As Fed ponders rate cuts, Bain/Dynata research shows some consumers might be ‘battening down the hatches’

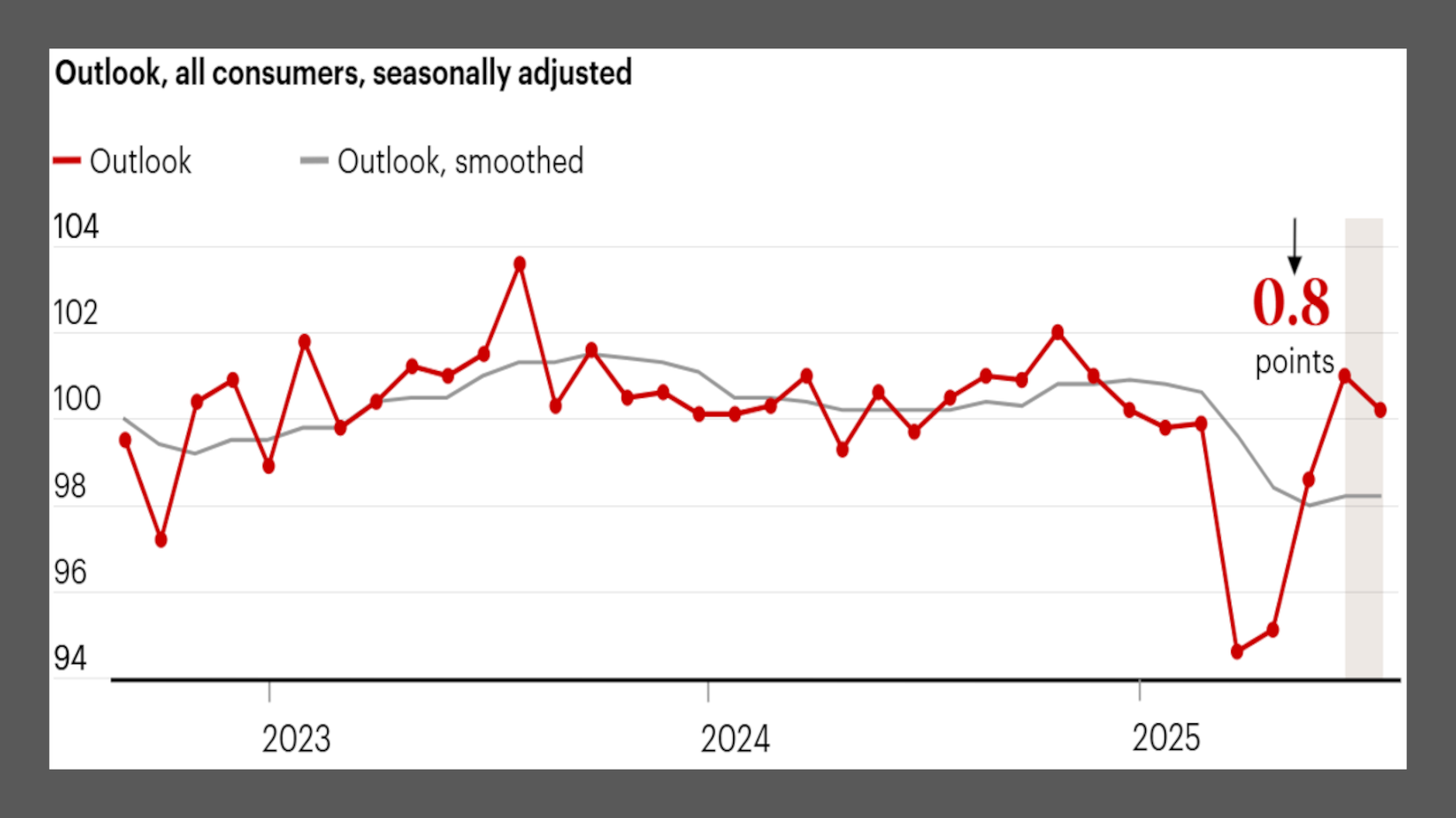

Screenshot courtesy of the Bain & Company/Dynata Consumer Health Indexes (CHI).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Just ahead of the Federal Reserve chair making some of his most important public comments of the year on Friday, the latest results of the Bain & Company/Dynata Consumer Health Indexes (CHI) indicated a souring mood among U.S. consumers is emerging.

And that mood appears to be strongest within a consumer segment often served by subprime auto finance companies.

The CHI report’s headline outlook gauge for consumer prospects across all U.S. income groups slipped in August, declining to 100.2 from July’s 101.0 reading, reflecting the worsening sentiment among American households and a more fragile consumer environment.

