Edmunds: More than 26% of Q4 used- & new-car deliveries backed by monthly payments topping $1,000

Charts courtesy of Edmunds.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The first auto-finance number to know less than a week into 2026 might be $1,000.

That’s because of the record number of consumers who took delivery of used and new cars during the fourth quarter with monthly payments of $1,000 or more.

Edmunds reported on Monday that a record number of used-vehicle buyers in Q4 — 6.3% to be exact — committed to monthly payments of at least $1,000. That’s up from 6.1% in Q3 and 5.4% in Q4 2024.

On the new-car side, the new record is even higher. Edmunds said 20.3% of all financed new-vehicle purchases in Q4 were connected to monthly payments of $1,000 or more. That’s up from 19.1% in Q3 and 18.9% in Q4 2024.

“Auto financing trends in the fourth quarter underscored just how challenging 2025 was for car shoppers,” Edmunds’ director of insights Ivan Drury said in a news release. “Faced with persistently high vehicle prices and borrowing costs, many consumers were forced to adapt by financing larger amounts, stretching loan terms and, increasingly, taking on four-figure monthly payments.

“The record-setting figures we’re seeing reflect the financial strain many buyers faced throughout the year,” Drury continued.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Here are some of those other metrics that prompted Drury to make those comments.

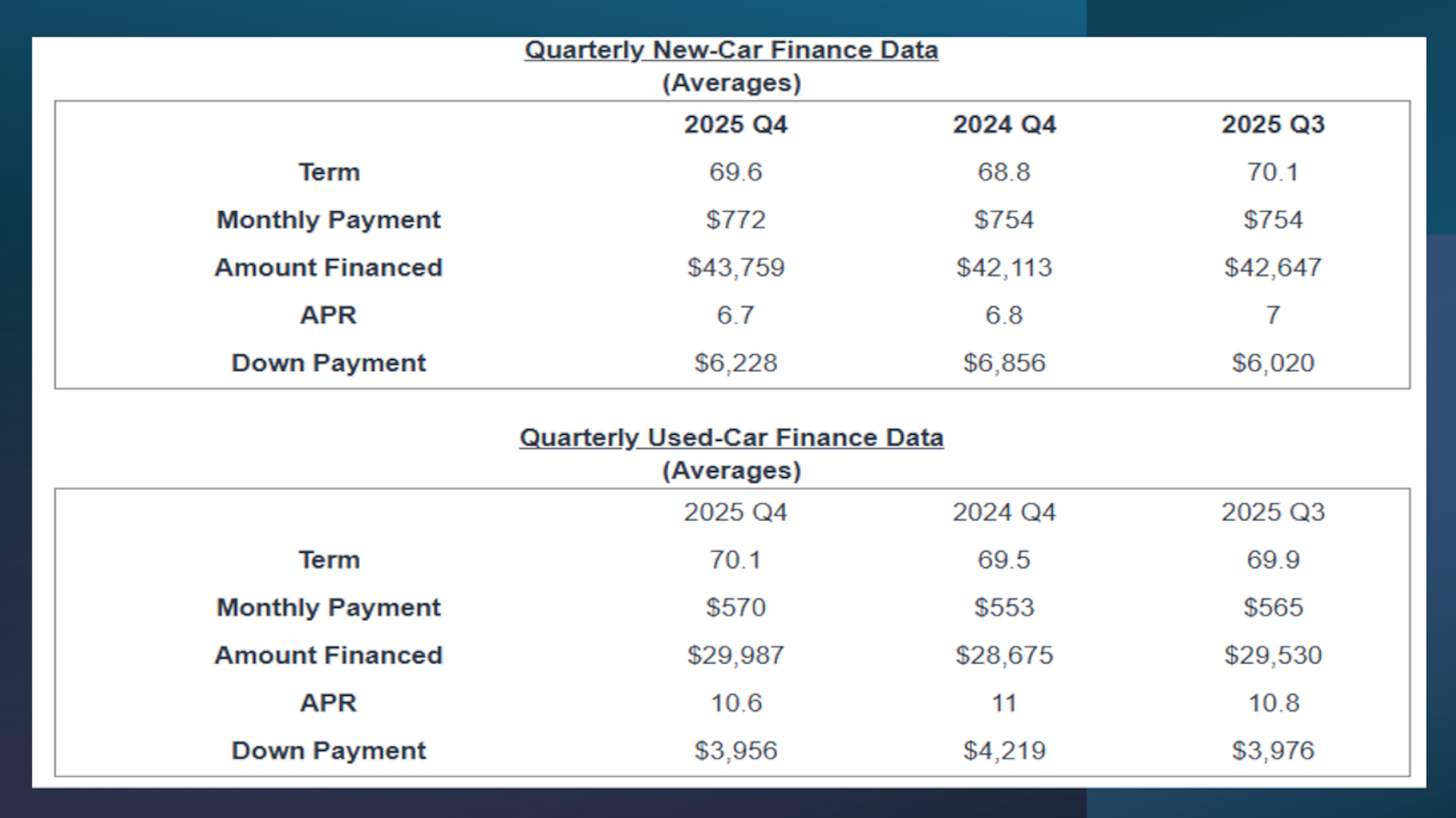

—Monthly payments for new vehicles climbed to the highest levels ever recorded. The average monthly payment on financed new-vehicle purchases reached a new all-time high of $772 in Q4, compared to $754 in Q3 and $754 in Q4 2024.

—Shoppers financed more money than ever to buy new vehicles. The average amount financed for new-vehicle purchases climbed to a record high of $43,759 in Q4, compared to $42,647 in Q3 and $42,113 in Q4 2024.

—Longer loan terms continued to play a major role in managing new-car financing costs. Edmunds data showed that 84-month or longer contracts made up 20.8% of financed new-car purchases in Q4.

While this figure was slightly down from 22% in Q3, Edmunds analysts noted that it remained well above the 17.9% share seen in Q4 2024, underscoring consumers’ continued reliance on extended loan terms as an affordability tool.

—Interest rates eased modestly but remained elevated for new-car shoppers.

The average annual percentage rate (APR) for new-vehicle purchases dipped slightly to 6.7% in Q4, down from 7% in Q3 and 6.8% from Q4 2024 but still near historically high levels.

Edmunds analysts pointed out that promotional financing continued to be limited in Q4: Just 3.1% of new-vehicle loans carried a 0% rate, down from 3.3% in Q3 but up slightly from 2.4% in Q4 2024.

Looking ahead, Drury weighs in on how these dynamics could shape the auto market in 2026.

“Entering 2026, many of the affordability pressures that defined 2025 are still in place, including elevated new-vehicle prices and ongoing economic uncertainty,” Drury said. “That said, there are early signs of rebalancing ahead.

“New-vehicle prices remain high but are beginning to stabilize, lower interest rates could offer some relief for both new- and used-vehicle shoppers, and an increase in off-lease returns is expected to provide more affordable alternatives in the used market,” he went on to say.