Annual Protective report acknowledges ‘perceived lack of value’ for F&I products

Charts courtesy of Protective Asset Protection.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Potential buyers might see the significant value in having their next car equipped with Apple CarPlay, automatic braking or distinct wheels.

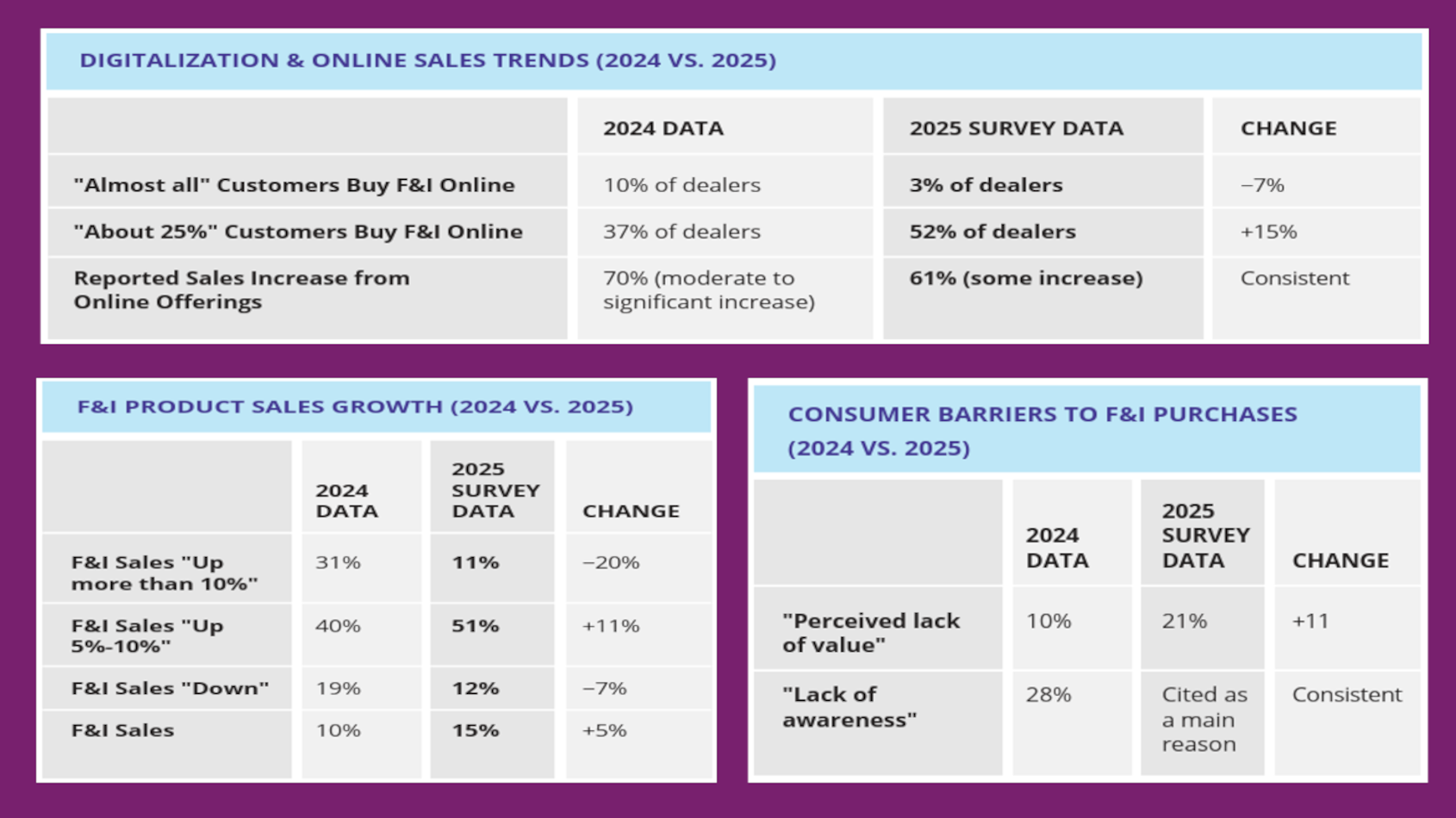

But Protective Asset Protection’s 2025 F&I Industry Report pointed to a significant shift in consumer perception, with dealers suggesting a “perceived lack of value” for F&I products more than doubling over the last year.

