CreditGauge reveals some stability in subprime auto finance & overall credit market

Chart courtesy of VantageScore.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

While overall consumer credit balances remained largely stable, the March edition of CreditGauge from VantageScore offered deeper insight into the subprime credit tier and auto financing.

When looking only at subprime consumers — what VantageScore pegs as individuals with scores between 300 and 600 — analysts found that the number of newly opened accounts that reflects the percentage of consumers that had at least one account opened in the past month rose again in March to 1.3%. That’s up from 1.1%, which was the reading in January and February.

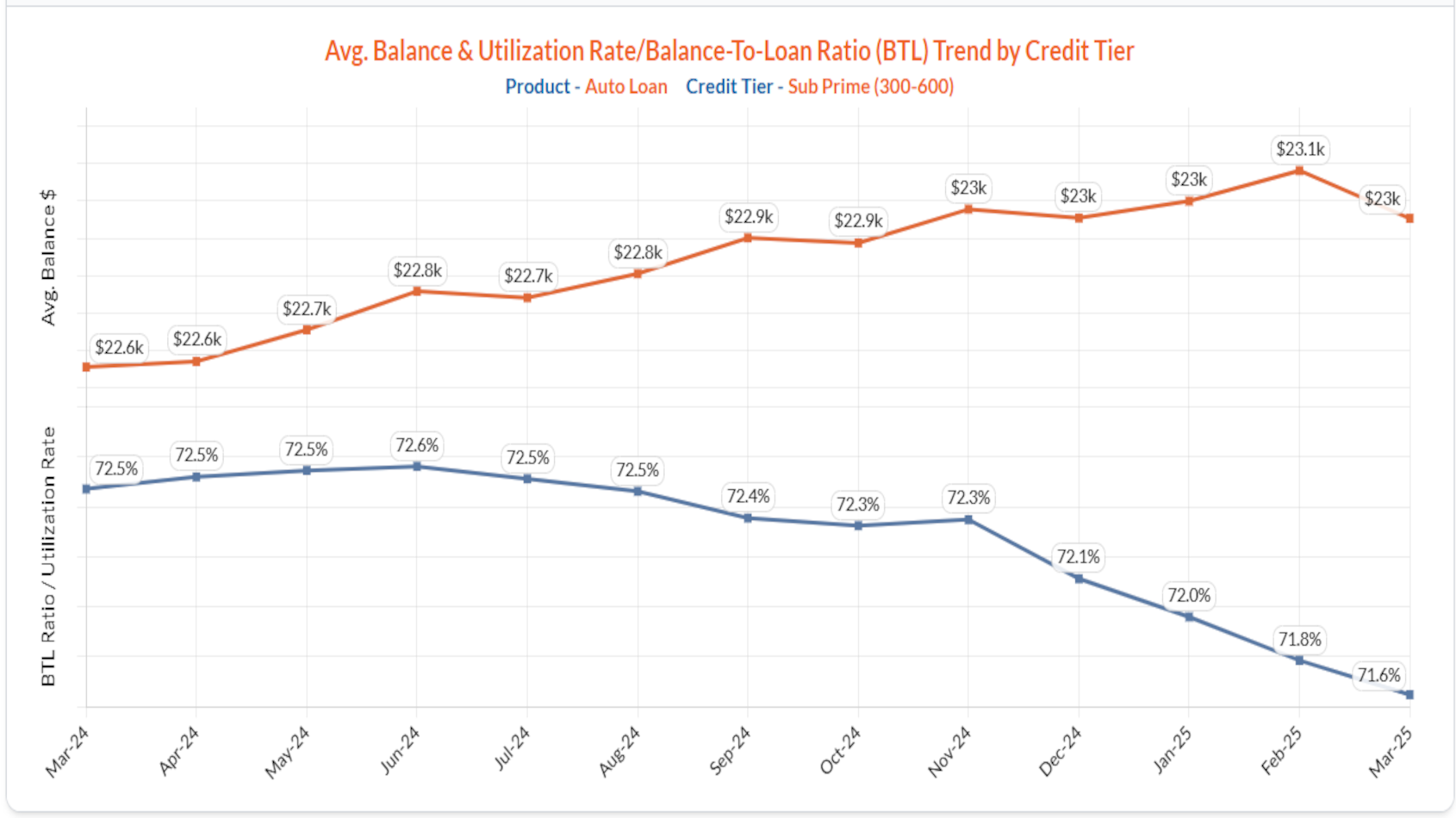

Through CreditGauge, VantageScore also offered a look at auto finance in the subprime credit tier for what analysts classified as the average balance and utilization rate and balance-to-loan ratio (BTL).

VantageScore explained these trends moved lower in March with the average balance dipping to $23,000 and the BTL ratio dropping to 71.6%. According to the data that goes back a year, the highest balance reading came in February at $23,100 and the BTL ratio peaked at 72.6% last June.

And when looking at delinquency, VantageScore’s data showed improvement in auto finance within subprime, with the rate of contracts 30 to 59 days delinquent dropping to 10.55% in March. That’s down from 13.32% in February and 14.38% in January.

Pulling back to the overall credit landscape, analysts indicated the average VantageScore credit score increased by one point to 702 from February to March, as the company said consumers demonstrated a disciplined and resilient use of credit despite significant financial market volatility

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Analysts added that new credit originations for credit cards and personal loans slowed month-over-month as banks appeared to tighten their lending criteria in a pivot to a more cautious lending posture.

“The latest CreditGauge insights show an emerging dichotomy between stable Main Street consumer behavior and the intense volatility on Wall Street,” said Susan Fahy, executive vice president and chief digital officer at VantageScore.

“Consumers are slowly moderating their borrowing and focusing on bringing their accounts up to date as banks tighten new lending in March,” Fahy added in a news release.

CreditGauge also showed overall credit delinquencies in March declined month-over-month across all days past due (DPD) categories for the first time since last April.

Additionally, VantageScore said consumer credit utilization ratios declined for all credit products in March, suggesting that borrowers are paying down their balances more effectively.

“Consumers are increasingly maintaining credit-healthy financial practices, contributing to an increased average VantageScore score,” analysts added.