AFSA unveils Consumer Credit Conditions Index

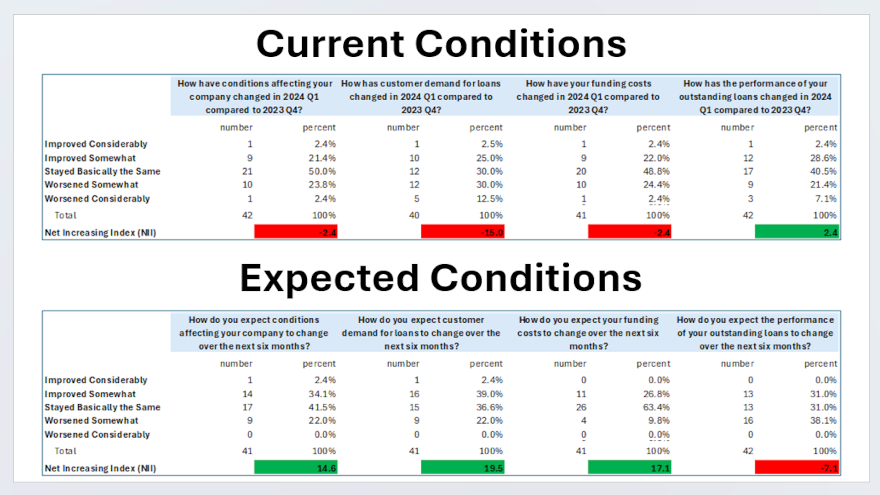

Results of auto finance companies that participated in a survey for AFSA’s Consumer Credit Conditions Index. Charts courtesy of the American Financial Services Association.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The American Financial Services Association (AFSA) leveraged its membership base to create its latest ongoing project — the Consumer Credit Conditions Index (C3 Index).

AFSA revealed the first findings from this initiative, which is meant to fill a need among finance companies, lenders, policymakers, consumer-facing businesses, the financial media and the public for a set of focused indicators that track the state of the industry, including the automotive segment.

“It provides crucial insights beyond what is available in other industry sentiment surveys or government statistical reports,” AFSA said in a statement about this index that’s based on a quarterly survey of its membership of mortgage, vehicle financing, personal installment loans, credit cards, and other consumer credit products.

Nearly 60 AFSA members representing the full spectrum of consumer credit responded to the initial survey, which was conducted in late March and early April.

Looking closer at auto financing, the survey found that precisely half of participants that offer vehicle credit said that business conditions stayed basically the same in the first quarter compared to the closing quarter of last year. And nearly a quarter said conditions improved during that timeframe.

And considering the next six months, AFSA reported that 41% of participating auto finance companies see business conditions staying the same, while 34% think they’ll improve somewhat. But 22% are concerned that conditions will deteriorate somewhat.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

AFSA also asked auto finance companies about their view of funding, demand for their credit products and performance of their outstanding portfolios.

When examining results from all personal loans, AFSA discovered difficulties for members.

The survey’s results showed conditions facing consumer lenders deteriorated on balance. The association said twice as many lenders said that business conditions worsened in Q1 (38.6%) as said they improved (19.3%).

AFSA pointed out the number of responses indicating their company offered credit cards, sales financing, student loans, mortgages/home equity loans, and other types of credit were insufficient to report separately. These were aggregated and reported as a single “other” category.