Experian launches new tool to combine credit, cash flow & alternative data into single score

Screenshot courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

This week, Experian rolled out what the company said is the most advanced credit decisioning model it has ever released, marking a “positive milestone in Experian’s mission to help increase fair access to credit.”

The company highlighted the Experian Credit + Cashflow Score combines Experian’s credit, alternative and trended data, and consumer-permissioned banking information into a singular score.

“Leveraging Experian’s world-class data with information about how a consumer is managing their finances through open banking is the future of underwriting,” said Scott Brown, group president of financial and marketing services for Experian North America.

“Our unmatched expertise and commitment to constant innovation make Experian uniquely capable of helping our clients rethink what’s possible, driving better consumer outcomes, expanding access to credit and ultimately bringing financial power to all,” Brown continued in a news release.

The model integrates Experian’s most comprehensive and differentiated data assets, including:

—Consumer-permissioned bank account data, including income, balances, card payments, bank fees and loan transactions.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—Credit data, detailed credit account information on more than 220 million U.S. consumers.

—Clarity Services data, an alternative credit bureau, expanding visibility into tens of millions of consumers who use nontraditional financial services and may otherwise lack traditional credit histories.

—Trended data, providing a 24-month view of how consumers manage credit over time.

The score ranges from 300 to 850 and will be available to make decisions across the entire financial lifecycle.

Lenders can gain early access to Experian’s new score for testing through custom analytics, archives or through the Experian Ascend Platform.

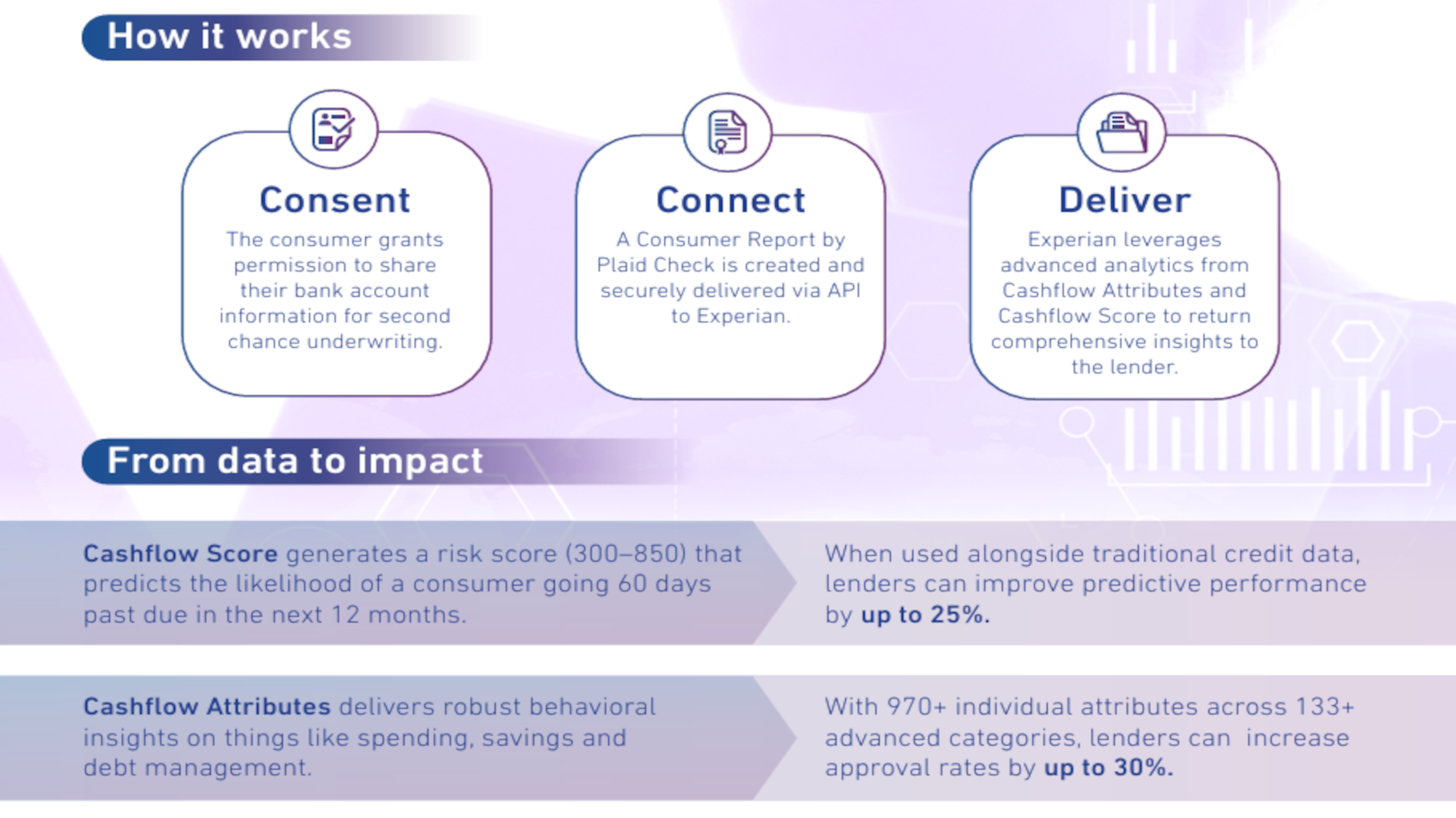

The Experian Credit + Cashflow Score builds on Experian’s suite of expanded credit solutions, including Experian’s Cashflow Score, Cashflow Attributes and the company’s interactive cash flow insights dashboards.

“Early analysis shows the Experian Credit + Cashflow Score outperforms conventional credit scores and cashflow-only scores across all major lending products, including personal loans, lines of credit, bankcards and mortgages — improving predictive accuracy by over 40% when compared to conventional credit models,” the company said.