Fed can look at newest TransUnion auto-finance data to see interest-rate impact

Chart courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The Federal Reserve says at almost every opportunity that policymakers watch all sorts of data and trends before adjusting interest rates.

If the Fed wants more information about what a rate cut can do, it can examine the auto-finance portion of TransUnion’s Q1 2025 Credit Industry Insights Report, which includes a delinquency rate not seen in 16 years.

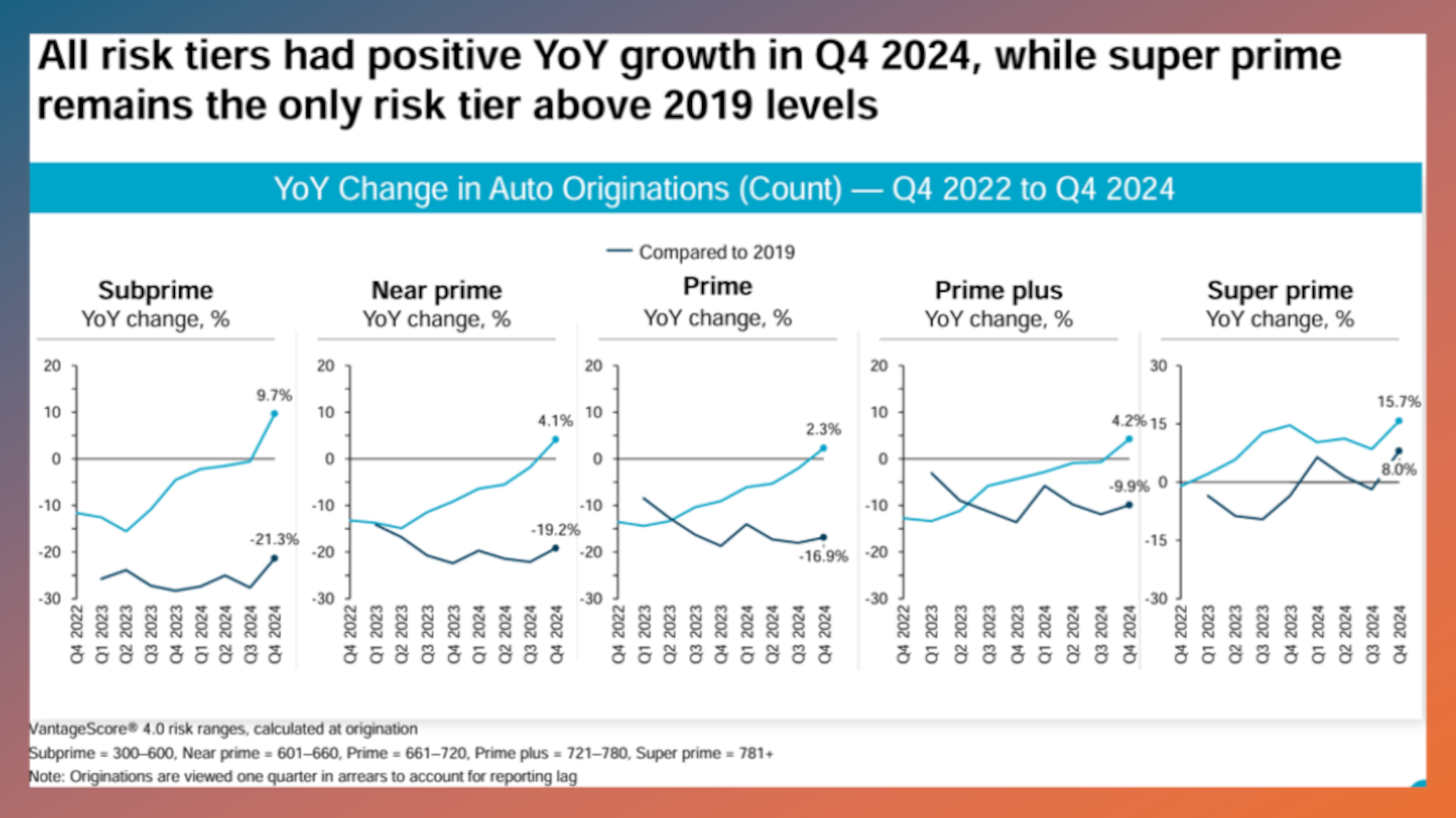

With originations viewed one quarter in arrears to account for reporting lag, TransUnion reported on Thursday that auto-finance originations in Q4 2024 reached 6.2 million, representing an 8% lift year-over-year.

Analysts indicated this growth was observed across all risk tiers, with super prime leading the way with a year-over-year rise of 15.7%. TransUnion said the increase was largely driven by Federal Reserve interest rate cuts in late 2024, rising inventories, and the return of incentives.

TransUnion determined new vehicles made up 47% of units financed in Q4 2024, as compared to 53% used, the highest Q4 share for new vehicles since pre-pandemic times.

Analysts pointed out that leasing share continued to approach pre-pandemic levels, rising to 26% in Q1.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

TransUnion also noted the 60-day delinquency rate increased by 5 basis points year-over-year in Q1 to 1.38%. Analysts acknowledged this rate exceeds the peak delinquency rate of 1.33% observed in Q1 2009, although the rate of growth has recently slowed.

