Credit applications tick up as vehicle-buying intentions remain stable

Screenshot courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive chief economist Jonathan Smoke said Tuesday that unique credit applications per dealer on Dealertrack increased 6% year-over-year last week, perhaps reflecting some previously mentioned consumer sentiment trends shared by the Conference Board.

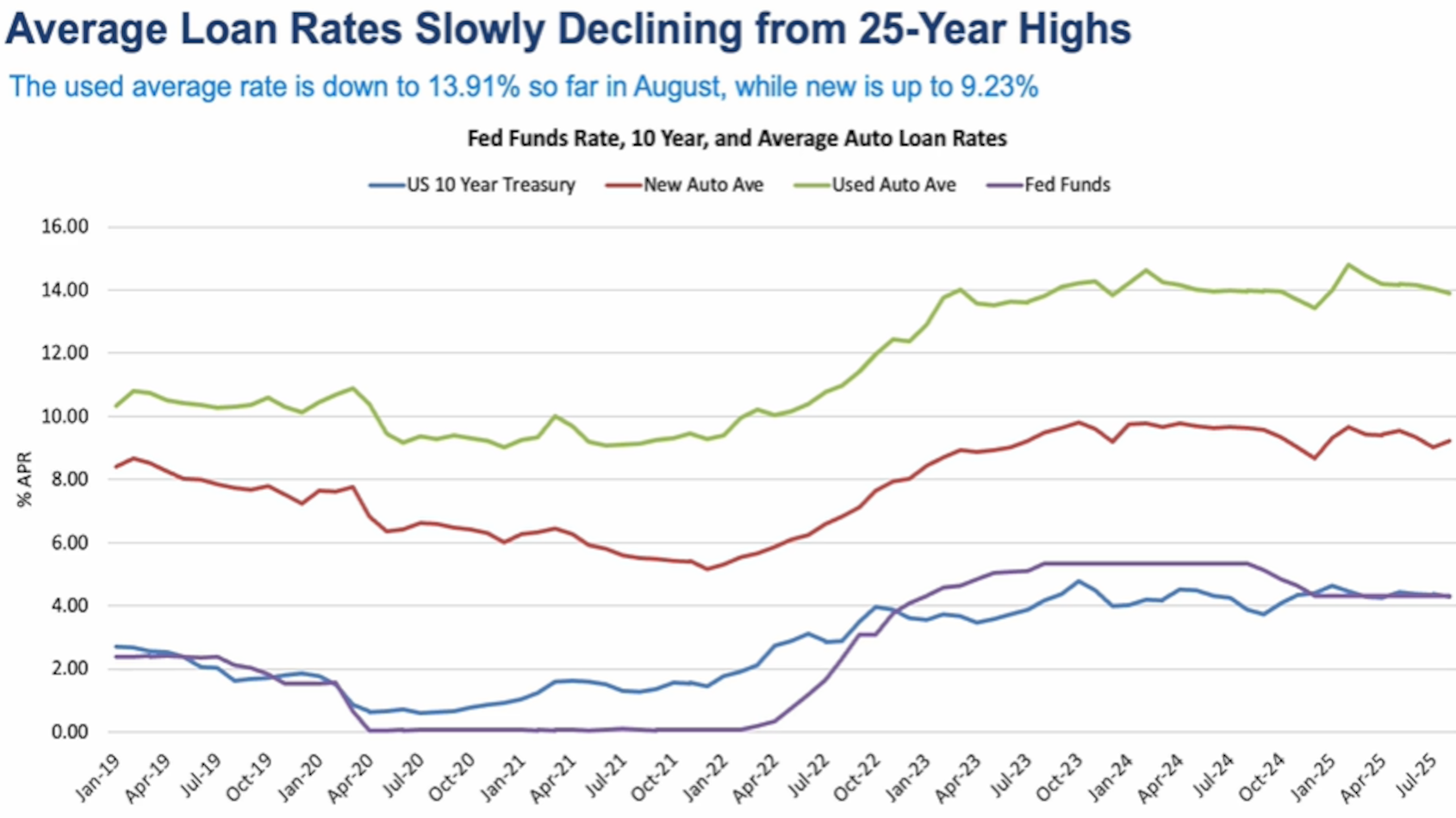

In his weekly Auto Market Report, Smoke acknowledged “consumers with great credit are seeing the lowest rates in several years.” According to Cox Automotive tracking, the average interest rate for used-car financing completed in July was 14.04%, which Smoke said was the lowest level since January.

So far in August, Smoke noted, the trend has continued to improve for some consumers with the average rate for used-car financing softening to 13.91%.

“If rates keep drifting lower, affordability will keep improving below the averages,” Smoke said in the report.

Affordability might help consumers make a commitment to buying a vehicle since the Conference Board said its research showed purchasing plans for cars and homes declined in July but remained stable on a six-month moving average basis.

“Consumer confidence has stabilized since May, rebounding from April’s plunge, but remains below last year’s heady levels,” said Stephanie Guichard, senior economist at the Conference Board. “In July, pessimism about the future receded somewhat, leading to a slight improvement in overall confidence. All three components of the Expectation Index improved, with consumers feeling less pessimistic about future business conditions and employment, and more optimistic about future income.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Meanwhile, consumers’ assessment of the present situation was little changed,” Guichard continued in a news release. “They were a tad more positive about current business conditions in July than in June. However, their appraisal of current job availability weakened for the seventh consecutive month, reaching its lowest level since March 2021. Notably, 18.9% of consumers indicated that jobs were hard to get in July, up from 14.5% in January.”

The Conference Board indicated July’s modest gain in confidence was driven by consumers over 35 years old and shared across all income groups except those earning the least (with household annual income below $15,000).

By partisan affiliation, researchers found confidence improved in July among Republican consumers and was stable for Democrats and independents.

Guichard added: “Consumers’ write-in responses showed that tariffs remained top of mind and were mostly associated with concerns that they would lead to higher prices. In addition, references to high prices and inflation rose in July, even though consumers’ average 12-month inflation expectations eased slightly to 5.8%, down from 5.9% in June and a peak of 7% in April.

“A number of survey respondents mentioned the recent budget reconciliation legislation passed by Congress (referring to it as the ‘One Big Beautiful Bill) with some consumers praising its potential positive economic impact and others expressing concerns. However, the bill and its implications were relatively low on the list of themes that consumers were focused on in July,” Guichard went on to say.