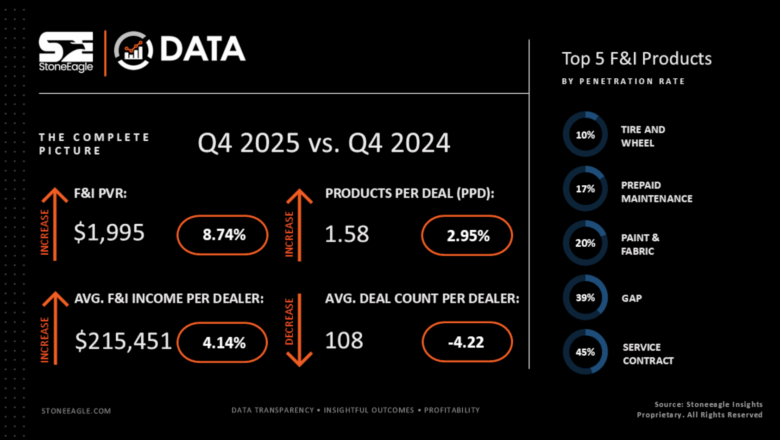

StoneEagle: PVR record in November among Q4 performances generated by dealer F&I departments

Wednesday, Feb. 25, 2026, 09:53 AM

CarMax & DOJ settle allegations of repossessing vehicles of active servicemembers

Wednesday, Feb. 25, 2026, 12:52 PM

More insight into fraud at dealerships with Experian’s Jim Maguire

Experian senior director for automotive Jim Maguire made another appearance on the Auto Remarketing Podcast to recap findings from the company’s latest dealer survey that examined the impact of fraud at dealerships. Maguire then touched on the balance dealers and ... Listen Here

Thursday, Feb. 26, 2026, 03:55 PM

Cox Automotive on guiding the modern car buyer

One of the keynote presentations from Used Car Week 2025 featured Micah Tindor and Elizabeth Stegall of Cox Automotive for a session titled, “Guiding the Modern Buyer with Trust, Tech & Smarter Trade-Ins.” Valuable study findings and dealership recommendations now ... Listen Here

Tuesday, Feb. 17, 2026, 05:17 PM

Kevin Roberts of CarGurus on 2026 Used-Car Market

Kevin Roberts, who is director of economic and market intelligence at CarGurus, is back on the show to talk about the hot start to 2026 for the retail used-car market. Roberts and Cherokee Media Group senior editor Joe Overby discuss ... Listen Here

Monday, Feb. 16, 2026, 07:18 PM

Fed’s Bowman outlines path to ‘tailored’ supervision

Friday, Feb. 27, 2026, 10:44 AM

SubPrime Auto Finance News Staff

Michelle Bowman, who serves as vice chair for supervision at the Federal Reserve, testified on Thursday during a hearing in Washington, D.C., hosted by the Senate Banking Committee. How Bowman said the Federal Reserve approaches supervisory and regulatory activities of ... [Read More]

