Experts tackle lending-market impact if ‘unease’ creates recession

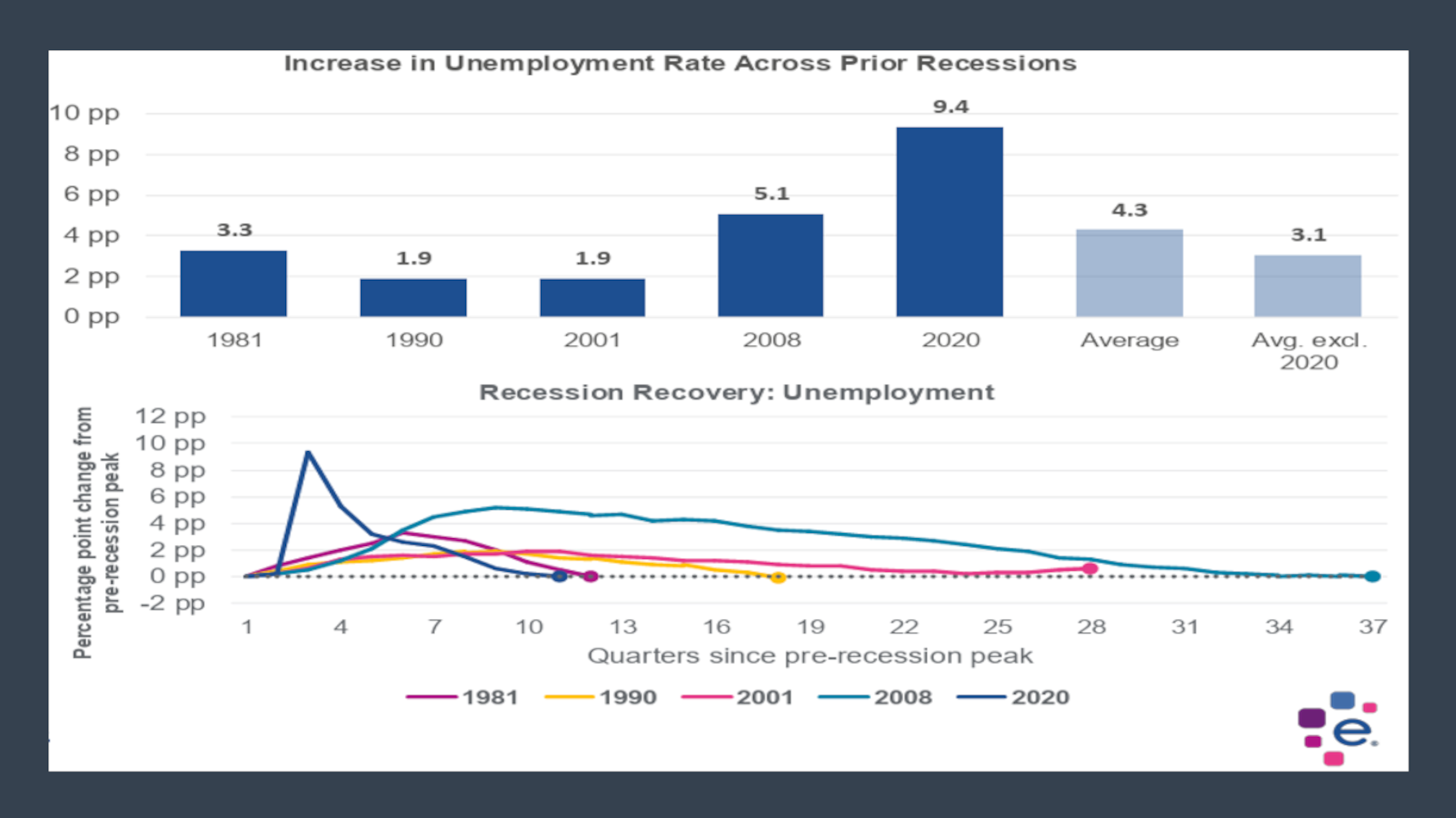

Chart courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Experian North America chief economist Joseph Mayans and ADP chief economist Nela Richardson have used the terms “recession” and “unease” when discussing their respective looks at the lending market, the employment scene and general economy in recent days.

