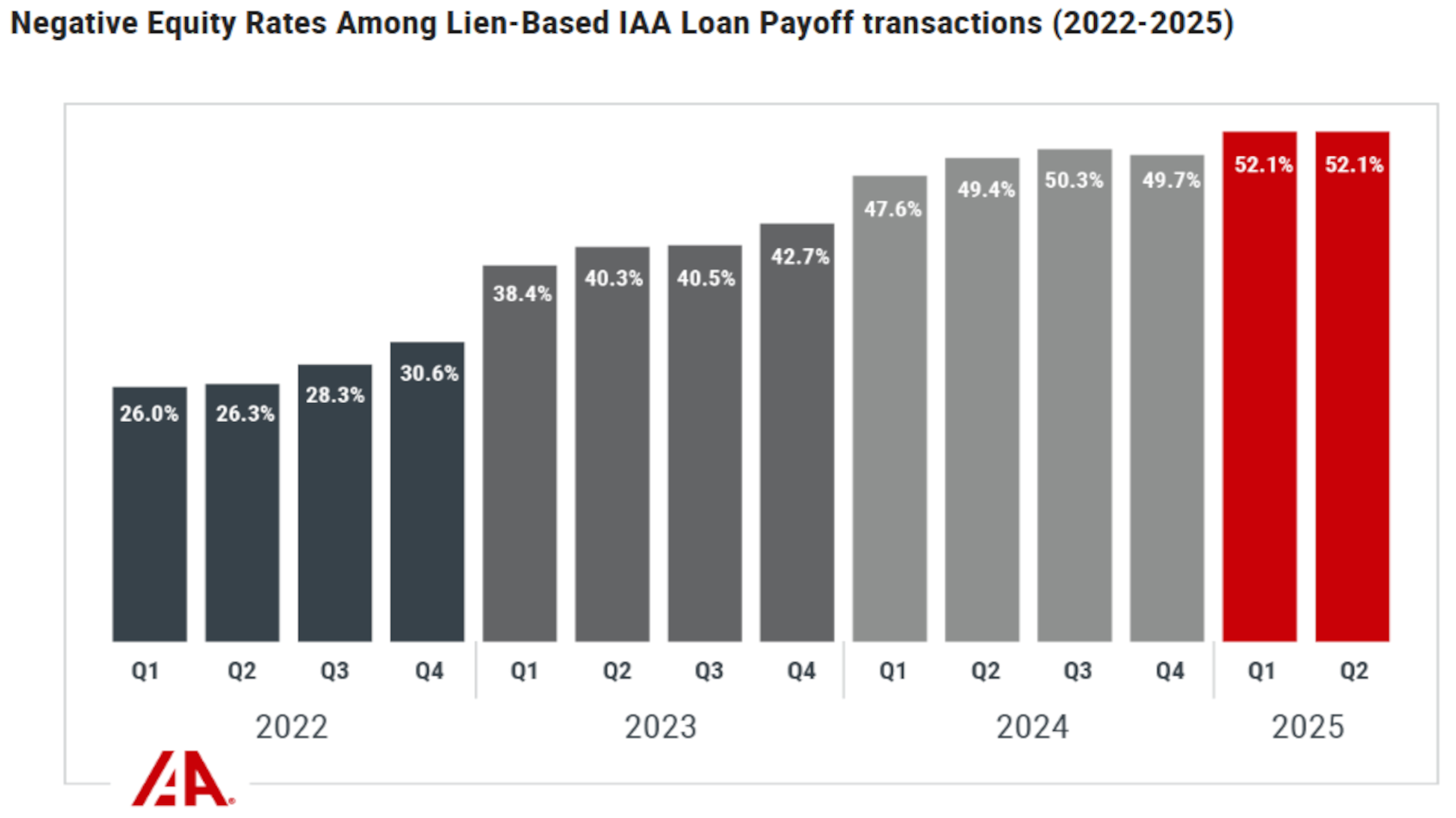

IAA sees salvage transactions with negative equity remain at 3-year high in Q2

Chart courtesy of IAA.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Negative equity can be significant hurdle to clear when dealerships handle trades, as Edmunds recently reported 7.7% of trade-ins toward a new-vehicle purchase during the second quarter were upside down by more than $15,000.

Negative equity can be a conundrum in the repossession and recovery worlds, too, especially if the vehicle ends up as a salvage unit.

IAA closely tracks negative equity trends on vehicle transactions within the IAA Loan Payoff portal.

As of the second quarter, IAA reported the share of negative equity transactions held steady at 52.1% and remained at a three-year high. IAA observed negative equity transactions increase by 12.2% from 2022 to 2023 and increase by 8.6% from 2023 to 2024.

According to a company blog post, the share of negative equity transactions in IAA’s pipeline stood at 26.3% after Q2 2022.

“The consistent increases in negative equity can largely be attributed to historically high prices of new and used vehicles, which have been driven by multiple factors, including supply chain constraints, longer loan terms, and higher interest rates,” IAA said.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“With negative equity rates still high, IAA Loan Payoff remains a critical tool for sellers to manage their total loss transactions,” the company added.

And while speaking about purchases, not delinquency nor repossessions, Edmunds’ director of insights Ivan Drury explained the quagmire that can be created with negative equity.

“Consumers being underwater on their car loans isn’t a new trend, but the stakes are higher than ever in today’s financial landscape,” Drury said in a news release. “Affordability pressures, from elevated vehicle prices to higher interest rates, are compounding the negative effects of decisions like trading in too early or rolling debt into a new loan, even if those choices may have felt manageable in years past.

“And as buyers take on new loans with much higher interest rates than those from just a few years ago, even potential tax deductions can’t meaningfully offset the thousands more they’ll pay in interest. With a growing share of upside-down owners thousands of dollars in the red, many are at risk of getting stuck in a cycle of debt that only grows harder to break over time,” Drury went on to say.