April credit availability comparisons come against ‘abnormal’ conditions

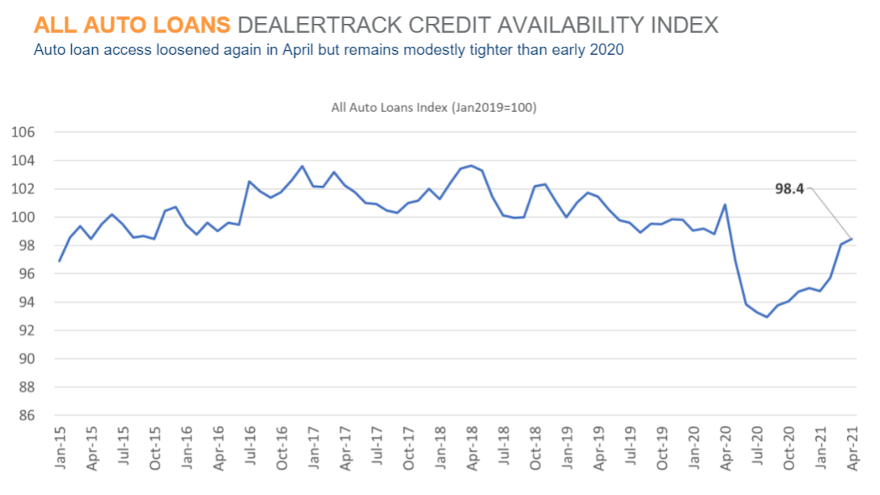

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

ATLANTA –

Cox Automotive reported this week that auto financing availability in April was the most accessible since April 2020, according to the Dealertrack Auto Credit Availability Index.

But analysts acknowledged that making year-over-year comparisons is challenging, since they’re versus the outset of the pandemic.

The index reading increased 0.4% to 98.4 in April, reflecting that credit was easier to get in the month compared to March. Analysts said access is tighter by 2.4% year-over-year, but that comparison is against “abnormal credit conditions” from April 2020.

Compared to February 2020, Cox Automotive said access is tighter by just 0.7%.

Looking closer at the data, analysts discovered that financing provided through independent dealers tightened the most.

“On a year-over-year basis, independent used financing, non-captive new-vehicle financing and franchised used financing are now looser,” Cox Automotive said in the report that accompanied the latest index update.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Other channels remain tighter year-over-year, with new-vehicle loans and used CPO having tightened the most,” analysts added.

Cox Automotive also mentioned credit availability loosened the most in April at captives, expanding by 1.1%, while credit tightened at credit unions by 1.3%.

“On a year-over-year basis, auto-focused finance companies and banks have loosened credit access, while credit unions are unchanged, and captives have tightened,” analysts said.

“However, the year-over-year comparison for captives is against a time when lending by captives was particularly aggressive during the pandemic lockdown period,” they continued.

“However, the subprime share and the negative equity share increased while down payments also increased, and those factors moved against credit expansion,” analysts went on to say.

Each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details including term length, negative equity, and down payments. The index is baselined to January 2019 to provide a view of how credit access shifts over time.

Across all auto financing in April, Cox Automotive said approval rates increased, yield spreads narrowed and the share of terms longer than 72 months increased, which all made credit more accessible.

Cox Automotive also included some general consumer observations and what they could mean for vehicle retailing and financing.

“The trend in daily new COVID cases ended April on a declining trend as substantial progress was made in vaccinations so that more than 100 million Americans were fully vaccinated,” Cox Automotive said.

“Consumer confidence according to the Conference Board increased 11.7% in April and left confidence down only 8% compared to February 2020,” analysts continued. “Plans to purchase a vehicle in the next six months jumped in April to a 23-month high.”