Affordability leads latest TransUnion study & AFSA event dialogue

Charts courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

By the time Cherokee Media Group reconnected with Satyan Merchant, the senior vice president of auto and mortgage business leader at TransUnion already appeared on stage during the Vehicle Finance Conference in Las Vegas hosted by the American Financial Services Association.

“I think going into this everyone thought the A word was going to be AI, but it’s actually affordability,” Merchant said late on Monday afternoon after the panel discussion and multiple other conversations at the event revolved around consumers being able to afford monthly payments for a new or new to them vehicle.

The event dialogue reinforced findings from a study TransUnion released on Tuesday. TransUnion reported that consumer intent to purchase vehicles remains strong for 2026, with four in 10 U.S. adults planning to buy a car, most within the next year.

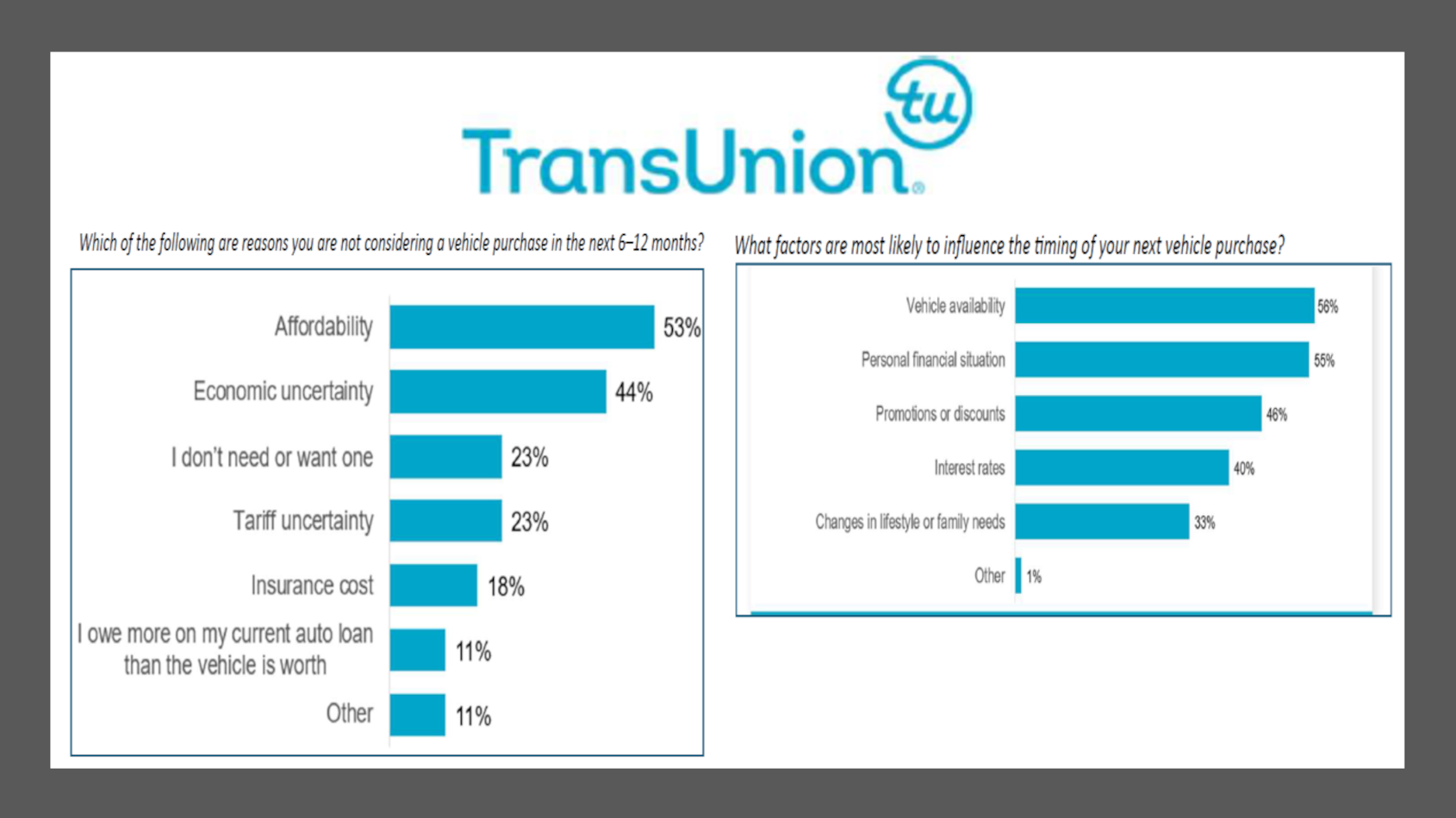

But researchers also acknowledged affordability remains the most significant obstacle for consumers not planning to buy. TransUnion said 53% of consumers who participated cited cost concerns and 44% pointed to economic uncertainty.

