Edmunds spots 3 new records connected to negative equity in Q3

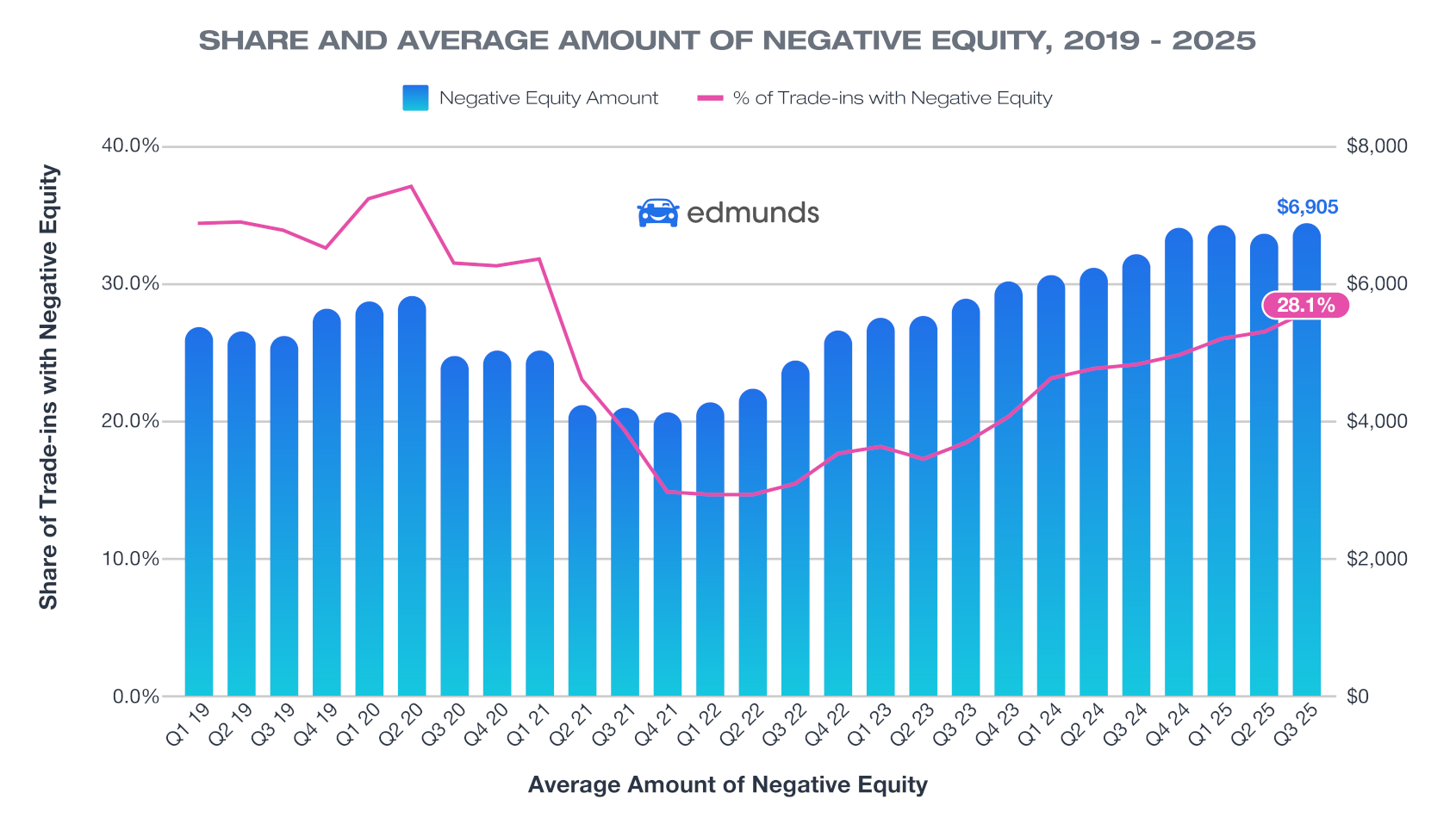

Chart courtesy of Edmunds.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The newest auto-finance data Edmunds released on Wednesday focused specifically on new-vehicle purchases and excluded used.

But it still showed the conundrum lenders are facing nowadays associated with average negative equity, which climbed to an all-time high in the third quarter.

Edmunds said Americans with upside-down car loans owe more than ever. The average amount owed on upside-down contracts set a record in Q3, rising to $6,905 and edging past the previous high of $6,880 posted in Q1 of this year.

Analysts also indicated more than one in four new-vehicle trade-ins are underwater, reaching a four-year high.

Edmunds reported 28.1% of trade-ins toward new-car purchases in Q3 had negative equity, up from 26.6% in Q2 and 24.2% in Q1. This is the highest share Edmunds has on record since Q1 2021, when 31.9% of new-car trade-ins were upside down.

And other new record highs surfaced in Q3, according to Edmunds.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Analysts determined nearly one in three underwater car owners owe between $5,000 and $10,000 on their contracts. Edmunds tabulated 32.9% of negative-equity trade-ins fell into this range in Q3, up from 32.6% in Q2 and continuing a steady climb since last year.

Furthermore, Edmunds said a record share of underwater car loans are carrying five-figure debt.

Analysts found nearly one in four (24.7%) trade-ins with negative equity carried more than $10,000 in debt in Q3, surpassing the previous high of 24.6% set in Q4 2024.

Edmunds added another 8.3% of trade-ins with negative equity carried more than $15,000 in debt, up from 7.7% in Q2 2025.

“The sheer amount of debt consumers are carrying in their trade-ins should be a wake-up call,” Edmunds director of insights Ivan Drury said in a news release. “Nearly one in three upside-down car owners owe between $5,000 and $10,000 — and a growing share owe far more than that. Much of this stems from shoppers trading out of vehicles too quickly, or carrying loans taken out during the pandemic car market frenzy, when prices were at record highs.

“Those choices are now catching up, making it far harder to buy again without piling on even more debt,” Drury continued.

To highlight the financial effect of rolling negative equity into a new-vehicle purchase, Edmunds analysts compared the costs for consumers who financed a new vehicle involving a trade-in with negative equity in Q3 against the industry average for all financed new vehicles.

They computed the average monthly payment for buyers who rolled negative equity into a new loan was $907 in Q3, down slightly from Q2’s high of $915 and $140 more than the overall industry average monthly payment of $767.

Edmunds added these individuals also financed $11,164 more than the typical new-vehicle buyer.

While Edmunds analysts said the growing amount of negative equity underscores broader affordability challenges, they also noted that consumers still have opportunities to make smarter financial moves, especially if they understand where they stand before trading in or taking on new debt.

“For many car owners, there’s no quick fix for being underwater. It’s about minimizing how much deeper you go,” Edmunds consumer insights analyst Joseph Yoon said in the news release. “If you can, wait until you’ve paid down more of your balance before trading in. But if you do need to replace your car, make sure your next purchase fits your budget, not just your needs.

“The right vehicle choice can prevent a short-term decision from becoming a long-term setback,” Yoon added.