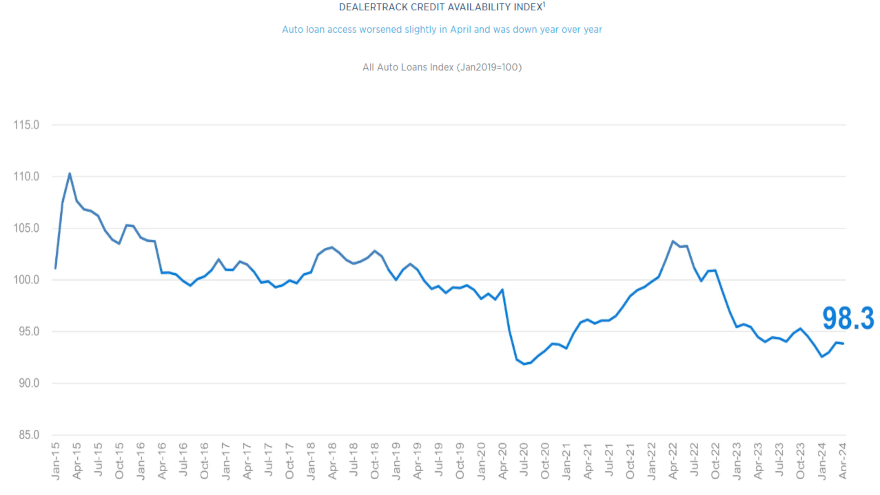

Access to auto credit tightened slightly in April

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Perhaps if your tax season didn’t meet your shop’s expectations, the latest reading of the Dealertrack Credit Availability Index could help explain why.

Cox Automotive reported last week that the index declined to 93.8 in April, which was down 0.7% year-over-year. Analysts indicated credit access in April was tighter than a year ago in all channels except used-car sales through independent dealers and new-car sales.

“Credit access was more varied year over year by lender type, as credit unions and auto-focused finance companies were looser while banks were tighter, and captives were unchanged,” analysts continued in their commentary that accompanied the index update.

“Credit availability factors mostly moved against consumers in April,” Cox Automotive continued. “Both approval rates and subprime share decreased. These moves reduced credit access for consumers. Yield spreads tightened, term lengths grew, down payments amount decreased, and the amount of negative equity in deals grew, which were all improvements for consumers. By channel, used loans through independent dealers saw the most loosening, while certified pre-owned loans saw the most tightening.

“On a year-over-year basis, channels were mixed, with used loans from independent dealers loosening while certified pre-owned loans saw the most tightening. Among lenders, auto-focused finance companies loosened the most in April, while banks tightened the most year-over-year,” analysts went on to say.

Cox Automotive explained the April index reading surfaced in part because the average yield spread on auto financing in April tightened by 46 basis points, so rates consumers saw on their contracts were more attractive in April relative to bond yields.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Analysts noted the average auto-finance rate decreased by 45 basis points in April compared to March, while the five-year U.S. Treasury increased by 1 basis point, resulting in a wider average observed yield spread.

Cox Automotive pointed out that the approval rate decreased by 20 basis points in April and was down 2.4 percentage points year-over-year.

Analysts added the subprime share declined in April to 13.2% from 14.9%, but it was up 1.2% year-over-year.

Cox Automotive also mentioned the share of contracts originated in April with terms longer than 72 months jumped by 89 basis points on a sequential basis but ticked down 1.0 percentage points compared to last year.

Each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity and down payments.

The index is baselined to January 2019 to show how credit access shifts over time.

Cox Automotive closed by noting some other headwinds that might be making originations and deliveries difficult.

“According to the sentiment index from the University of Michigan, consumer sentiment declined 2.8% in April but was up 21.2% year-over-year,” analysts said. “The median consumer expectation for inflation in a year jumped to 3.2%, its highest level since November, and the expectation for five years increased to 3.0%, which was also the highest since November.

“The consumer’s view of buying conditions for vehicles declined to the lowest level since December as views of interest rates and prices both deteriorated,” Cox Automotive added.