Protective explained the change appears to be driven largely by the rising total cost of vehicle ownership rather than the products themselves.

That’s one of the primary findings in the report released on Friday that summarized a maturing F&I industry landscape, characterized by moderating growth, persistent affordability challenges, and a strategic shift toward a deliberate omnichannel customer journey.

“Our 2025 report underscores a new phase for the automotive industry where market headwinds are beginning to take their toll,” said Rick Kurtz, senior vice president and chief distribution officer for Protective Asset Protection.

“While F&I sales growth remains resilient for most, the rapid expansion we saw post-pandemic has given way to a more nuanced reality,” Kurtz continued in a news release. “Dealers are no longer just overcoming price objections; they are tasked with a fundamental re-education of consumers to demonstrate the vital value of F&I protection in a high-cost environment.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

While digitalization remains a priority, Protective found that the narrative has shifted from a race toward fully online transactions to a more effective omnichannel model.

A few other report findings included:

—Omnichannel reality: Over 63% of dealers now offer online research options while still requiring an in-person transaction to close the deal.

—Moderating growth: While 62% of dealers still reported an increase in F&I product sales, the segment experiencing high growth (over 10%) plummeted from 31% in last year’s report to just 11% this year.

—Consumer priorities: Despite budget pressures, consumers continue to prioritize protection for major mechanical components, technology features, and protection against total loss.

To navigate these changes, the report identifies three critical pillars for dealer success in 2026, including

—Early stage consumer education

—Product innovation tailored for affordability and used vehicles

—Strategic adoption of technology

“The affordability crisis has become the defining challenge for our industry,” Kurtz said. “To maintain momentum, dealers are successfully pivoting toward a blend of early digital engagement and more flexible, value-driven product offerings that protect the customer’s significant investment.”

The report also explored the untapped potential of artificial intelligence (AI), noting that while only 8% of dealers are currently active users, AI represents a massive opportunity to personalize offerings and counter value-perception hurdles.

Conversely, Protective said wealth-building programs have moved from a conceptual opportunity to a practical standard, with 58% of dealers now participating in programs like reinsurance to diversify income and ensure long-term stability.

Beyond the automotive market, the report also touched on specialized analysis of the marine, powersports, and RV sectors as they deal with a period of post-pandemic normalization.

Experts noted the marine market is currently in an adjustment phase characterized by a softened market and an 11.19% year-over-year decline in registrations.

In contrast, Protective said the powersports sector is experiencing a significant market correction, with new unit sales declining by over 13% while the used market remains a bright spot, showing a 2.04% increase in sales.

Similarly, experts added the RV industry is undergoing an inventory correction but shows signs of stabilization, with 2025 wholesale shipments projected to reach a median of 337,000 units.

Across all three specialty segments, the report emphasized the growing importance of F&I product adoption — such as GAP coverage and extended service contracts — to offset lower front-end margins and protect consumers against rising repair costs and negative equity.

Protective wrapped up the report, which can be downloaded via this website, with these thoughts.

“Looking ahead, the affordability crisis will continue to be the defining theme for 2026,” the company said. “The onus is on F&I providers and dealers to innovate with products and payment structures that make coverage attractive without adding overwhelming cost.

“Education, both for consumers and dealership staff, will be the single most critical investment. The industry can no longer assume that consumers understand the value of F&I; it must actively demonstrate its necessity and justify its cost in a clear, compelling, and early-stage manner,” Protective went on to say.