Edmunds: Used-car buyers committing to $1,000 monthly payments at new record

Charts courtesy of Edmunds.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Edmunds reported the number of consumers who committed to a monthly payment of $1,000 or more when financing a used or new vehicle during the third quarter continues to be high, with a new record surfacing among used vehicles.

According to the latest analysis from Edmunds released on Wednesday, the share of buyers committing to monthly payments of $1,000 or more accounted for 19.1% of all financed new-car transactions in Q3, near the record set last quarter at 19.3%.

For used vehicles, monthly payments of $1,000 or more hit a record high of 6.1%, up from 5.6% in Q2, according to Edmunds tracking.

And terms are stretching, too.

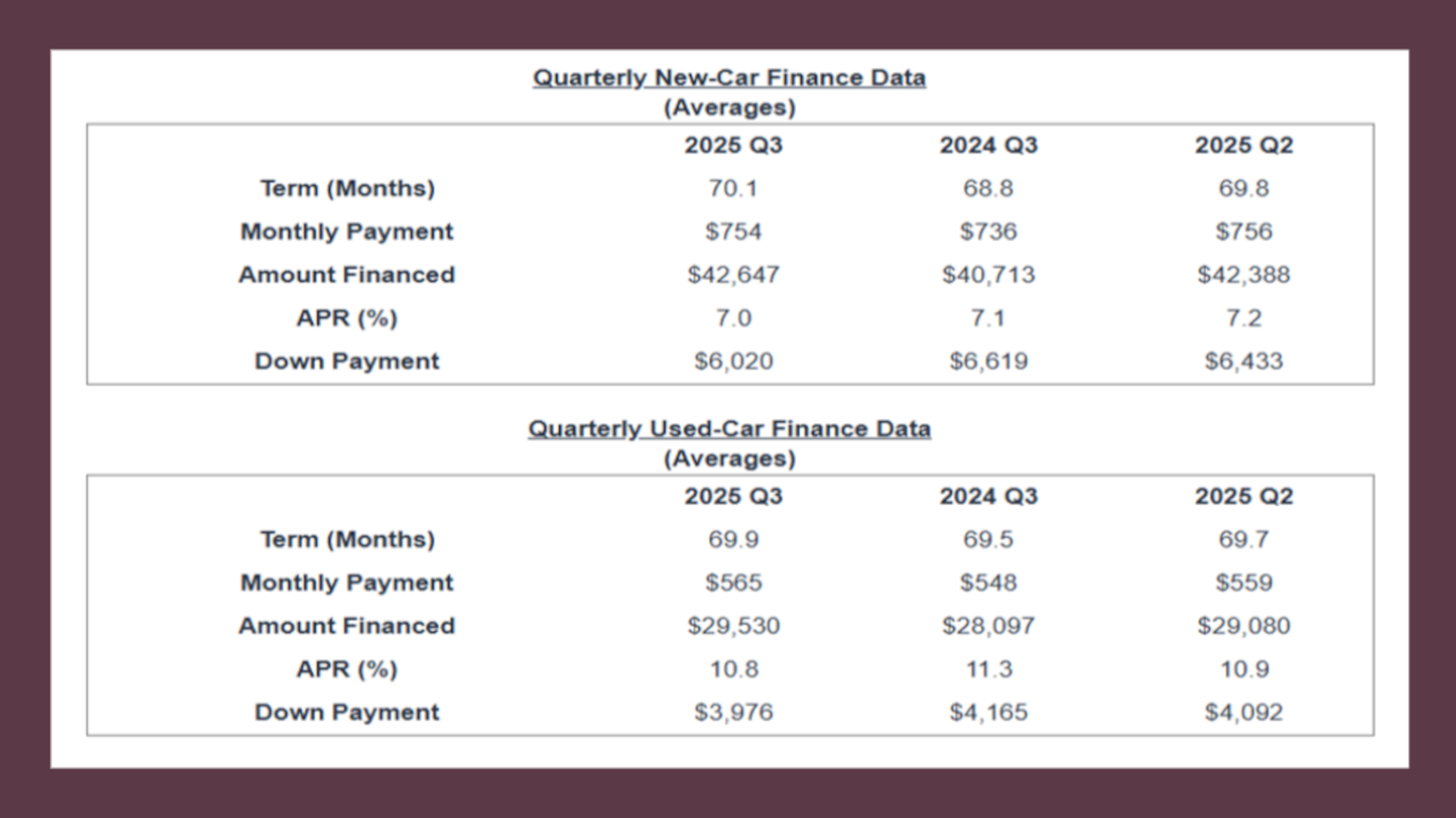

Edmunds reported the average contract length for new-car financing in Q3 went past 70 months. Analysts added the average contract length for used-car financing this past quarter came in at 69.9 months.

And there is plenty of paper with terms even longer. Edmunds reported that 84-month or longer loans made up 22% of financed new-car purchases in Q3, slightly down from 22.4% last quarter but up from 18.5% in Q3 of last year.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Further compounding the risk absorbed by finance companies, Edmunds said, down payments for new vehicles plunged to the lowest level in nearly four years.

Analysts said the average down payment for new-car purchases in Q3 dropped to $6,020, the lowest level since Q4 2021. This compares to $6,433 in Q2 2025 and $6,619 in Q3 2024.

For used cars, Edmunds indicated the average down payment in Q3 came in at $3,976, which is $189 less than a year earlier.

As a result, lender portfolios of outstanding balances are growing.

Edmunds pointed out that the average amount financed for new-vehicle purchases rose to $42,647 in Q3, up from $42,388 in Q2 2025 and $40,713 in Q3 2024.

Analysts noted the average amount financed for a used car delivered in Q3 rose $1,433 year-over-year to $29,530.

Finally, Edmunds acknowledged that the Federal Reserve’s late September rate cut came at the end of the quarter and thus did not have a significant effect in Q3.

Analysts reported the average annual percentage rate (APR) for new vehicle purchases held at 7% in Q3 — marking the third straight quarter this figure was at or above 7%. Edmunds said that promotional financing was limited in Q3, as just 3.4% of loans carried a 0% rate while 18.3% of loans carried rates below 4%.

By contrast, 71.6% of loans carried an APR of 5% or higher, and 13.8% were at an APR of 10% or higher, according to Edmunds.

For used-car financing in Q3, the average APR softened from 11.3% to 10.8% when comparing year-over-year.

“In Q3, affordability in the new-car market remained stretched, with buyers putting less money down, financing more and relying on longer terms to keep monthly costs in check,” Edmunds head of insights Jessica Caldwell said in a news release. “But compared to the near-new market, where inventory has been constrained by lean pandemic-era sales and reduced leasing activity, new vehicles seem to have emerged as the more compelling option.

“With the potential for lower APRs and tariff-related price increases yet to materialize in any meaningful way, shopping for a new vehicle may have felt like the smarter play in Q3 and could have given the new-car market a modest boost,” Caldwell continued.

Edmunds went on to mention that the model-year sell-down is well underway, with 2026 vehicles accounting for roughly 38% of on-lot inventory at the end of Q3.

“Even with the model-year sell-down in full swing, the smarter purchase might not seem as obvious as it has been in years past,” Edmunds director of insights Ivan Drury said in the news release. “With pricing and financing differences between 2025 and 2026 models so narrow, shoppers will benefit from prioritizing the features and content that they want.”