COMMENTARY: What dealer compliance will look like in a Biden administration

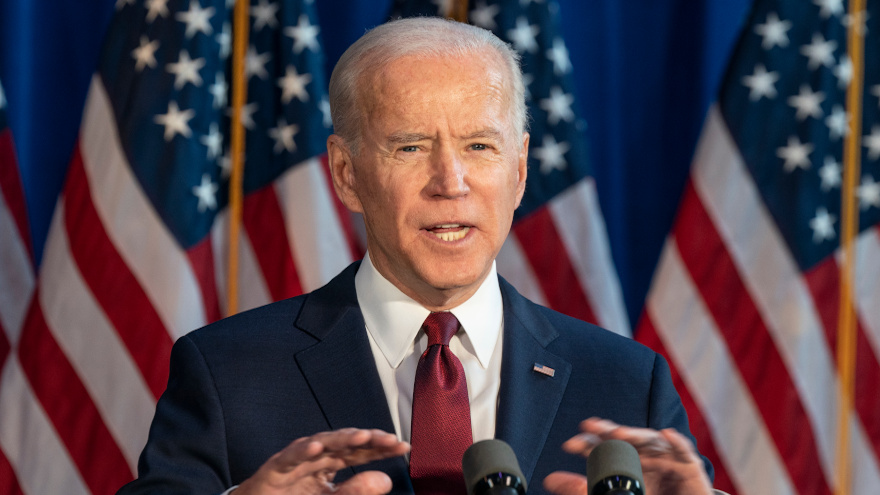

President-Elect Joe Biden. Image by lev radin / Shutterstock.com

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

CHARLESTON, S.C. –

Joe Biden’s victory likely will usher in a new era of consumer protection and compliance challenges for auto dealers. Four out of the five Federal Trade Commission (FTC) Commissioners will have their terms expire during the Biden Administration. President-Elect Biden will have the power to replace the head of the Consumer Financial Protection Bureau. The Democrats will, for at least two years, control the House and maybe the Senate, too.

The Democratic Party Platform stated that a Biden administration would work “to ensure equitable access to credit and banking products for all Americans, and reinvigorate the Consumer Financial Protection Bureau (CFPB) to ensure that banks, financial institutions, and lenders cannot prey on consumers.” The Platform also indicates Democrats will “eliminate the use of forced arbitration clauses.” Strong language is also given to protecting consumers’ rights to privacy and protecting consumers from data breaches.

In short, as Democratic Sen. Chuck Schumer said with respect to the Supreme Court, everything is on the table.

That being said, it is reasonable to expect changes in the automobile world to be evolutionary not revolutionary. The Trump administration has put new staffers at senior levels in the CFPB and FTC. While some of these people may leave or be replaced, there will not be a wholesale firing and replacement of Republican staffers on day one.

Here are some thoughts on what to expect.

CFPB

It is important to remember that Sen. Elizabeth Warren, the original architect of the CFPB, will have an important voice in Biden administration policy. Warren raised concerns earlier this year about auto finance and has indicated her disdain for auto dealers in the past.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Auto dealers got a specific exemption from CFPB oversight, and it is no coincidence that auto loans are now the most troubled consumer financial product,” Warren said. “Congress should give the CFPB the authority it needs to supervise car loans – and keep that $26 billion a year in the pockets of consumers where it belongs.” The $26 billion per year is Warren’s estimate of total dealer participation which Warren would like to eliminate.

Warren is also closely aligned with Richard Cordray who headed the CFPB during the Obama administration. You may recall that the CFPB under Cordray published the agency’s bulletin on auto finance indicating that dealer participation resulted in disparate impact credit discrimination. In May 2018, the Congress passed a joint resolution that was signed by President Trump disapproving the bulletin.

Disparate impact credit discrimination involves facially neutral practices that have the effect of discrimination. Actual intent to discriminate is not required. Disparate treatment credit discrimination generally requires intent to discriminate.

The U.S. Supreme Court in 2015 decided the case of Texas Department of Housing versus Inclusive Communities Project. This case appeared to make it harder to bring a disparate impact credit discrimination case under a statute like the Equal Credit Opportunity Act (ECOA) although ECOA was not at issue in the case. ECOA prohibits “any creditor to discriminate against any applicant with respect to any aspect of a credit transaction.” This picks up disparate treatment credit discrimination. But ECOA does not prohibit acts that “otherwise make unavailable” credit to protected classes as does the Fair Housing Act which was at issue in the case. It was this language that the Supreme Court ruled 5-4 picks up disparate impact credit discrimination. The Supreme Court has not ruled on whether ECOA prohibits disparate impact.

FTC

FTC commissioners serve staggered terms. No more than three commissioners can be of the same political party. Two Republican commissioners will have their terms expire in 2023 and 2024, respectively. When replacing a commissioner, including a Democratic commissioner as will occur in 2022, it is reasonable to believe that a Biden administration will appoint someone more leftward leaning than a Republican president would appoint. Over time, this could lead to a more activist FTC including against auto dealers and auto finance about which the FTC has held hearings.

FTC staff members may also turn over and it is not unreasonable to believe that more liberal replacements may be appointed. Expect the FTC to be more active during the Biden Administration although how soon and how much so will remain to be seen.

The Department of Justice (DOJ)

The DOJ has brought criminal actions against auto dealers, their owners, and their employees for bank fraud, interstate wire fraud, and other federal criminal law violations. Several dealer principals as well as F&I personnel have served jail terms for defrauding federally regulated lenders by, for example, submitting falsified credit applications, power booking, and other fraudulent behavior.

President Biden will appoint a new head of the Department of Justice to replace William Barr early in his term. This person will obviously be more liberal than Mr. Barr. It is reasonable to expect that senior levels in the DOJ may likewise move to the left. This could result in more investigations, enforcement actions, and criminal proceedings against auto dealers who falsify documents and misrepresent transaction information to lenders.

State attorneys general

The CFPB and State Attorneys General (AGs) act in close concert on consumer protection matters. During the Trump administration, many enforcement actions against auto dealers have originated with State AGs.

An activist CFPB and aggressive AGs can be expected to pursue more claims against auto dealers. Your state AG is the most likely regulator you will encounter. It is critical that you have a policy and procedure for addressing consumer complaints. Use this procedure for every consumer complaint. Remember that even a small complaint can become a big problem if the consumer reports it to the Attorney General.

What’s a dealer to do?

If you have put compliance on the back burner during the Trump Administration, now is the time to get prepared, review and update your policies, and train/retrain your employees. A checkup with your legal or compliance advisor is an excellent idea.

The Biden administration is likely to focus on safeguards and privacy so make those first on your list. (Review your privacy notice and make sure it states what your actual sharing practices are). Consumer protection in sales and f & I will be another area for activist agencies. If you have not already done so, adopt and implement the NADA Fair Credit Compliance Program and the NADA Voluntary Protection Products policy and program.

In recent enforcement actions, the FTC has made dealer principals jointly and personally liable with the dealership for violations including broad unfair and deceptive practices violations. This trend will continue. That should be reason alone for your senior management to give priority to compliance as the Biden Administration takes over.

Randy Henrick is an auto dealer compliance expert who provides compliance consulting services to dealers directly at www.AutoDealerCompliance.net. He served for 12 years as Dealertrack’s lead regulatory and compliance attorney and wrote all Dealertrack’s Compliance Guides. He has presented workshops at five NADA national conventions and speaks to dealer associations, 20 Groups, performs deal jacket auditing, and prepares training and other compliance materials for dealers. Because of the general nature of this article, it is not intended as legal or compliance advice to any person but raises issues you may want to discuss with your attorney or compliance professional.