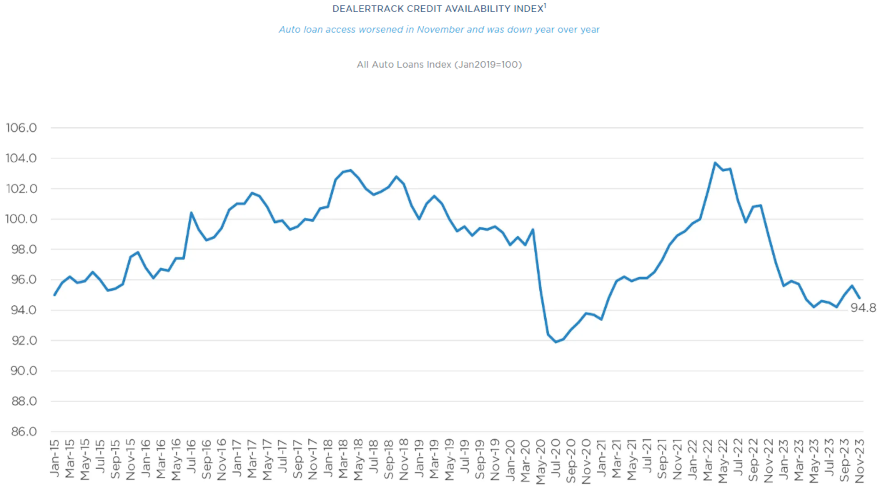

Auto credit tightens in November

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

November typically contains a variety of enticement offerings to get consumers to spend on holiday gifts.

Evidently, finance companies didn’t take that approach to stimulate automotive retail activity like what might have happened for electronics or home and personal items.

The newest Dealertrack Auto Credit Availability Index showed access to auto credit worsened in November after it had loosened for three months in a row.

According to an update released by Cox Automotive on Monday, the index decreased by 0.8% to 94.8 in November. With the decrease in November, access was tighter by 4.2% year-over-year. And compared to February 2020, access was tighter by 4.0%.

“Movement in credit availability factors was mixed in November,” analysts said in their commentary that accompanied the index update. “Yield spreads increased, subprime share decreased, average term shortened, fewer deals had negative equity, and the down payment amount increased, and those moves hurt credit access for consumers. Approval rates were steady in November but at the lowest level this year.

Cox Automotive explained the average yield spread on auto finance booked in November widened by 10 basis points, so rates consumers received were less attractive in November relative to bond yields.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The average interest rate decreased by 19 basis points in November compared to October, according to Cox Automotive, while the five-year U.S. Treasury rate increased by 29 basis points, resulting in a wider average observed yield spread.

Cox Automotive said the approval rate actually increased by 9 basis points in November but remains 0.4 percentage points lower year-over-year.

Analysts indicated the subprime share decreased to 12.1% from 12.2% in October and dropped 0.7 percentage points year-over-year.

The update went on to mention that the share of contracts with terms longer than 72 months decreased by 47 basis points and was down by 1.7 percentage points year-over-year.

“Credit availability tightened across all channels in November. New-vehicle loans saw the least tightening, while certified pre-owned (CPO) loans saw the most tightening. On a year-over-year basis, all channels were tighter, with CPO loans having seen the most tightening,” Cox Automotive said.

“Credit availability tightened in November across all lender types, except for captives, which loosened slightly. Credit unions tightened the most. On a year-over-year basis, credit access to all lenders was tighter, with credit unions tightening the most,” analysts went on to say.

Each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity, and down payments. The index is baselined to January 2019 to show how credit access shifts over time.