Fed governor asks 3 questions about financial inclusion

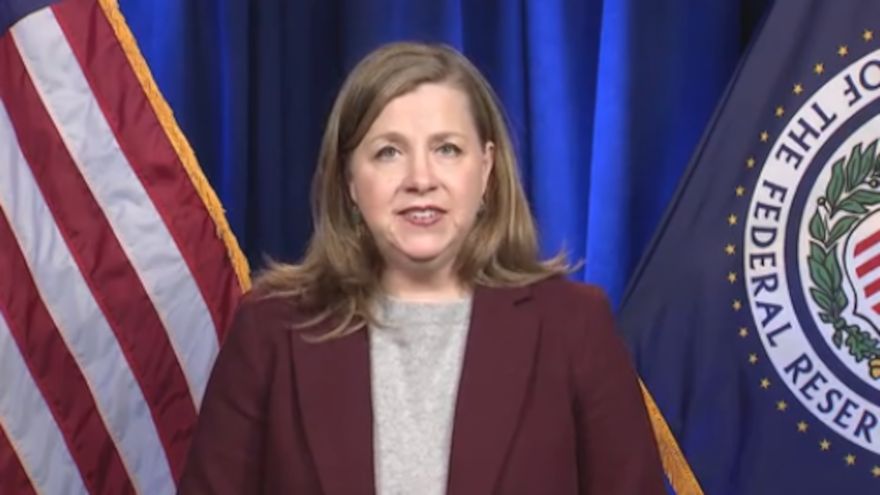

Michelle Bowman, one of the seven members of the board of governors at the Federal Reserve, appeared via online video this week for a conference hosted by the Aspen Institute. Screenshot courtesy of the Fed.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Michelle Bowman, one of the seven members of the board of governors at the Federal Reserve, appeared via online video this week for a conference hosted by the Aspen Institute about financial inclusion.

While Bowman didn’t speak about subprime auto financing specifically, the Fed policymaker discussed a tool sometimes used by consumers who might already be in the portfolios of subprime auto finance companies. Bowman recapped how the Fed has tried to be of assistance for small-dollar lending.

“For many years, a variety of surveys have indicated that consumers use small-dollar credit to address temporary cash-flow imbalances, unexpected expenses, or income shortfalls during periods of economic stress or natural disasters. So, we began to consider the ways in which the Federal Reserve and other financial regulators could be helpful,” Bowman told the Aspen Institute’s gathering for the event dubbed, Charting a Course Towards a More Inclusive Financial System: Our Collective Call to Action

Bowman mentioned that shortly after she joined the Federal Reserve, policymakers issued two interagency statements in 2019 and 2020 to provide clarity for banks that use alternative data for underwriting and on principles for offering responsible small-dollar loans.

“Our guidance clarified that with a consumer’s permission, banks can use alternative data, like checking account balance activity, to qualify them for credit,” Bowman said. “Our guidance also underscored that small-dollar lending products that support successful repayment outcomes and that avoid continuous cycles of debt due to rollover and reborrowing can help facilitate financial inclusion.

“We have seen some evidence that suggests the release of these small-dollar interagency lending principles correlated with a subsequent increase in bank consumer lending. Ensuring that small-dollar lending is available through depository institutions rather than through other non-depository lenders could increase the credit opportunities available to consumers at lower cost and with fewer fees,” she continued.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Bowman then delved into how technology can play a role.

“Banks may also pursue expanding their lending opportunities through technology innovations that provide mechanisms for more effective risk modelling or enhancing their online access to financial services for consumers,” she said. “These advancements can result in faster loan decision-making, more convenient customer access, and reduced costs and risks for both banks and borrowers.

“Over time, we are seeing more banks incorporating these approaches to better serve clients with credit, including the use of alternative data to support underwriting. We will continue to monitor these promising developments to better understand the impact on consumers,” she continued.

Bowman wrapped up her nearly 15-minute presentation by asking the gathering three questions.

“First, building on some progress in small-dollar credit,” she began, “how can we encourage the development of lower-cost products and refine our understanding of the degree to which these products may foster consumers’ financial well-being?

“Second, given the value of mission-driven organizations in expanding access to financial products and services in underserved communities,” she continued, “how can we best provide support to the activities of Minority Depository Institutions (MDIs), Women-Owned Depository Institutions (WDIs), and Community Development Financial Institutions (CDFIs)?

“Third, the Central Bank Network for Indigenous Inclusion (CBNII) relies on the participation and wisdom of Indigenous leaders and community members to advance financial inclusion,” she added. “How can we leverage this model of engagement and shared learning?

“Financial inclusion is not a one-size-fits-all issue. Involving consumers and communities in identifying issues and crafting approaches for solutions is critical to success. Advancing financial inclusion will clearly take many hands and a diverse set of stakeholders,” Bowman went on to say.

You can watch her entire presentation on this website.