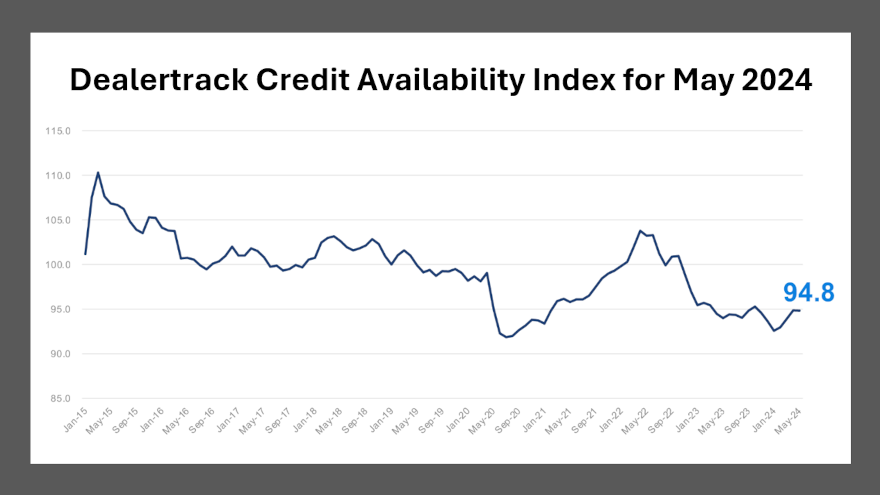

Analysts revise April Dealertrack Credit Availability Index when sharing May reading

Chart courtesy of Cox Automotive

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive took a second look at the April reading of the Dealertrack Credit Availability Index.

As a result, both the April and May readings looked a bit more favorable for dealerships and finance companies.

What might be ahead later in the summer could be even more murky.

Analysts reported on Tuesday that access to auto credit still declined slightly in May as credit tightened across most channels and all financing types. The index came in at 94.8 in May, which was down only a 0.1 percentage point from the upwardly revised April reading. But it was 0.9% higher year-over-year.

“The subprime share and negative equity share both declined, and those moves made credit access more challenging for consumers,” Cox Automotive said in its analysis that accompanied the latest index reading. “However, the approval rate increased, yield spreads narrowed, term length increased, and down payments were up slightly, and the moves in those factors were beneficial for consumers for the month.

“Credit access in May was looser than a year ago in all channels except franchised used sales, where it was flat year-over-year,” Cox Automotive continued. “Credit access was also looser year-over-year for all lender types, with captives and credit unions loosening the most.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“By channel, used loans through independent dealers and new loans saw the most loosening year-over-year, while certified pre-owned (CPO) loans only loosened availability marginally,” analysts went on to say. “For the month, banks and captives saw standards tighten the most while used loans through independent dealers tightened the least.”

Drilling deeper into the data, Cox Automotive recapped that the average yield spread on auto financing in May tightened by 18 basis points, so rates consumers obtained were more attractive in May relative to bond yields.

Analysts indicated the average rate for auto financing decreased by 24 basis points sequentially in May, while the five-year U.S. Treasury decreased by 6 basis points, resulting in a narrower average observed yield spread.

Cox Automotive said the contract approval rate increased by 20 basis points in May but dropped 2.4 percentage points year-over-year.

Analysts pointed out the subprime share decreased to 12.5% from 13.2% in April. But the share grew 1.2 percentage points year-over-year, according to Cox Automotive.

Also of note, analysts mentioned the share of contracts with terms longer than 72 months increased by 10 basis points on a sequential basis, but that share was off by 1.5 percentage points year-over-year.

Cox Automotive reiterated each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity, and down payments. The index is baselined to January 2019 to show how credit access shifts over time.

Analysts wrapped up the index update by touching on some measures of consumer confidence.

Cox Automotive noted the Conference Board Consumer Confidence Index increased by 4.6% in May “as views of both the present situation and the future improved. Still, views of the future improved substantially and more than erased April’s decline in that index.”

Analysts added that plans to purchase a vehicle in the next six months were unchanged compared to April and May last year.

“The daily index of consumer sentiment from Morning Consult was again volatile in May and declined by 2.1% for the month, leaving the index up by 6.9% year-over-year,” Cox Automotive said.

“The consumer’s view of buying conditions for vehicles declined to the lowest level since November as the view of interest rates deteriorated,” analysts went on to say about the Morning Consult information. “Gas prices also fell in May, which may boost consumer sentiment in the coming weeks.”