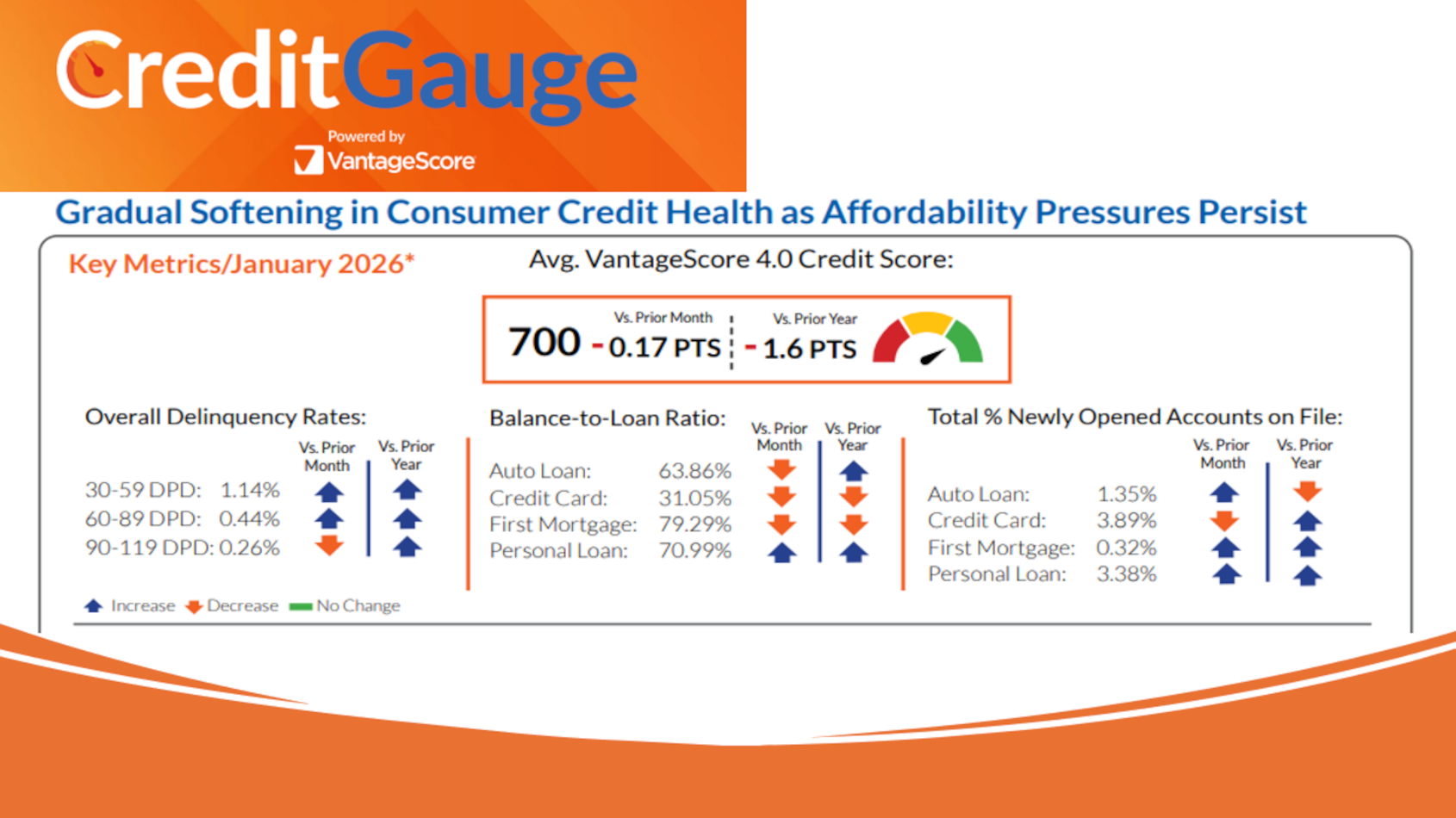

January VantageScore report shows how affordability impact is chipping away at consumer credit health

Thursday, Feb. 26, 2026, 10:50 AM

SubPrime Auto Finance News Staff

Experts from VantageScore are taking measured reactions when reviewing the January data highlighted in the latest edition of CreditGauge — a report that showed modest upticks in overall delinquency rates and slight deterioration in credit scores. Looking at overall delinquency ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Economic roundup: Recession outlook & explaining Supreme Court decision about tariffs via automotive

Monday, Feb. 23, 2026, 10:54 AM

Nick Zulovich, Senior Editor

Experts from Comerica Bank, Edmunds and S&P Global Ratings tackled a variety of economic topics with connections to automotive, including the chance of a recession in the next 12 months, the Supreme Court’s decision about President Trump’s tariffs, and gross ... [Read More]

Yendo lands $200M funding commitment from i80 Group to continue growth of vehicle-secured credit card

Friday, Feb. 20, 2026, 10:27 AM

SubPrime Auto Finance News Staff

In October, Yendo announced a $50 million Series B funding round to fuel its efforts to grow as a company that claims to be behind the first-ever vehicle-secured credit card. Now at a time when private debt markets remain historically ... [Read More]