Merchant noted that whether these barriers lessen will depend on the direction of vehicle prices, interest rates and improving consumer confidence.

For those consumers planning to purchase in the next 12 months, TransUnion discovered main considerations regarding when to buy a car included vehicle availability and personal financial situations.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cherokee Media Group asked Merchant how much vehicle affordability and availability might be connected.

“It’s a great call out that vehicle availability is absolutely a driver into affordability, especially for those consumers that want to manage their monthly payments,” Merchant said. “They’re looking for a less expensive vehicle that may not exist. I’m not sure any manufacturer makes one that has an MSRP below $20,000, which is very different than not that long ago.

“I think the good news is as we’re learning here, looking forward into the next year or is that there should be more off-lease vehicles coming into the market in 2026 and beyond,” he added. “There was a pinch in supply over the last couple years, so there could be relief in sight in terms of more vehicle availability.”

Should affordable vehicles become more plentiful, there appears to be a notable pool of individuals eager to finance them and take delivery.

TransUnion surveyed 3,076 U.S. consumers age 18 and older. Among them, 1,190 respondents say they intend to buy a vehicle — 39% of the total sample — showing that vehicle purchases rank high on consumers’ priority lists.

More than 80% of consumers who indicated intent to buy a vehicle expect to purchase within the next 12 months, according to TransUnion. Researchers indicated this trend holds across all generations. Additionally, 65% of prospective buyers expect to trade in their current vehicle, which supports the market for used cars.

“New-vehicle purchases remain a clear priority for consumers, with more than a third of those surveyed planning to buy a car within the next 12 months,” said Jason Laky, executive vice president of financial services at TransUnion. “This intent to purchase points to solid underlying market demand and could meaningfully increase used‑car supply as shoppers replace existing vehicles.”

Among consumers planning a vehicle transaction, TransUnion found that 87% intend to buy, and 13% intend to lease.

Researchers added that younger generations express greater interest in leasing — 17% of Gen Z and Millennials compared with 7% of Baby Boomers — reflecting a preference for flexibility and lower upfront and ownership costs.

Merchant explained that these leasing trends emerged as auto loan originations began to rise in 2025, driven by anticipation of tariffs and, to a lesser extent, the end of the EV tax credit. He also mentioned super prime and subprime segments led this growth, despite ongoing challenges related to affordability.

TransUnion wrapped its study report by highlighting that auto financing growth in 2026 is likely to be modest and selective, shaped by affordability and inventory constraints. By leveraging the right data-driven solutions, experts said lenders and retailers can best position themselves to capture the right opportunities and build long-term loyalty.

For lenders, TransUnion said:

—Audience segmentation and credit-based targeting can help identify consumers most likely to transact soon

—Income and ability-to-pay insights will be key in an environment where affordability is top of mind

—Advanced risk models leveraging best-in-class, trended credit and alternative data can contribute to more informed decisioning — helping price loans more accurately

“Credit-based targeting allows a lender or a dealer to find the consumer that might be in market for a vehicle but also use the credit attributes to identify what they can actually afford,” Merchant told Cherokee Media Group. “That allows them to be more specific on an offer, which is good for the consumer so they’re not provided offers that that don’t really work for them and it’s also good for the lender or the dealer to not spend their time and money.”

TransUnion also touched on what kind of vehicle individuals might acquire once their budget situations are smoothed.

Researchers found that half of prospective buyers indicated they intend to purchase a traditional gas-powered vehicle compared to 33% for hybrids and 16% for electric vehicles.

TransUnion noticed Millennials show a slight preference for hybrids over gas-powered vehicles, while Gen Z favors traditional gas models. Still, nearly half of all respondents say they remain open to considering an EV in the future.

Researchers added that consumers interested in EVs cite lower fuel costs (72%), environmental benefits (66%) and new technology features (62%) as key reasons. Those who do not consider EVs cite preference for combustion engines (51%), range anxiety (41%), limited charging infrastructure (34%) and price concerns (37%).

Older consumers considering future EV purchases emphasize fuel savings and environmental benefits, whereas Gen Z places additional value on advanced technology and features, according to TransUnion.

“Internal combustion powertrains still dominate because affordability and charging infrastructure continue to challenge EV adoption,” Merchant said in a news release. “Millennials show increasing interest in hybrids, while Gen Z leans toward traditional gas vehicles — likely due to affordability constraints. Audience segmentation and credit-based targeting tools enable lenders to pinpoint affordability driven consumers across generations who are most likely to be ready to enter the auto market in the near term.”