You might ask why Mayans and Richardson turned to those monikers since private sector employment increased by 62,000 jobs in April and annual pay was up 4.5% year-over-year, according to the April ADP National Employment Report produced by ADP Research in collaboration with the Stanford Digital Economy Lab.

The ADP National Employment Report is an independent measure and high-frequency view of the private-sector labor market based on actual, anonymized payroll data of more than 25 million U.S. employees.

“Unease is the word of the day. Employers are trying to reconcile policy and consumer uncertainty with a run of mostly positive economic data,” Richardson said in a news release. “It can be difficult to make hiring decisions in such an environment.”

Difficulty in hiring is one of the elements that could be associated with a forthcoming recession. That’s why Mayans focused on recessions in his newest installment of Macro Moment.

Mayans began his update by asking, “If we go into a recession, what does it mean for lending activity? What does it mean for delinquency?

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“As banks, credit unions and fintechs grapple with these questions, sometimes it helps to look to the past for guidance,” he continued. “In this latest Macro Moment, I look back at prior recessions and provide a quick view of their impact on unemployment, delinquency and loan growth.”

Mayans explained that the unemployment rate is one of the economic variables that tends to peak after a recession ends. In the last five downturns, he noted unemployment peaked an average of three quarters after the recession ended.

“During that time, the unemployment rate rose an average of 4.3 percentage points and took an average of 19 quarters (excluding the 2001 downturn as it did not recover before the next recession) to return to its pre-recession level,” Mayans said.

“The greatest increase among the demographic groups was seen among 16- to19-year-olds, Hispanics and Latinos, and men. Unemployment for part-time workers tends to be less impacted by recessions than full-timers, with the one major exception being during the 2020 recession,” he continued.

Not surprisingly, if someone doesn’t have gainful employment and steady income, those individuals likely will fall into delinquency.

In the last four recessions, Mayans said 30-day delinquency on all loans increased by an average 1.6 percent points. He pointed out the largest percentage-point increase was seen in real estate (2.3 percentage points), followed by business (1.4 percentage points), and consumer loans (0.5 percentage points).

Mayans didn’t mention auto finance specifically in this part of his analysis.

“In terms of timing, overall delinquencies tend to peak two quarters after the end of a recession; however, consumer loans exhibited their peak, on average, during the recession,” he said.

“Expected higher levels of delinquency and default can also cause lenders to tighten credit standards and reduce their overall exposure to more sensitive segments of the market. In the last three recessions, the tightening cycle for credit cards lasted an average of 10 quarters,” Mayans added.

So, if unemployment and delinquency rise, what about originations? Mayans touched on that segment of the credit market, too.

“In times of stress, financial institutions begin to tighten lending standards, while at the same time consumers and businesses take more precautionary measures to protect their finances,” he said. “This two-sided relationship results in fewer loans being made and an overall softening of lending activity around periods of recession.

“Because of the key role that credit serves in the economy, weaker lending activity can also drive a slowdown and elongate a recession — such as what occurred after the Great Financial Crisis and 2008 Recession,” he continued.

“In the prior five recessions, quarterly credit growth slowed from 1.9% in the two years in the lead up to recession to -0.1% in the year following a recession,” Mayans went on to say. “Lending activity tends to slow the most for consumer loans during recessions, while it slows the most for business (C&I) loans and real estate loans in the year after.”

Meanwhile, the Federal Reserve will announce its next decision about interest rates on Wednesday. Comerica Bank chief economist Bill Adams and senior economist Waran Bhahirethan expect policymakers will keep the fed funds target rate on hold at a range of 4.25% to 4.50%.

“Markets will be extra attentive to chair (Jerome) Powell’s comments on the tradeoff between controlling inflation and supporting the job market,” Adams and Bhahirethan said.