Experian sees affordability improve slightly in Q3

Chart courtesy of Experian Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Perhaps the affordability hurdle that’s been a challenge throughout the year for dealerships and finance companies to get deals done with consumers is starting to fade.

According to Experian’s State of the Automotive Finance Market Report that contained third quarter data, analysts discovered the amount financed for both used and new vehicles dipped.

For used vehicles, the amount financed at origination during the Q3 dropped $1,517 year-over-year to $27,167. For new models, the amount financed when those units rolled over the curb in Q3 softened to $40,184 from $41,543 a year earlier.

The reversal is much more pronounced on the new-car side. Experian pointed out that from Q3 2021 to Q3 2022, the average amount finance for new vehicles increased $3,698.

In addition to decreases in average amount financed, Experian noticed the average monthly payment for new- and used-vehicle installments only experienced modest increases.

Analysts determined the average monthly payment for a new vehicle only increased $25 year-over-year, reaching $726, while the average monthly payment for a used vehicle only increased $4 to $533 over the same period.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Experian added that the average interest rate for new-vehicle financing was 7.03% in Q3 2023, up from 5.26%. The average interest rate for used-vehicle financing came in at 11.35%, up from 9.38% last year.

“While we’ve seen the average loan amount for new and used vehicles rise over the better part of the last three years, it’s a welcome sight to see average vehicle loan amounts decrease,” said Melinda Zabritski, Experian’s head of automotive financial insights.

“Once you factor in monthly payments remaining relatively stable despite rising interest rates, the industry seems to be heading in a positive direction, especially with consumers having more options available to them during the financing process,” Zabritski continued in a news release.

Shorter terms in new market

For consumers who could swing it, they’re gone with shorter contract terms when taking delivery for new vehicles.

Experian reported 13.40% of new-vehicle paper had terms in the 1- to 48-month category, up from 9.99% the previous year.

Similarly, analysts said new-vehicle financing with 49- to 60-month terms reached 17.16%, up from 16.50% in Q3 2022.

And new-vehicle financing with 61- to 72-month terms reached 38.65%, up from 36.67% in Q3 2022, according to Experian, which mentioned new-vehicle contracts with 73- to 84-month terms decreased from 35.11% in Q3 2022 to 29.15% this past quarter.

Experian explained much of the shift toward shorter-term contract can be attributed to new vehicle shoppers securing lower interest rates.

For instance, contracts up to 48 months offered an average interest rate of 4.03% in Q3, while the average rate for 49- to 60-months was 5.67%, followed by 61- to 72-months at 7.24%, 73- to 84-months at 8.80%, and more than 85 months at 8.81%.

“With interest rates remaining at elevated levels, it’s not unexpected to see consumers lean towards shorter terms considering the lower interest rates offered, particularly for new vehicles,” Zabritski said.

“With most vehicle shoppers keeping monthly payments top of mind, it’s important for lenders to help consumers identify vehicle financing options that are within their budgets,” she added.

Bigger piece for captives

Experian noticed captives grew significantly in Q3, comprising the majority of total financing market share.

Analysts discovered captives held 30.43% as of Q3, up from 21.55% in the same quarter a year earlier.

Meanwhile, total market share for banks decreased from 27.34% last year to 25.17% this quarter and credit unions slid from 29.16% to 23.11%.

They were followed by finance companies — providers that do not hold deposits — at 12.45% and BHPH/others at 8.85%.

Experian said it’s notable that captives also gained market share for new-vehicle financing in Q3, coming in at 59.18%, up from 44.74% in Q3 2022.

Analysts said banks trailed behind at 22.21% this quarter, a decrease from 25.85% last year.

Experian added credit unions saw a considerable decline in the new-car finance market, sliding from 24.38% to 13.18% year-over-year, followed by finance companies (4.72%) and BHPH/others (0.72%).

Additional findings for Q3

Four other notable trends Experian spotted:

—Credit unions made up the largest market share for used vehicles at 30.30% in Q3, followed by banks (27.31%), finance companies (18.05%), BHPH/others (14.74%), and captives (9.60%).

—The average contract term for a new vehicle went from 69.75 months in Q3 of last year to 68.26 months in Q3 of this year, and the average contract term for a used vehicle decreased from 68.02 months to 67.57 months in the same timeframe.

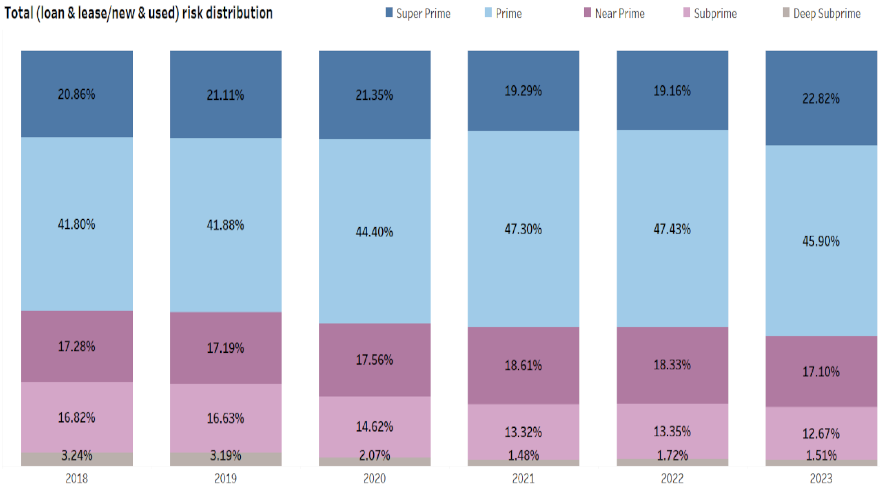

—The market continues to grow in prime (45.90%) and super prime (22.82%), comprising over 68% of total financing in Q3 2023.

—30-day delinquencies reached 2.33% in Q3, and 60-day delinquencies reached 0.91%.

To learn more, watch the entire State of the Automotive Finance Market Report: Q3 2023 presentation on demand via this website.