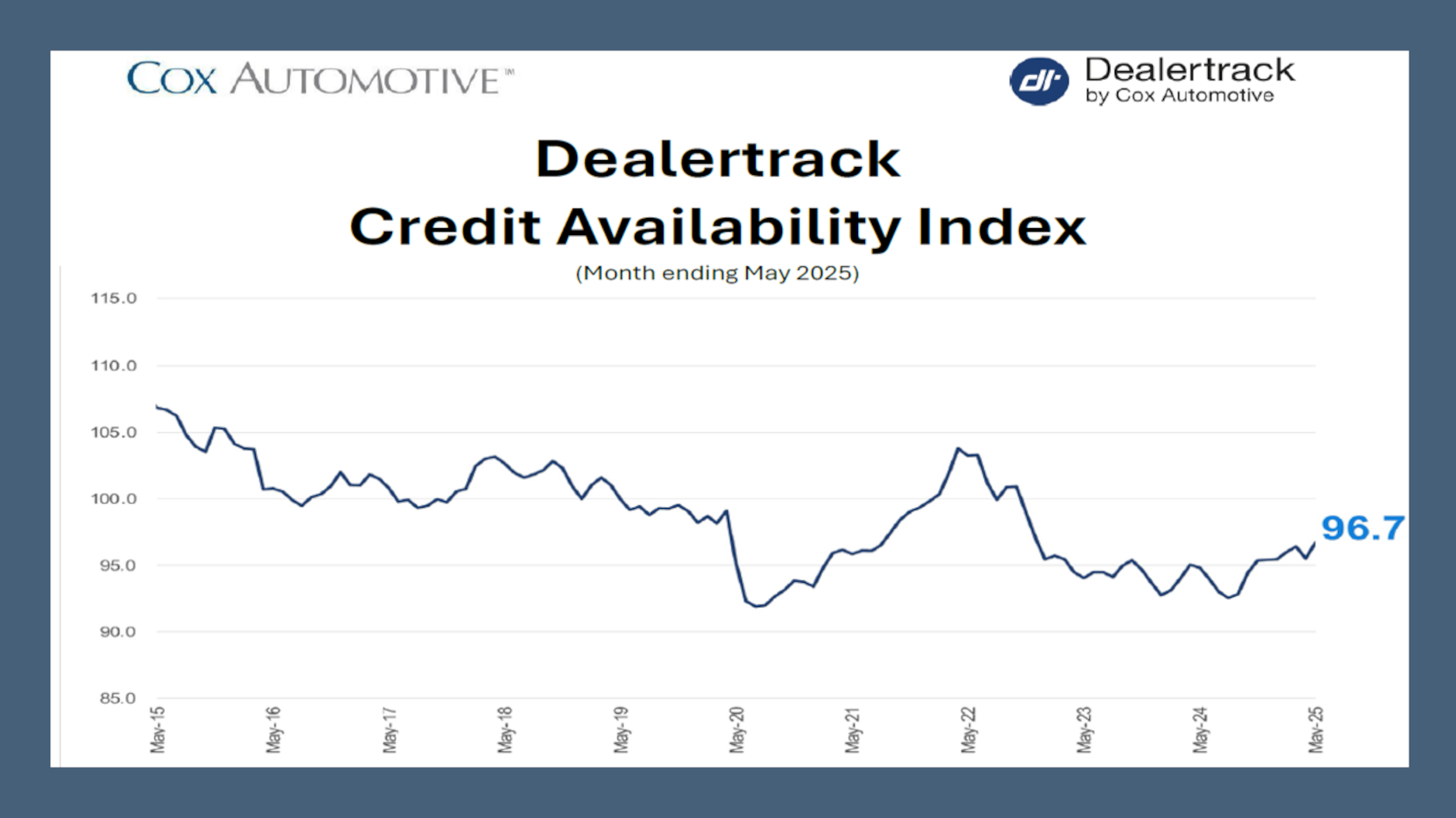

Cox Automotive spots more modest improvement in auto credit availability in May

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Perhaps finance companies are acknowledging that they’re going to have to absorb a bit more risk to keep origination objectives within reach.

Cox Automotive reported this week that the May Dealertrack Credit Availability Index showed a modest improvement in auto credit access across several key metrics, including the subprime segment.

Analysts indicated the index rose to 96.7, up from 95.5 in April. Jonathan Gregory, a senior manager on Cox Automotive’s economic and industry insights team, explained that the May movement continued a gradual upward trend in credit availability.

“Overall, the May Dealertrack Credit Availability Index reflected a modest loosening in auto credit conditions, shaped by both lender strategy and evolving economic signals,” Gregory said in his analysis that accompanied the newest index.

“Consumers experienced slightly improved access to financing, particularly among subprime borrowers, while lenders adjusted to rising interest rates and shifting demand with cautious optimism,” he continued.

As he regularly does, Gregory elaborated about the six key elements of auto credit access, beginning with approval rates.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive determined the approval rate for auto financing increased by 28 basis points in May.

“This uptick suggests lenders were slightly more willing to approve applications, potentially reflecting confidence in borrower creditworthiness or broader economic stability,” Gregory said.

Perhaps the most notable of the May metrics, Cox Automotive indicated the share of contracts extended to subprime consumers rose by 33 basis points.

Gregory said the movements might be indicating “a slight loosening of credit standards for higher-risk consumers. This shift may reflect competitive pressures or a more optimistic view of consumer repayment capacity.”

Next, Cox Automotive got deeper into the numbers when examining the yield spread.

Analysts pointed out the yield spread ticked up by 5 basis points, moving from 7.21% in April to 7.26% in May. That metric is based on the difference between the average contract rate and the five-year Treasury yield.

Cox Automotive noted the contract rate rose from 11.12% to 11.28%, while the five-year Treasury yield increased from 3.91% to 4.02%.

“This modest widening suggests that lenders passed on some of the rate pressure to borrowers, maintaining their margins despite rising benchmark rates,” Gregory said.

The trend with one of the highest movements in May was contract terms.

Cox Automotive noticed the share of loans with terms longer than 72 months increased by 53 basis points on a sequential comparison.

“This continued rise suggests that consumers are increasingly opting for longer loan terms to manage monthly payments, even though it results in higher total interest costs over time,” Gregory said.

Coinciding with those lengthening terms and what Gregory acknowledged as “a potential sign of growing financial strain or vehicle depreciation outpacing loan repayments,” Cox Automotive said the proportion of credit applicants with negative equity rose by 34 basis points in May.

To offset that movement, Cox Automotive added that the average down payment percentage edged 6 basis points higher in May, reaching 9.58%.

“This increase may reflect lender caution or consumer efforts to reduce loan balances,” Gregory said.

All told, Gregory explained that credit unions and banks showed a slight loosening in credit standards in May, while captives remained relatively stable. Auto-focused finance companies continued to show a cautious approach.

“The modest improvement in credit access, especially for subprime borrowers, may provide more opportunities for vehicle financing. However, rising contract rates and longer loan terms suggest consumers should remain cautious and consider the long-term cost of borrowing,” Gregory said.

“The increase in subprime share and longer loan terms indicates a slightly more aggressive lending posture. However, the rise in negative equity and contract rates suggests that lenders must continue to strike a balance between growth and prudent risk management,” he went on to say.