Levison on repossession compliance: Mobile platforms put the goal line in sight

Image courtesy of ALS Resolvion

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

CHARLOTTE, N.C. –

Anyone who has been involved with the repossession industry over the past several years knows that the world looks very different today than before the Consumer Financial Protection Bureau arrived. Most of the focus during this period has been on third- and fourth-party oversight. Given the CFPB’s official position on vendor management, it is no longer acceptable to rely solely on the agent or repossession management company to keep their shops in order.

Today, extensive vetting, on-site visits to every storage lot, proper contracting, performance/compliance score cards and broader insurance coverage are the norm. As a result, lenders and regulators can be comfortable that the agents recovering cars on their behalf have been well vetted and are closely monitored. Indeed, the CFPB has expressed general satisfaction on this aspect of vendor management

At this point, there are two primary areas the CFPB is focused on when it comes to repossession:

1. Fees that consumers are charged for retrieving personal property, and to a lesser extent redeeming their vehicle

2. Repossessions made in error

Adequately addressing these issues will pretty much squeeze out the remaining regulatory concern and legal exposure.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The “fees” issue has largely been addressed, especially by major lenders. Most have either mandated that any consumer charges be billed back to the lender (and posted to the customer’s account) or the allowable charges have been capped at defined and reasonable levels. There is still the issue of ensuring that agents follow the requirements, but we will save that for another post.

This leaves the issue of repossessions in error as the final major area to be addressed. Indeed, the CFPB has referenced the matter in its last two bulletins.

The vast majority of repossession in errors occur due to communication breakdowns. We see two types:

1. Internal communication breakdown within the lender’s operation where the auto repossession management company or agent was not notified when a repossession order was put on hold or closed. As a repossession management vendor for lenders, there is not much we can do to impact their internal processes/operations.

2. Vendor(s) communication breakdowns when a hold/close has been issued properly by the lender but the proper communication and systems updating by all involved parties did not take place.

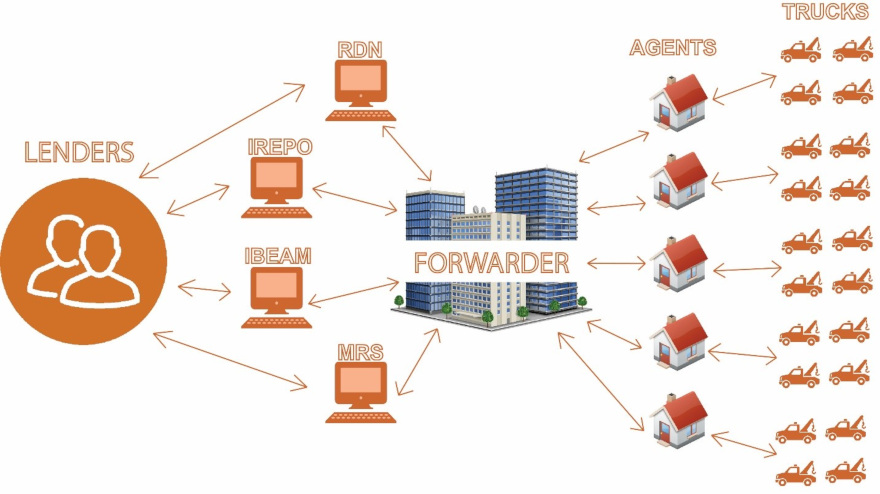

The latter is largely a technology issue. The lenders, management companies (forwarders) and agents generally operate on different platforms and degrees of sophistication. And for each of these players, there are multiple platform options. Breakdowns can occur at each point along the way and these breakdowns account for a large percentage of repossession in errors. The diagram at the top of this page illustrates the challenge and the components/integrations that must be in place to solve the problem.

To address the challenge, there must be close to real time communication from lender to forwarder to agency system of record to repo truck driver. Fortunately, recent improvements in systems integrations and the emergence of mobile platforms supporting repossession agency operations, provide solutions to the challenge, for the first time.

Today, there are two primary mobile platforms that, if integrated properly, can support the data exchange requirements. These are RDN/Clearplan and the Recovery Compliance Mobile (RCM) platform provided by MBSi. While each takes a somewhat different approach, both are solid systems that are designed to provide compliance functionality at the truck level. The recent acquisition of Clearplan by RDN and KAR Auction Services does offer some additional functionality and efficiencies made possible by the fact that the vast majority of repossession agencies use these two platforms as their systems of record.

If your institution relies on repossession management companies (forwarders) to coordinate the repossession activity, deep integrations with these platforms must be in place. Due to internal constraints, very few have the capability to facilitate the data between the various parties regardless of the source. At ALS Resolvion, we have invested heavily in these integrations and by mid-February, we will be only utilizing repossession agencies that deploy this type of mobile technology in the field.

Our expectation is that more and more lenders will be mandating real time “two-way” communication all the way down to the truck level. Doing so will bring us all very close to meeting both regulator and lender senior management expectations for squeezing out repossession made in error.

Mike Levison is the chief executive officer of ALS Resolvion. More details about the company can be found at www.alsresolvion.com.