Despite ‘mixed year’ for subprime, S&P Global Ratings watches auto ABS volume generate another record in 2025

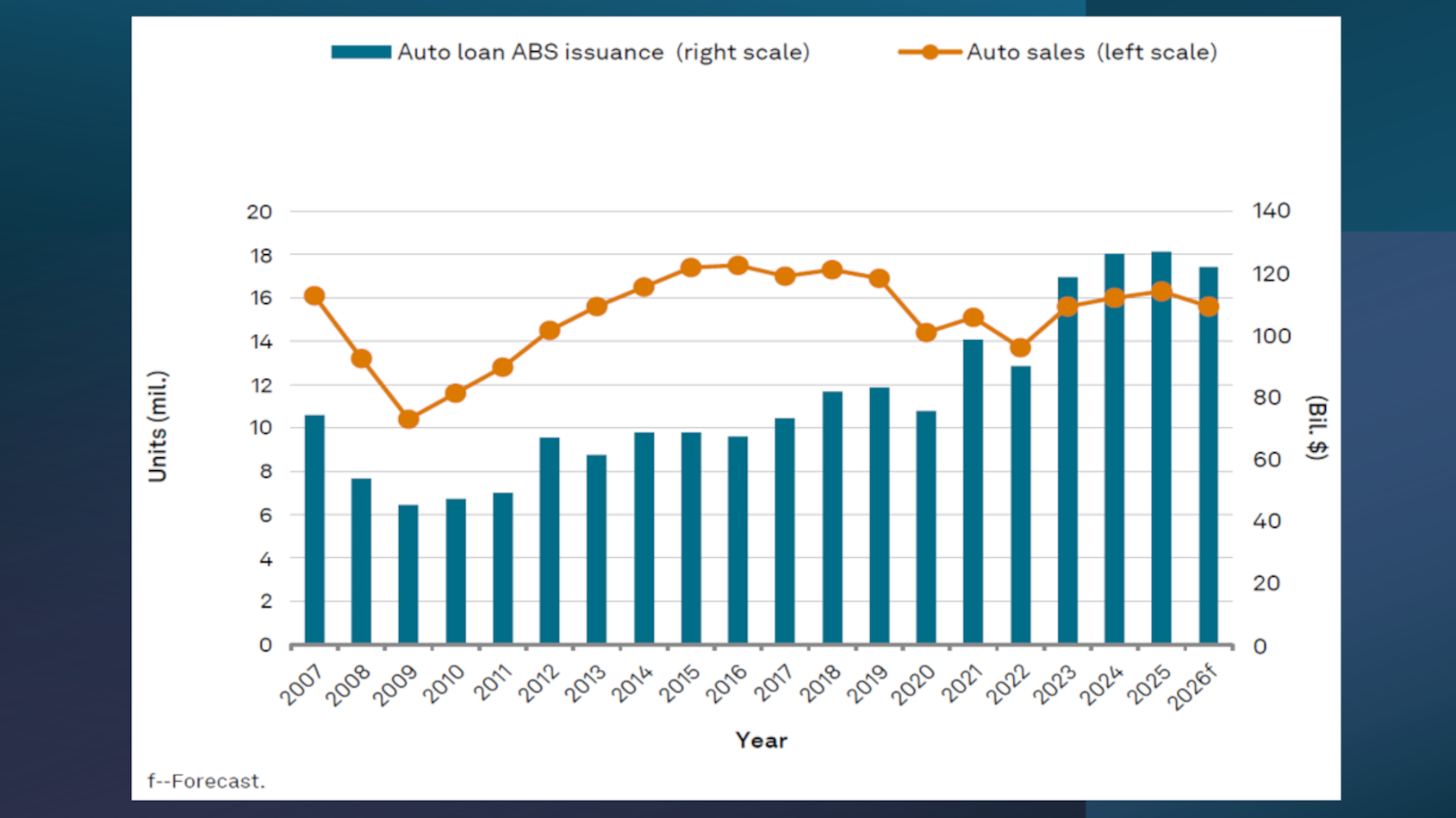

Chart courtesy of S&P Global Ratings.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Saying the subprime sector “had a mixed year,” S&P Global Ratings reported that U.S. auto loan ABS issuance volume reached a record high for the second consecutive year.

According to the firm’s newest report released last week and shared with Cherokee Media Group, auto ABS volume climbed to $127 billion in 2025.

“However, the general economic malaise that began affecting subprime auto borrowers in 2022 spread to certain pockets within the prime space last year,” analysts said in the report. “Cumulative net losses (CNLs) rose significantly on the 2023 and 2024 vintages as many borrowers struggled under the weight of higher monthly payments.

“Delinquencies and extensions also remained elevated, exceeding pre-pandemic levels,” analysts continued.

S&P Global Ratings elaborated about the subprime space, focusing on paper that finance companies booked immediately after the pandemic.

“Because most lenders quickly recalibrated their lending models after 2022’s shockingly bad performance, CNLs on the 2023 and 2024 subprime cohorts have been trending lower than 2022. However, some lenders failed to adjust their lending strategies and are reporting much higher-than-anticipated losses, which have led to downgrades. Delinquencies also remain at an all-time high,” analysts said.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Later in the report, S&P Global Ratings pinpointed key year-over-year changes in the subprime segment, including:

—Average annualized losses increased to 8.88% in 2025 from 8.51% in 2024.

—60-day delinquencies rose to a record high of 6.18% from 5.78%.

—Recoveries decreased to an average of 37.74%, which is the lowest seen on an annual basis going back to 2007.

Analysts explained how much the subprime segment has evolved during the past 16 years.

“Annualized losses and delinquencies weakened considerably in 2025, relative to 2024, as poor performance from the 2022 and 2023 vintages continued to roll through. While these loans’ 60-plus-day delinquencies exceeded those of 2009 and annualized losses have started to approach those peak levels, the subprime sector composition has changed dramatically since then,” analysts said.

“In 2009, there were only seven subprime issuers and only two (representing 10% of the outstanding loans in that year) were of deep subprime quality (with expected ECNL of about 18% or more). In 2025, there were over 20 issuers in our subprime composite and deep subprime pools represented a third of the outstanding loans,” analysts continued.

Looking forward, S&P Global Ratings doesn’t expect the entire auto ABS sector to set another record in 2026. In fact, analysts suspect a 3% softening to $122 billion, primarily created by a drop in new-car sales.

Analysts also touched on what’s been the clear theme impacting pretty much the entire automotive retailing and financing spaces: affordability.

“Higher vehicle prices and interest rates have resulted in higher average payments for new and used financed vehicles,” S&P Global Ratings said.

“Lower income consumers were the first to feel the effects of higher vehicle prices and inflationary pressures starting in 2022, but those same pressures began weighing on higher wage earners last year,” analysts continued. “Many of these individuals and households are now struggling month to month with higher rent, childcare expenses, utility costs, and lack savings for unexpected costs.

“For example, not only are drivers grappling with higher auto and insurance payments, but, according to Kelley Blue Book, the typical repair cost is approximately $838, which is essentially a monthly loan payment for a new vehicle,” analysts went on to say.