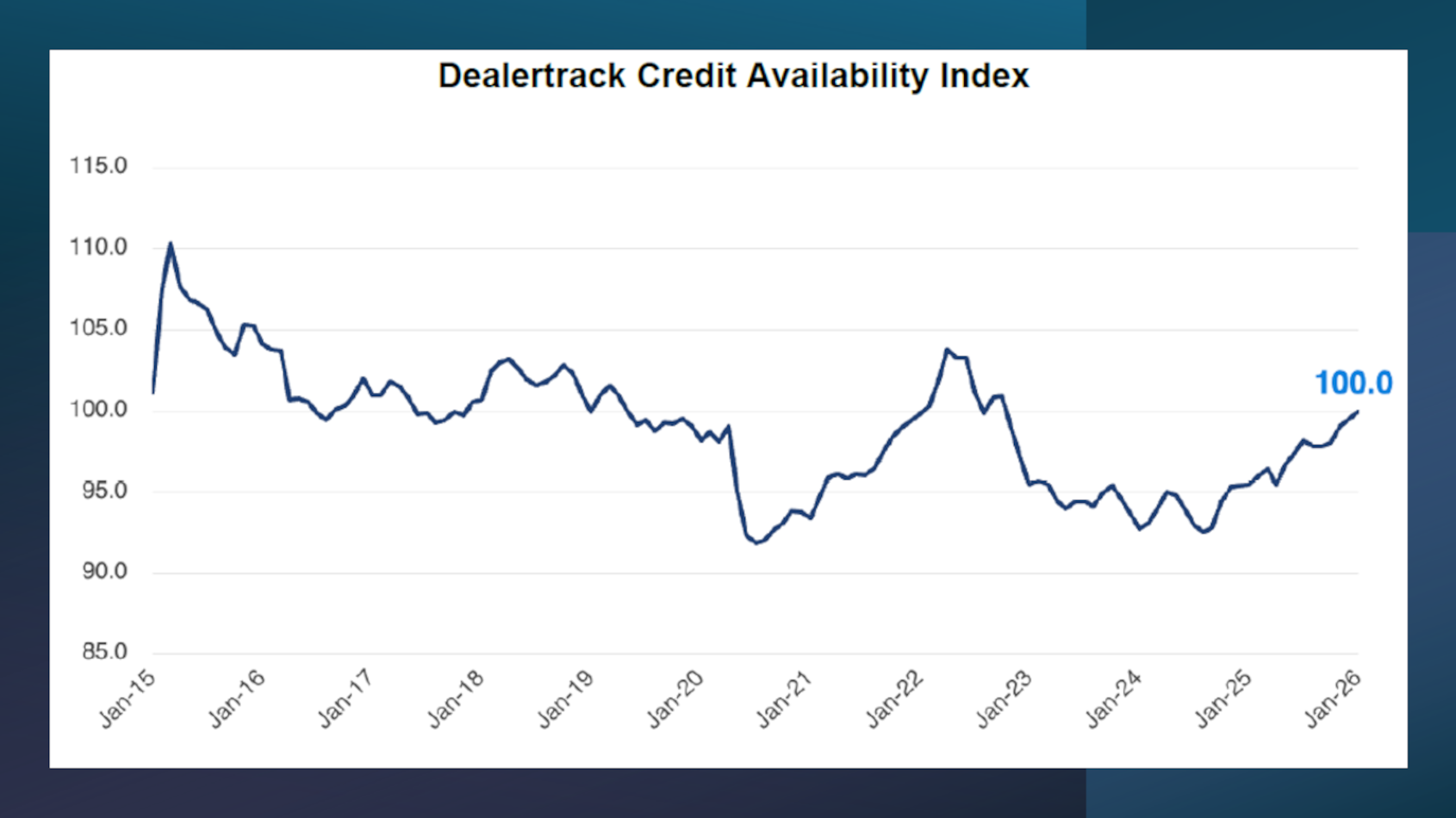

Credit availability steady in January as negative equity climbs and terms stretch

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive spotted a steady start to the year on the credit front, despite some turbulence involving negative equity, down payments and contract terms.