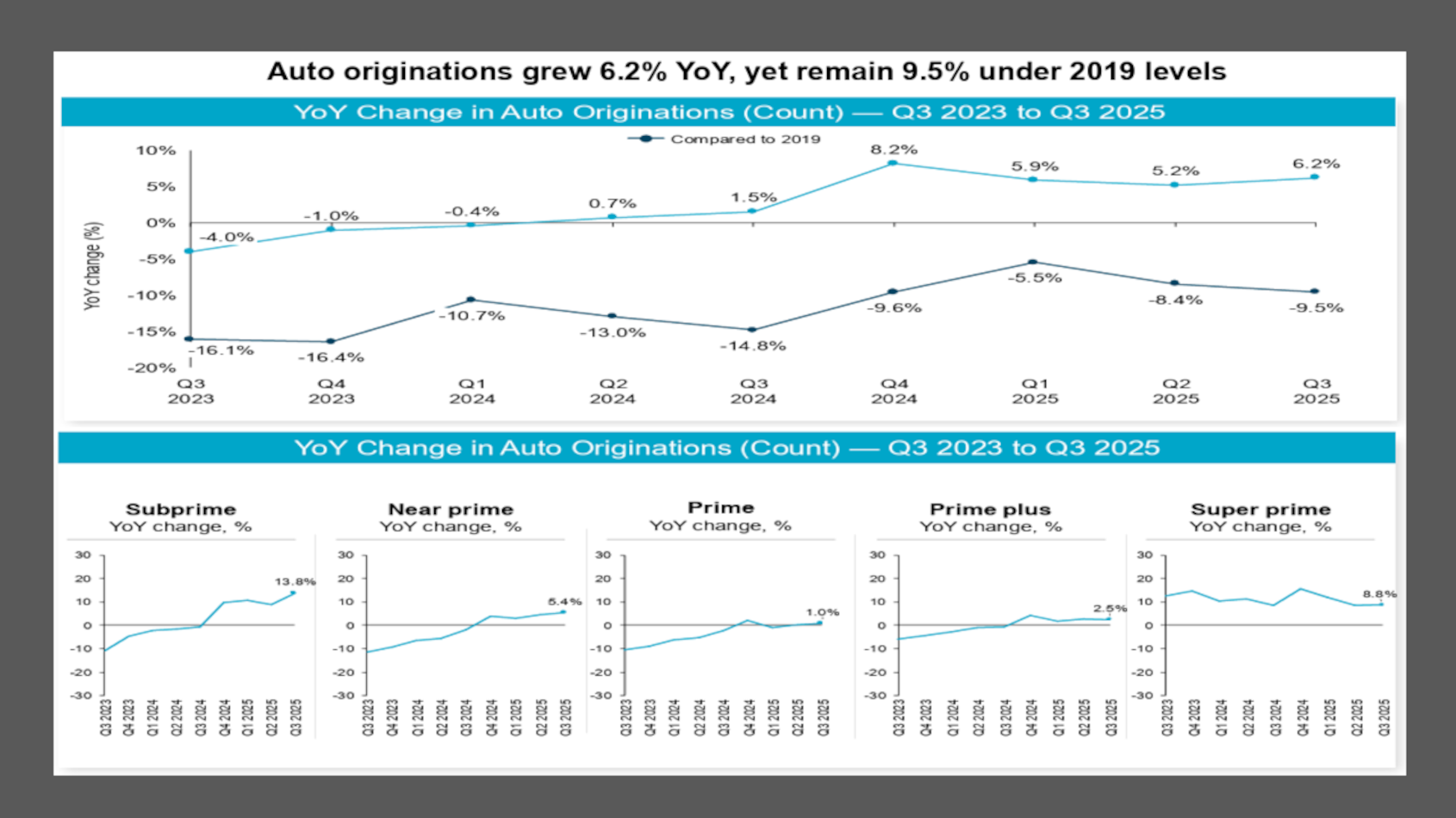

TransUnion projects slight dip in auto originations after robust 2025 volume

Thursday, Feb. 19, 2026, 11:22 AM

SubPrime Auto Finance News Staff

Auto finance often moves counter to other segments of the credit market in positive ways, but not this time, according to TransUnion’s 2026 credit originations forecast released on Thursday. Among the five credit market segments specified in the forecast, only ... [Read More]

ARA, AIR, Wheeler, among others seeking to stop ‘serious threat’ to repossessions by local municipalities

Wednesday, Feb. 18, 2026, 02:59 PM

SubPrime Auto Finance News Staff

The American Recovery Association (ARA), the Alliance of Illinois Repossessors (AIR) and DRN|MVTRAC|SCM president Jeremiah Wheeler are all involved in what they see as “a serious threat to the entire repossession industry” that started as a local issue in Illinois ... [Read More]

Experts at Cox Automotive, Conference Board decipher latest credit & job information

Wednesday, Feb. 18, 2026, 10:54 AM

SubPrime Auto Finance News Staff

It’s the puzzle that dealerships and finance companies have had to solve since the start of awarding credit to deliver a vehicle. You likely must have a car to get a job, and you likely have to have a job ... [Read More]

X