Overall, TransUnion said new-vehicle loan vintages continue to show consistent performance compared to pre-pandemic periods (2018/2019). However, when broken down by risk tiers, recent new vehicle vintages have elevated delinquency levels, particularly for prime and below tiers, according to TransUnion.

“There have been positive signs of recovery and momentum across all tiers, not just super prime,” said Satyan Merchant, senior vice president and automotive and mortgage business leader at TransUnion.

“The return of incentives has provided a tailwind to vehicle sales and financing,” Merchant continued in a news release. “Nevertheless, some of this progress may reverse if the recently announced trade policies are implemented long-term, as they could further impact affordability.

“Despite this, we expect Q1 2025 originations to increase, as many consumers likely tried to secure a new vehicle before the tariffs were implemented,” he added.

| Auto Lending Metric |

Q1 2025 | Q1 2024 | Q1 2023 | Q1 2022 |

| Total Auto Loan Accounts |

80.0 million | 80.1 million | 80.1 million | 80.5 million |

| Prior Quarter Originations 1 | 6.2 million | 5.8 million | 5.8 million | 6.5 million |

| Average Monthly Payment NEW 2 | $759 | $746 | $741 | $657 |

| Average Monthly Payment USED 2 | $526 | $521 | $521 | $509 |

| Average Balance per Consumer | $24,413 | $24,035 | $23,214 | $21,606 |

| Average Amount Financed on New Auto Loans 2 | $42,877 | $41,222 | $41,539 | $40,184 |

| Average Amount Financed on Used Auto Loans 2 | $26,494 | $25,655 | $26,260 | $27,995 |

| Consumer-Level Delinquency Rate (60+ DPD) | 1.56% | 1.50% | 1.34% | 1.09% |

1 Note: Originations are viewed one quarter in arrears to account for reporting lag.

2 Data from S&P Global Mobility AutoCreditInsight, Q1 2025 data only for January and February.

Source: TransUnion

Less risk improves delinquency among unsecured personal loans

Let’s turn next to personal loans, which some auto-finance providers also offer.

In Q4 2024, TransUnion determined unsecured personal loan originations reached a new high of 6.3 million, a 26% increase over Q4 2023, driven by all risk tiers, especially super prime, with 29% jump year-over-year.

Analysts computed this activity led to a 17% year-over-year growth in total new account balances to $34 billion.

TransUnion pointed out that total balances for Q1 only grew for above prime tiers, reaching $253 billion, a 3% increase over the prior year.

Analysts also noted that a record 24.6 million consumers had balances, a 5% increase year-over-year, but average balances per consumer only grew for above prime tiers.

TransUnion explained that lenders expanded their borrower base but maintained cautious exposure, leading to a 7% decrease in average new account balances for Q4 2024, the fifth consecutive quarter of decline.

Subprime delinquencies fell to 14.0% in Q1 from 15.6% last year, while other risk tiers saw increases, according to TransUnion.

The update also mentioned the overall borrower-level delinquency rate declined to 3.49% in Q1 from 3.75% last year, thanks to a balanced lending mix.

“The unsecured personal loan market has not only rebounded but also expanded, setting new records in loan volumes and balances,” said Josh Turnbull, senior vice president of consumer lending at TransUnion Growth is evident across all credit risk tiers, with super prime borrowers leading in year-over-year growth in the most recent quarter.

“Lenders appear to be limiting loan amounts for individual consumers, even as the aggregate borrower-level delinquency rate continues to decline. Increased competition and demand in the lowest risk credit tiers, along with advances in risk management practices, are now resulting in lower delinquency rates. These factors should support sustained growth, even in a challenging macroeconomic environment.”

TransUnion notices inflation-adjusted debt growth much smaller than previously believed

When looking at the overall credit market, TransUnion uncovered a more complex reality amid other recent studies that revealed consumers have an increased reliance on credit products to help make ends meet as they grapple with rising costs and high interest rates.

Analysts determined total balances in nominal dollar terms (before adjusting for inflation) across all consumer credit products rose from $14.1 trillion in Q1 2020 to $18.0 trillion in Q1 2025, approximately 28%.

TransUnion said the cumulative Consumer Price Index increase over that same time, as measured by the U.S. Bureau of Labor Statistics, was nearly 24%.

When adjusted for inflation, total balance growth in real dollar terms is more modest, amounting to $0.5 trillion over the five-year period, an increase of closer to 3%, according to TransUnion.

The analysis also revealed that inflation-adjusted balances for consumers actually declined in real dollar terms across the majority of credit risk tiers from 2020 to 2025.

TransUnion pointed out this decrease was most pronounced in the prime risk tier, which saw a 14% drop in balances after adjusting for inflation.

In contrast, analysts found that super prime consumers experienced an 18% growth in balances over the same period. Much of the increase for super prime borrowers was attributed to higher mortgage balances.

The only other risk tier to see an inflation-adjusted increase over the period was subprime at 1.9%, according to TransUnion.

“Our latest analysis reveals a picture of credit usage that goes beyond simply an increase in total balances,” said Jason Laky, executive vice president and head of financial services at TransUnion. “When we account for the recent period of higher inflation, the rise in balances suggests that consumers in most risk tiers are not over-extended.

“In fact, many consumers experienced significant income gains since 2019, which have enabled most borrowers to effectively manage their debt levels,” Laky added.

The complete report and complementary webinar from TransUnion is available online.