Growing volume of paper booked in Q3 has terms stretching toward 2033

Chart courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Imagine an excited individual who financed and took delivery of a used vehicle on Labor Day. Perhaps it was a gently used, older car or maybe even a certified pre-owned model.

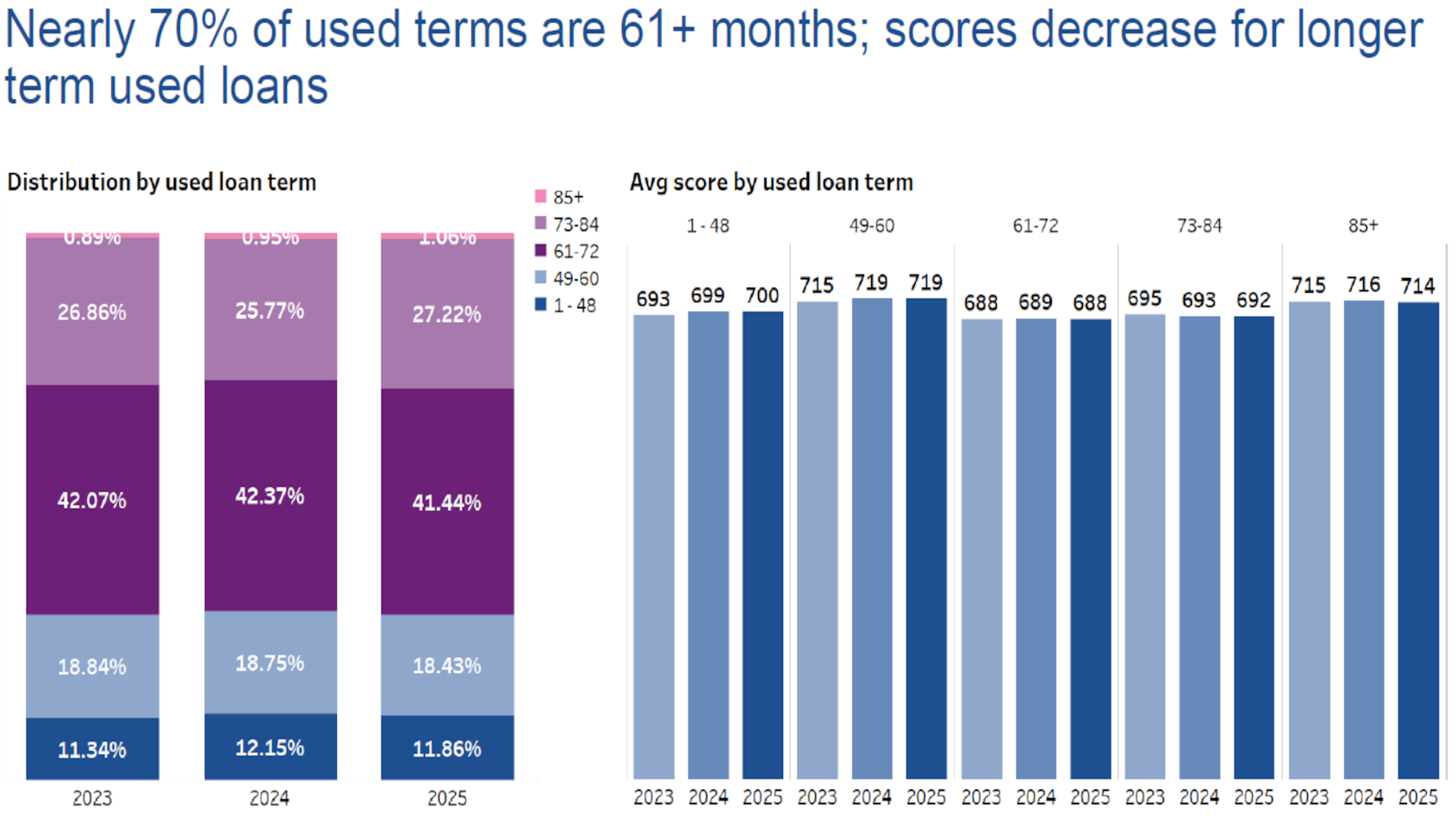

There’s a possibility that contract won’t reach its payoff date until Nov. 1, 2032. That’s because Experian reported on Thursday that 1.06% of all used-car financing booked in the third quarter had terms stretching more than 85 months.

“Consumers tend to shop for vehicles based on monthly payment,” said Melinda Zabritski, Experian’s head of automotive financial insights. “Although we’re beginning to see interest rates slowly decline, affordability remains top of mind for many shoppers.

“It’s not surprising to see some shoppers explore the idea of extending loan terms to secure a lower monthly payment,” Zabritski added in a news release that highlighted Experian’s State of the Automotive Finance Market Report: Q3 2025.

Experian reported the average interest rate for used-car financing in Q3 decreased to 11.40% from 11.86% last year. However, analysts said the average loan amount went up $825 from last year to $27,128 and the average monthly payment slightly grew from $524 to $532 during the same period.

On the new-car side in the third quarter, Experian indicated the average interest rate for new-vehicle financing declined to 6.56% from 6.65% in Q3 of last year. Meanwhile, analysts determined the average loan amount increased $1,378 year-over-year, reaching $42,332 during the quarter, and the average monthly payment increased from $735 to $748 in the same period.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

And to show that hypothetical scenario from Labor Day wasn’t too farfetched, Experian detailed how terms are stretching throughout the market.

For instance, the percentage of new vehicles with 73- to 84-month contract terms increased to nearly 30%, up from just over 27% a year ago.

Similarly, the percentage of new vehicles with loan terms of more than 85 months reached 2.31%, up from 1.83% over the same period.

Furthermore, the percentage of used vehicles with 73- to 84-month contract terms increased to 27.22%, from 25.77% the previous year.

Additional report findings from the third quarter included:

—Banks remain the leader for total automotive financing market share in Q3 at 28.91%, followed by captives (26.20%) and credit unions (21.10%).

—30-day delinquencies increased to 2.45% in Q3, from 2.39% in Q3 2024, while 60-day delinquencies slightly grew from 0.92% to 0.96% over the same period.

—New-vehicle financing grew during the quarter, reaching 43.27%, up from 41.74%. Meanwhile, used vehicle financing declined from 58.26% to 56.73%.

—The average monthly savings when refinancing a vehicle has consistently grown since 2023, reaching $77 in Q3.

—CUVs and SUVs continue to comprise the majority of new-vehicle financing at 63.59%, from 62.87% last year. On the contrary, sedans declined from 16.15% to 14.63% over the same period.