Caribou sees plenty of opportunities for auto refinancing

Screenshots courtesy of Caribou.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

While there’s some stability in used-vehicle financing, Edmunds recently highlighted multiple all-time highs registered during the second quarter for consumers to take delivery of a new vehicle, including the percentage of individuals paying more than $1,000 monthly.

At Caribou, the trends could mean a fertile field ahead for the auto refinance platform. The Edmunds data arrived after Caribou released its Auto Refinance Trends Report, which contained new insights into payment reductions, rate reductions, and the broader impact of refinancing on household finances.

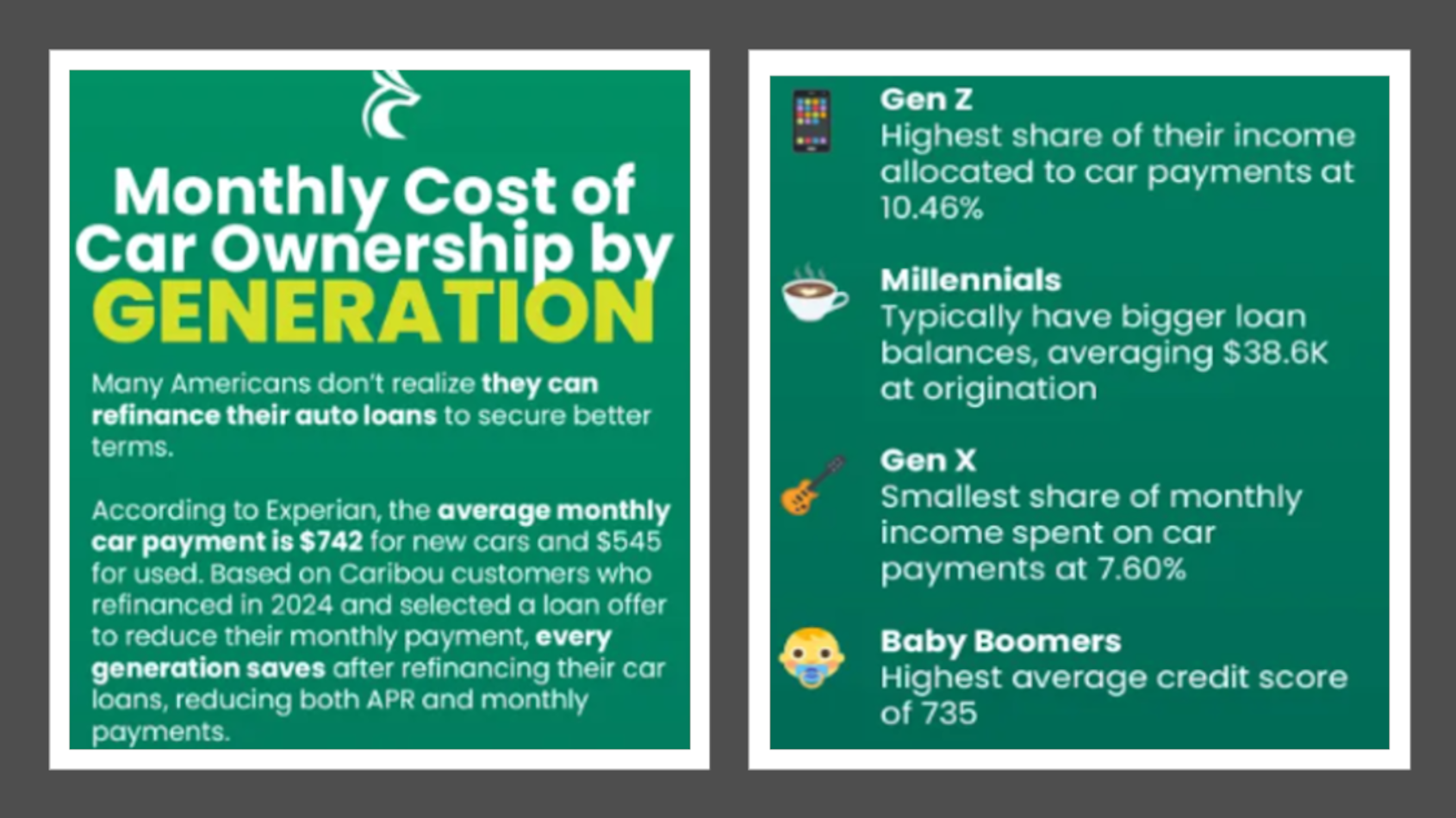

Caribou’s analysis is based on customers with good credit scores and stable incomes, ensuring the results reflect genuine payment reductions and not outliers. This report breaks down before-and-after savings by generation, highlighting the unique financial challenges and opportunities faced by each group:

Gen Z (1995–2012):

- Highest % of their income going towards their car payment at 10.46%

- Lowest average original starting loan balance of $32,069; with average refi loan amount of $28,811

- Begins with the highest average APR at 14.05%, reflecting limited credit history

- Refinancing reduces APR by 5.56 points to 8.50%

- Gen Z customers were able to save an average of $126 per month, reducing their monthly payment from $648 to $522

Millennials (1980–1994):

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

- Typically carry larger loan balances, with average original starting loan of $38,158 and average refi loan amount of $33,313

- Millennial customers were able to save an average of $143/month, $733 to $590

- APR drops by 4.02 points

Gen X (1965–1979):

- Lowest % of their monthly income going towards their car payment, at 7.60%

- Highest average original loan amount of $39,395; average refi loan amount of $34,387

- Gen X customers realized the largest average monthly savings: $147, from $757 to $610

- APR falls by 3.80 points

Boomers (1946–1964):

- Boomer customers were able to save an average of $131 per month, a meaningful benefit for those approaching retirement

- Boomers also tied Gen X customers for the lowest APR after refinancing at 8.39% APR

“Car payments represent a major financial burden for many households, yet too often consumers assume they are locked into their original rates,” Caribou CEO Simon Goodall said in a news release. “Our analysis demonstrates that drivers of all ages can unlock meaningful savings by refinancing. This is not simply a financial tip; for many, it’s a critical strategy for improving monthly cash flow.”

The entire report can be viewed here.