Ally Financial tops subprime space in J.D. Power study for fifth consecutive year

Charts courtesy of J.D. Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

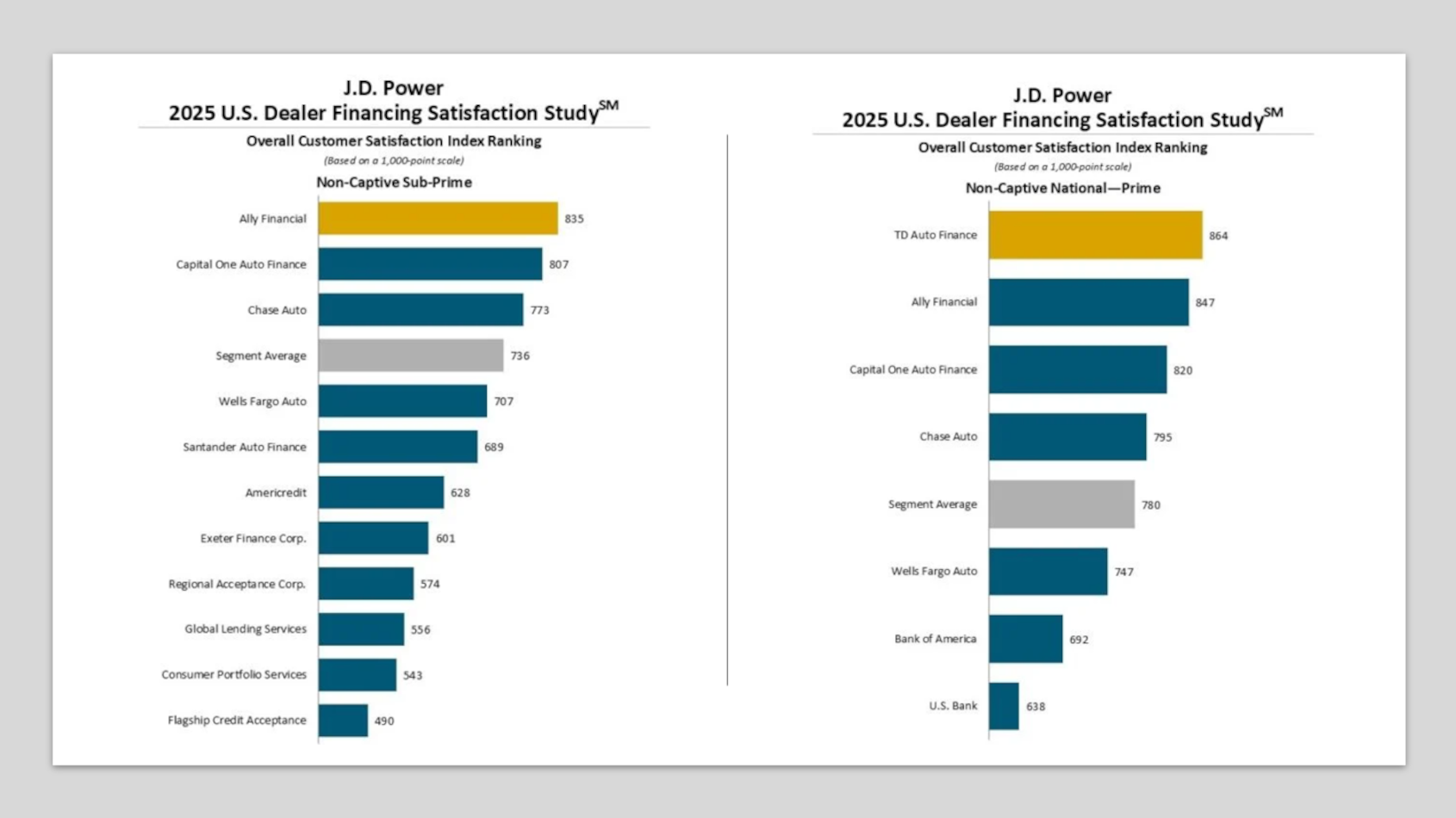

Along with a discussion about performance among banks, the J.D. Power 2025 U.S. Dealer Financing Satisfaction Study highlighted that Ally Financial topped the chart again among non-captive subprime auto finance companies.

The study showed Ally Financial ranked highest in overall dealer satisfaction for a fifth consecutive year, compiling a score of 835 on a 1,000 scale. Capital One Auto Finance came in second at 807, and Chase Automotive Finance placed third in the subprime category at 773.

The 2025 U.S. Dealer Financing Satisfaction Study is based on 24,085 total evaluations from 5,035 auto dealer financial professionals.

The study, which was fielded in from April through May, measured auto dealer satisfaction in four other segments of prime lenders, including:

Captive premium

Maserati Capital USA ranked highest in overall dealer satisfaction with a score of 927, followed by Porsche Financial Services (879) and Jaguar Land Rover Financial Group (874).

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Captive mass market

Southeast Toyota Finance ranked highest in overall dealer satisfaction for a third consecutive year with a score of 874, followed by Subaru Motors Finance (866) and Honda Financial Services (775).

Non-captive national

TD Auto Finance ranked highest in overall dealer satisfaction for a sixth consecutive year, with a score of 864. Ally Financial (847) came in second and Chase Auto (820) landed in third.

Non-captive regional

Huntington National Bank ranked highest in overall dealer satisfaction for a third consecutive year, with a score of 759. Santander Auto Finance (736) placed second and M&T Bank (726) came in third.

Amid swirling economic headwinds, J.D. Power said national banks remain significantly ahead of regional banks in satisfaction among auto dealers.

According to the study, national banks (780) have significantly outperformed regional banks (713) in overall satisfaction and dealer intent for a third consecutive year.

While regional banks have narrowed the gap, J.D. Power indicated they still trail national banks in all five of the metrics evaluated in the study, an indication that progress is not happening quickly enough to shift dealer preferences or behaviors.

“National banks continue to demonstrate the resilience and adaptability that set them apart in today’s economic climate,” said Patrick Roosenberg, senior director of automotive finance intelligence at J.D. Power.

“If regional banks want to stay competitive, they must clearly differentiate their value proposition and show dealers how their services are superior in meeting their needs. Without that, they risk losing relevance and market share,” Roosenberg added.