Researchers also found that the outlook reading for lower-income Americans (individuals earning below $50,000 per year) fell to 96.4, extending a decline that began in June and marking its third consecutive month at the low end of the gauge’s range for the past year.

Alongside, the August CHI outlook score for middle-income households (earning $50,000 to $100,000 per year), which had stalled for the previous five months, fell 0.7 points to 99.5, taking it below its neutral level of 100 for the first time since mid-2023.

While upper-income consumers (earning more than $100,000 per year) remain in a positive position for now, the Bain/Dynata analysis warns of signs that optimism among this better-off group is rolling over simultaneously across the CHI indicators for outlook, spending intentions, and intent to use debt.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In August, the outlook score for upper-income Americans declined by 1.2 points to 104.3; the intent to spend reading rose by only a modest 0.8 points, registering its smallest gain in months; and the gauge for intent to use debt dipped by 0.1 points to 104.1.

The report concluded that this pattern of movements, taken together, suggests a meaningful inflection for upper-income consumers may be underway, even though the overall positioning for these earners remains strong at present.

“The consumer is sending negative signals across all income groups. Both lower-income and middle-income households are showing poor outlook readings and upper-income households’ optimism is starting to roll over,” said Brian Stobie, vice president in Bain & Company’s Macro Trends Group.

“A delicate consumer is getting ever closer to the edge. We advise businesses to plan for scenarios that include weakening consumer demand for the coming quarters,” Stobie continued in a news release.

Weaking consumer demand is among the elements the Federal Reserve likely will consider when policymakers have their next opportunity to adjust interest rates on Sept. 17.

Chief economist Bill Adams and senior economist Waran Bhahirethan said on Monday that Comerica Bank’s next rate forecast has the Fed cutting the funds target a quarter percent both September and December.

“The minutes of the FOMC’s July meeting show a divided committee, worried about the same inflation and employment risks mentioned in Powell’s Jackson Hole speech,” Adams and Bhahirethan said in an analysis.

That speech was Fed chair Jerome Powell appearing in Jackson Hole, Wyo., for the annual summertime economic symposium sponsored by the Federal Reserve Bank of Kansas City. Powell spent significant time explaining how difficult the current job of the Federal Open Market Committee (FOMC) is nowadays, with inflation and employment trends moving in varying directions.

“Putting the pieces together, what are the implications for monetary policy? In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside — a challenging situation,” Powell said. “When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate. Our policy rate is now 100 basis points closer to neutral than it was a year ago, and the stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance. Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.

“Monetary policy is not on a preset course. FOMC members will make these decisions, based solely on their assessment of the data and its implications for the economic outlook and the balance of risks. We will never deviate from that approach,” he added.

In the meantime, many consumers are being squeezed significantly, especially ones on tight budgets.

Turning back to the information from Bain, August’s further worsening in the outlook gauge for lower-income U.S. households provides strengthened evidence of problems in the job market impacting this group.

The Bain/Dynata analysis showed this month’s fall comes after July’s CHI report cautioned that the lower-income group’s declining outlook reading was a signal of deteriorating labor market conditions — a conclusion validated by the subsequent, unusually large downward revisions to prior months’ official payroll data.

Researchers said the weaker outlook scores for lower-income Americans are not yet affecting the group’s spending intentions, with the CHI gauge of these steady this month at 99.0, the report noted. But it cautions that the spending situation could shift rapidly if sizable job losses begin to be seen in the economy.

Spending intentions for middle-income consumers are also holding steady for now, according to the CHI data. However, the reading for the group’s intent to use debt fell by 3.6 points in August, to 95.1, the lowest since August 2020, while the gauge for its savings intentions jumped by 3.4 points to 98.5.

It’s dynamic that the Bain/Dynata analysis “suggests may indicate middle-income earners are battening down the hatches,” according to researchers.

The CHI report concluded that U.S. consumers are collectively feeling more pessimistic, even if this shift is not yet apparent in broader economic data.

While the outsized role of upper-income earners in U.S. discretionary spending may help sustain overall consumer demand in the near-term, the CHI data pointed overall to a negative shift in consumers’ perceptions of prospects.

In turn, Stobie said businesses should include scenarios for a weaker consumer outlook in their planning.

“Lower-income households are telling us something is off in the labor market and the recent revisions to the official payroll data back up this signal,” Sobie said. “For middle-income earners, the housing tailwind that often drives optimism just isn’t there this year – and housing weakness is starting to register, with this group bracing for tougher conditions.

“And while the upper-income consumer is still in a strong position for now, the peak optimism we saw last month took a step back even as markets continue to rally. The signs are that the exuberance of early summer is giving way to something more cautious,” he went on to say.