The January reading of the Dealertrack Credit Availability Index remained at 100.0, staying at its best level since October 2022. The latest mark also represented a lift of nearly 5% from last January.

Jonathan Gregory, a senior manager on Cox Automotive’s economic and industry insights team, explained in an analysis the accompanied the latest index update that individual metrics showed mixed movement, with some indicators of loosening offset by signs of tightening.

“Overall, the January Dealertrack Credit Availability Index reflected mixed auto credit conditions,” Gregory said. “While the index held steady at 100.0, individual metrics told a more complex story. Some measures continued to loosen, with increased subprime lending and longer loan terms offering expanded opportunities for certain borrowers.

“However, other indicators revealed tightening, most notably the decline in approval rates for the first time in three months and the sharp rise in negative equity to its highest level in recent months,” he continued. “The widening yield spread also indicates less favorable pricing for consumers despite the overall stable index level.”

Gregory’s commentary elaborated in more detail about those trends, beginning with how the approval rate for auto financing fell to 71.8% in January. That represented a sequential slide of 110 basis points, but a rise of 40 basis points year-over-year.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Approval rates softened after two straight months of gains, according to Cox Automotive.

Gregory noted that the share of loans to subprime borrowers increased by 70 basis points month-over-month (from 15.0% to 15.7%) and is up 290 basis points year-over-year.

“After declining in November and December, subprime lending resumed its upward trajectory in January, reversing the two-month pullback and suggesting lenders are once again loosening access for higher-risk borrowers,” Gregory said. “Subprime lending remains significantly elevated compared to a year ago, reflecting sustained appetite for higher-risk credit.”

According to Cox Automotive the yield spread in January rose by 31 basis points from 6.83% to 7.14%, while the average contract rate climbed by 39 basis points from 10.5% to 10.9%.

Gregory added that the five-year U.S. Treasury yield increased by 8 basis points from 3.70% to 3.78%.

“This widening spread represents less favorable pricing for consumers and may reflect lenders charging a premium to offset the increased risk from higher subprime lending and elevated negative equity,” Gregory said.

And speaking of negative equity, Cox Automotive reported the proportion of applicants in January with negative equity increased by 220 basis points month-over-month from 54.1% to 56.3% and is up 470 basis points year-over-year.

Gregory explained this “significant” monthly increase reversed the improvement of 140 basis points recorded in December and “pushes the share to its highest level in recent months, signaling increased risk as more borrowers finance vehicles worth less than their outstanding loan balances.”

And finance companies are continuing to absorb risk since Cox Automotive said the average down payment percentage in January increased by only 10 basis points from 13.3% to 13.4%. However, the metric is 80 basis points lower than a year ago.

“This modest increase may reflect lenders requiring slightly more upfront capital or consumers voluntarily putting more down, though down payments remain well below year-ago levels,” Gregory said.

Finally, when it comes to term length, the percentage of contracts booked in January stretching more than 72 months increased by 50 basis points from 27.5% to 28.0%. The percentage has spiked 400 basis points since last January.

“This may reflect ongoing affordability pressures as consumers opt for longer terms to manage monthly payments, with lenders appearing willing to accommodate these requests,” Gregory said.

Gregory wrapped up the monthly update with these observations.

“Ongoing improvements in credit access, especially in both new and used markets, continue to offer financing opportunities. While approval rates declined, the increase in subprime lending combined with longer loan terms suggests expanded access for some borrowers,” Gregory said. “However, the sharp rise in negative equity and higher yield spreads indicates growing risk and increased borrowing costs. Consumers should remain mindful of the total cost of ownership when evaluating loan offers.

“The performance across lender types reflects a shift in strategic priorities,” he continued. “Finance companies, captives, banks and credit unions all appear to be expanding access but with varying degrees of caution. The significant increase in negative equity suggests heightened risk exposure.

“As credit conditions evolve, lenders must balance growth with prudent risk management, especially amid shifting rate environments and consumer behavior,” Gregory went on to say.