Agora welcomes Mancero as managing director

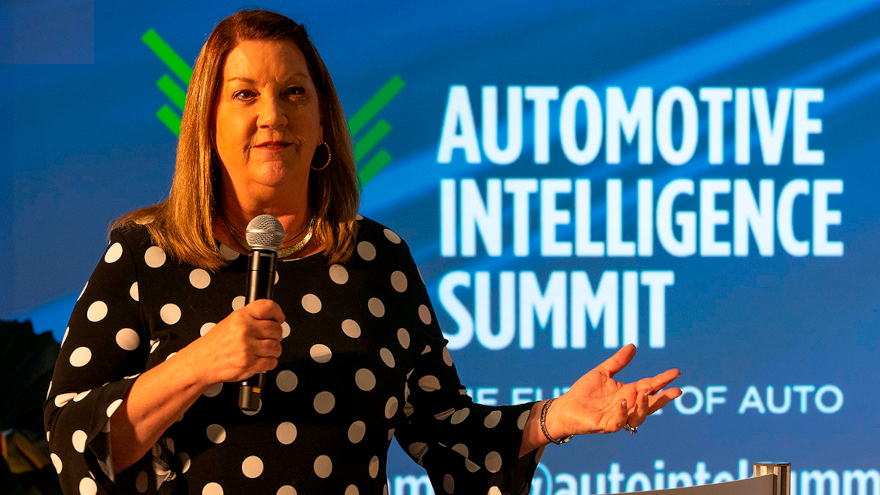

Sharon Mancero, pictured here during the 2019 Auto Intel Summit, now is managing director of Agora Data. Photo by Jonathan Fredin.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

A familiar name in the subprime auto finance industry now is part of Agora Data.

The fintech company — which provides technology, capital and guidance with predictable contract performance and analytics for the subprime space — announced the appointment of Sharon Mancero as managing director on Tuesday.

The company said Mancero joins Agora with “an impeccable finance background and deep auto industry experience.”

Agora is asking Mancero to help introduce strategic initiatives that best leverage the company’s assets and auto financing talents to optimize portfolios and balance sheets for small to mid-sized institutions including banks, credit unions and finance companies.

“With Sharon’s remarkable background and experience, she can quickly identify revenue opportunities that will help banks, credit unions, and finance companies maximize their growth potential,” Agora Data CEO Steve Burke said in a news release.

“Sharon’s deep industry knowledge and indisputable background in capital markets makes her the ideal industry expert to assist financial institutions with compelling financing options that promote stability and growth,” Burke continued.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Mancero spent more than 30 years at Wells Fargo, 20 of which were in the asset-backed finance group providing senior lending facilities to consumer finance companies in the U.S. and Canada. She was responsible for market and business development, building strategic relationships with national brands, and developed new lending channels and programs for consumer finance assets.

For over a decade, Mancero served in board positions as vice president and president for National Automotive Finance Association and vice chair and chairperson of American Financial Services Association.

“As Agora continues to grow as an innovative auto finance powerhouse, I look forward to working with small to mid-sized institutions to develop complimenting strategies that will improve portfolios and balance sheets,” said Mancero, who also was among the first group of Women in Auto Finance honorees in 2018. “Banks, credit unions, and finance companies will benefit from Agora’s wide range of financing solutions such as cleaning up transactions in their portfolio, reducing the capital investment needed to keep in-house finance company operations, or providing an exit strategy to free-up capital.

“I’m excited to be a part of Agora’s evolution as a highly innovative company and look forward to doing my part to positively transform the auto industry.”