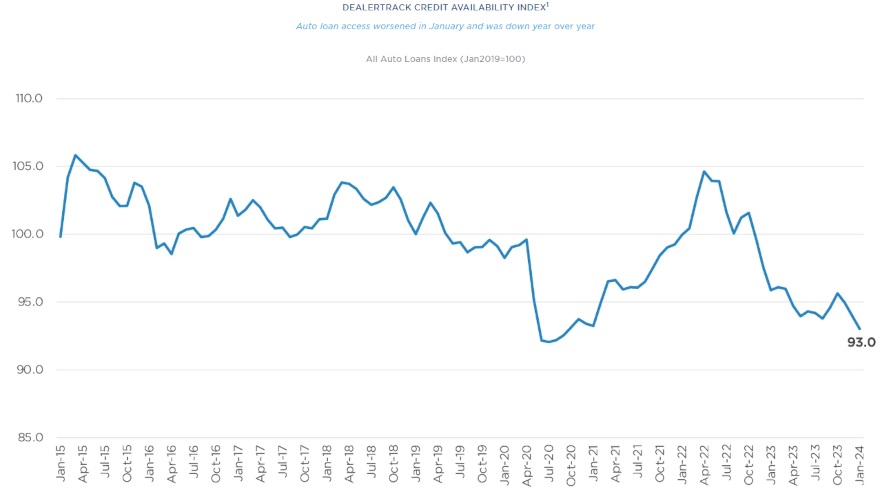

Dealertrack Credit Availability Index dips to lowest point in more than 3 years

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

It was pretty chilly throughout much of the country in January, especially at finance companies based on the newest Dealertrack Credit Availability Index.

Cox Automotive reported on Monday that the index reading declined to 93.0 in January. That’s 3% below a year ago, marking the lowest level since August 2020.

“The Dealertrack Auto Credit Total Loan Index had shown some improvements during the summer and fall of last year,” analysts said in their commentary that accompanied the latest update. “But those gains have been wiped out by the declines seen over the past three months.

“Credit access was tighter than a year ago in all channels and all lender types. Compared to February 2020, credit access was tighter in all channels except for used sales through independent dealers and loans from auto finance companies,” Cox Automotive continued.

So, how did the auto-finance market get to this point?

Analysts said credit availability factors mostly moved against consumers in January.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Yield spreads widened, term length, approval rate, and subprime share all declined, and those moves reduced credit access for consumers,” Cox Automotive said. “An increase in the negative equity share represented the only improvement for consumers.

“The down payment share was unchanged but at the highest level in the history of the data series,” analysts continued.

“By channel, new-vehicle loans saw the most tightening, while used-vehicle loans through independent used dealers saw the least amount of tightening,” Cox Automotive went on to say. “On a year-over-year basis, all channels were tighter, with used-vehicle loans through franchised dealers having seen the most tightening. Banks tightened the most among lenders in January, but credit unions were the tightest year-over-year.”

Analysts explained that the average yield spread on auto financing in January widened by 15 basis points, so rates consumers secured for auto financing were less attractive in January relative to bond yields.

Cox Automotive said the average interest rate for auto financing booked in January increased by 13 basis points compared to December, while the five-year U.S. Treasury note decreased by 2 basis points, resulting in a wider average observed yield spread.

Another headwind in January was softening approval rates, as Cox Automotive said they decreased by 8 basis points in January, dipping 1.6 percentage points year-over-year.

While the subprime share decreased to 11.2% in January from 11.4% in December, the reading ticked up 0.6 percentage points year-over-year, according to Cox Automotive tracking.

Furthermore, analysts pointed out the volume of contracts longer than 72 months dipped by 2 basis points sequentially and 1.8 percentage points year-over-year.

Cox Automotive added a few more observations about consumer behavior when wrapping up its latest update about of the Dealertrack Auto Credit Index, which tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity, and down payments. The index is baselined to January 2019 to show how credit access shifts over time.

“The Conference Board Consumer Confidence Index increased by 6.3% in January, powered by views of the present situation jumping 9.6% and to the highest level since March 2020. Consumer confidence was up 8.3% year-over-year,” analysts said. “Plans to purchase a vehicle in the next six months declined to the lowest level since April and were down year-over-year.

“Consumer sentiment also improved in January, according to the sentiment index from the University of Michigan,” analysts continued. “The Michigan index increased 13.3% for the month and was up 21.7% year over year. Consumer expectations for inflation in a year declined to 2.9%, which was the same expectation for inflation in five years. The consumer’s view of buying conditions for vehicles increased to the highest level since the summer of 2021 as views of prices and interest rates were less negative.”