Experian watches banks recapture top auto-finance market share spot in Q2

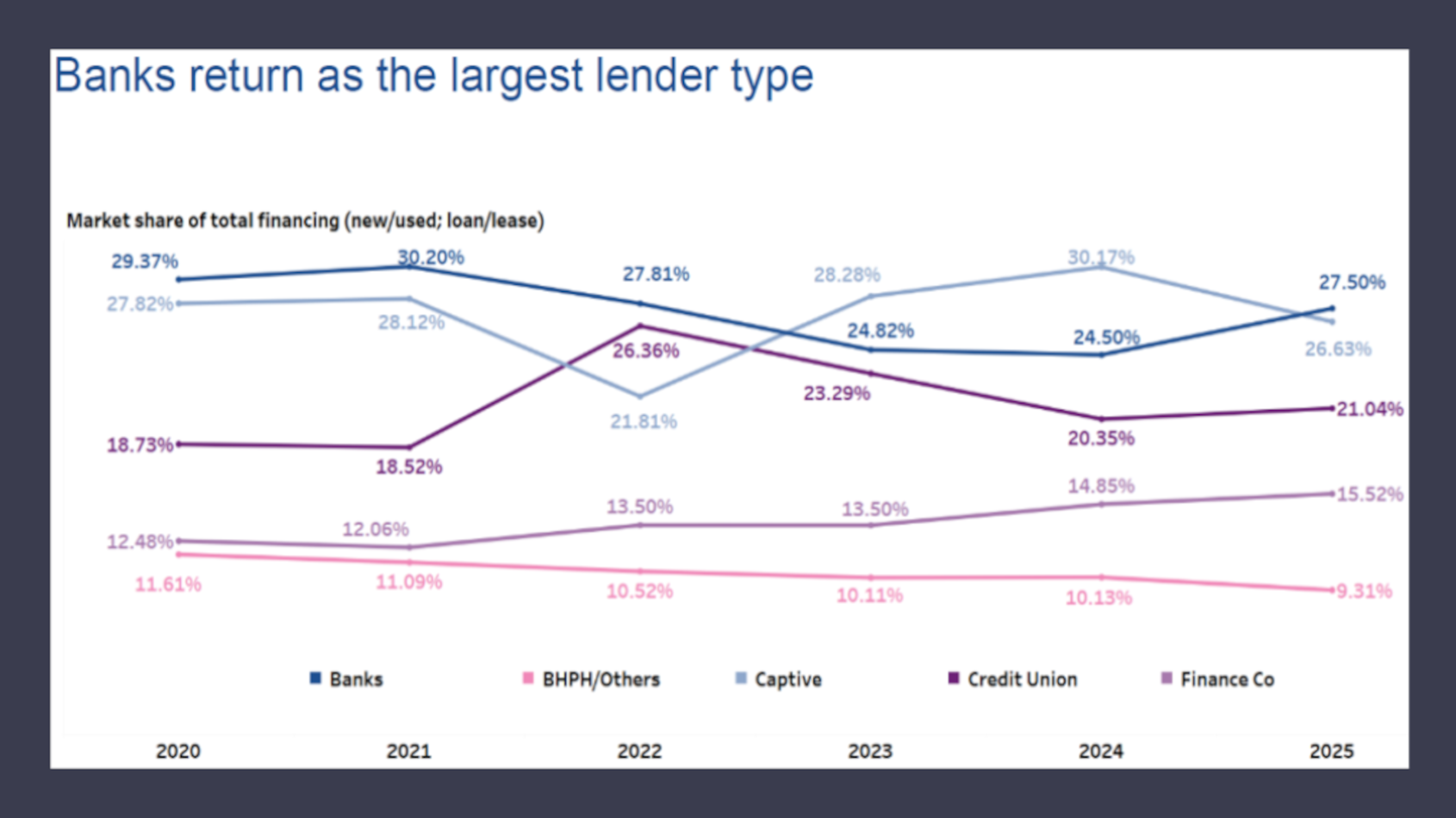

Chart courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Experian’s State of the Automotive Finance Market Report: Q2 2025 showed that perhaps banks not making many underwriting adjustments in the auto-finance department during the second quarter was shrewd strategy.

Experian reported banks returned as the largest lender for total automotive financing, capturing 27.50% of the market during Q2. That’s up from 24.50% the previous year.

Analysts watched captives slide to 26.63% from 30.17%. Experian added credit unions grew slightly from 20.35% to 21.04% over the same period.

The auto-loan portion of the July Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) generated by the Federal Reserve showed high percentages of participants keeping strategy intact during the reporting period when asked about elements such as maximum maturity and down payments.

While banks maintained the lion’s share of total vehicle financing, Experian said captives remained the top lender in market share for new-vehicle financing at 52.39% in Q2, though down from 60.74% last year.

Analysts said banks increased their share of new-car financing from 21.12% to 25.91%, while credit unions rose from 9.99% to 12.24% during the same period.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Also of note, Experian indicated banks narrowly extended their lead in market share for used-vehicle financing, coming in at 28.59% this quarter, up from 26.80% last year.

Credit unions saw a slight uptick from 27.59% to 27.63% and captives declined from 7.83% to 6.40%. according to the report.

“The shift in lender market share highlights an increasingly competitive landscape for automotive financing,” said Melinda Zabritski, Experian’s head of automotive financial insights. “With banks showing a renewed focus in automotive combined with new OEM relationships, we’re seeing a completely different environment.

“In an ever-evolving industry, leveraging the most current data can help automotive professionals identify emerging patterns and adapt to changing dynamics,” Zabritski added.

Experian noted additional findings from the second quarter included:

—The average loan amount for a new vehicle increased $1,017 to $41,983 in Q2, and the average loan amount for a used vehicle increased $481 to $26,795 over the same period.

—The average monthly payment for a new vehicle increased from $735 to $749 year-over-year, while the average monthly payment for a used vehicle went from $527 to $529.

—The electric vehicle share of new vehicle purchases declined from 8.76% last year to 8.34% this past quarter.

—30-day delinquencies rose to 2.27% in Q2, from 2.24% in Q4, while 60-day delinquencies increased from 0.78% to 0.83% over the same time frame.

—New leasing declined to 23.62% this quarter, from 26.12% last year.

To learn more, watch the entire State of the Automotive Finance Market Report: Q2 2025 presentation on demand.