Experian: Banks post auto-finance market rebound in Q1

Chart courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

There’s a new way to revisit that old phrase, “You can take it to the bank.”

That’s because dealership finance managers might have been saying those words since Experian highlighted banks reclaimed ground across the automotive finance industry market during the first quarter.

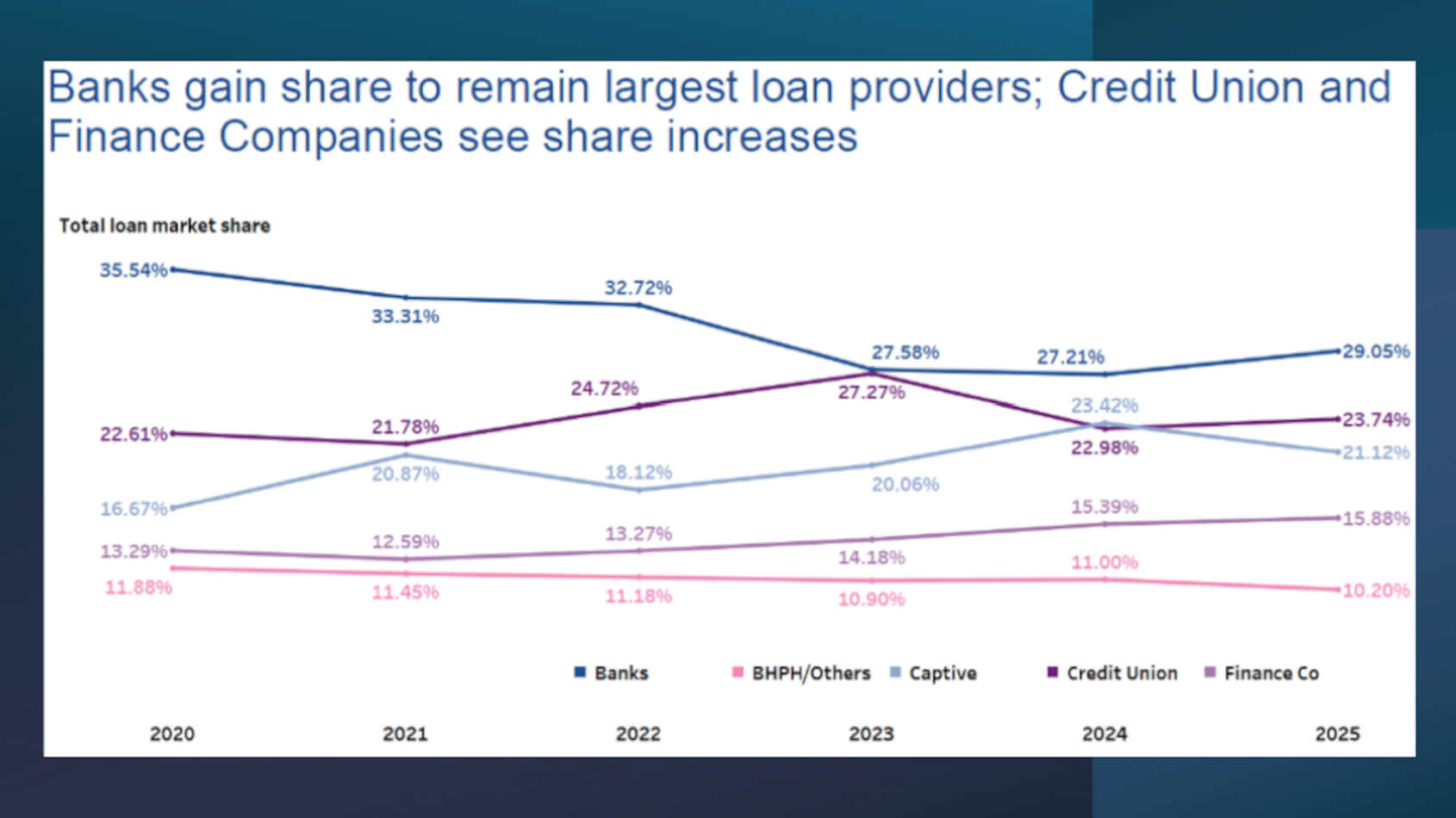

According to Experian’s State of the Automotive Finance Market Report: Q1 2025, banks’ total market share increased to 26.55% during the quarter, up from 24.79% in Q1 of last year.

Meanwhile, analysts noticed captives’ market share declined from 31.28% last year to 29.81% this past quarter and credit unions experienced slight growth from 20.20% to 20.63% during the same time comparison.

“For the first time in years, we’re seeing banks expand market share and reassert their presence in a growing and competitive market,” said Melinda Zabritski, Experian’s head of automotive financial insights.

“This shift counters many of the trends we observed in the post-pandemic era, where high interest rates and the re-emergence of new inventory allowed captives to push heavy incentives and capture significant market share,” Zabritski continued in a news release.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Beyond some of the changes in lender market share, the Q1 report indicated consumers seem to be managing their monthly payments.

In fact, Experian said 30-day delinquencies improved during the quarter, declining to 1.95% from 2.10% in Q1 of last year, while 60-day delinquencies remained flat at 0.83% year-over-year.

Digging into the contract attributes for both new and used financing, the report showed modest increases.

The average loan amount for a new vehicle increased $1,110 from last year, reaching $41,720 in Q1. Meanwhile, the average interest rate dropped from 6.85% in Q1 2024 to 6.73% this past quarter and the average monthly payment grew from $737 to $745.

On the used side, the average amount financed only increased $90 year-over-year to $26,144. The average interest rate declined from 12.36% last year to 11.87% this quarter and the average monthly payment edged $3 lower from Q1 2024 to $521.

“With many consumers receiving tax refunds and others exploring refinancing options, we observed some positive shifts in the automotive finance market,” Zabritski said. “Lenders and dealers will want to keep a close eye on how these trends evolve over the coming months and years ahead and adjust go-to-market strategies accordingly.”

Although banks experienced growth in Q1, Experian pointed out captives continue to hold the majority of market share for new vehicle financing at 57.08%.

However, captives’ market share declined from 62.07% a year ago.

Banks increased from 20.37% in Q1 2024 to 24.13% in Q1 2025 and credit unions went from 9.62% to 10.89% year-over-year, according to Experian’s tracking of new-car financing.

Furthermore, Experian reported banks have the most market share for used financing at 28.37% this past quarter, up from 27.88% last year. Credit unions followed closely at 28.24%, from 27.71% and captives declined from 8.45% to 7.42%.

Additional findings from Experian’s Q1 data included:

—New vehicles made up 43.29% of automotive financing in Q1, up from 40.90% the previous year, while used vehicles made up the remaining 56.71%.

—New leasing experienced slightly growth during the quarter, reaching 24.69%, up from 23.71%.

—Nearly 10% of all new vehicle transactions were EVs in Q1, and nearly 60% of all EVs transactions were leased.

—The average payment difference between a new-vehicle loan and lease was $142 this past quarter.