New FICO report shows deterioration of scores among consumers already in auto portfolios

Charts courtesy of FICO.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The FICO Score Credit Insights report — a new analysis offering a detailed look at how consumer credit behaviors are evolving across the United States — contained some notable trends about auto financing, especially associated with the consumers already in your portfolio.

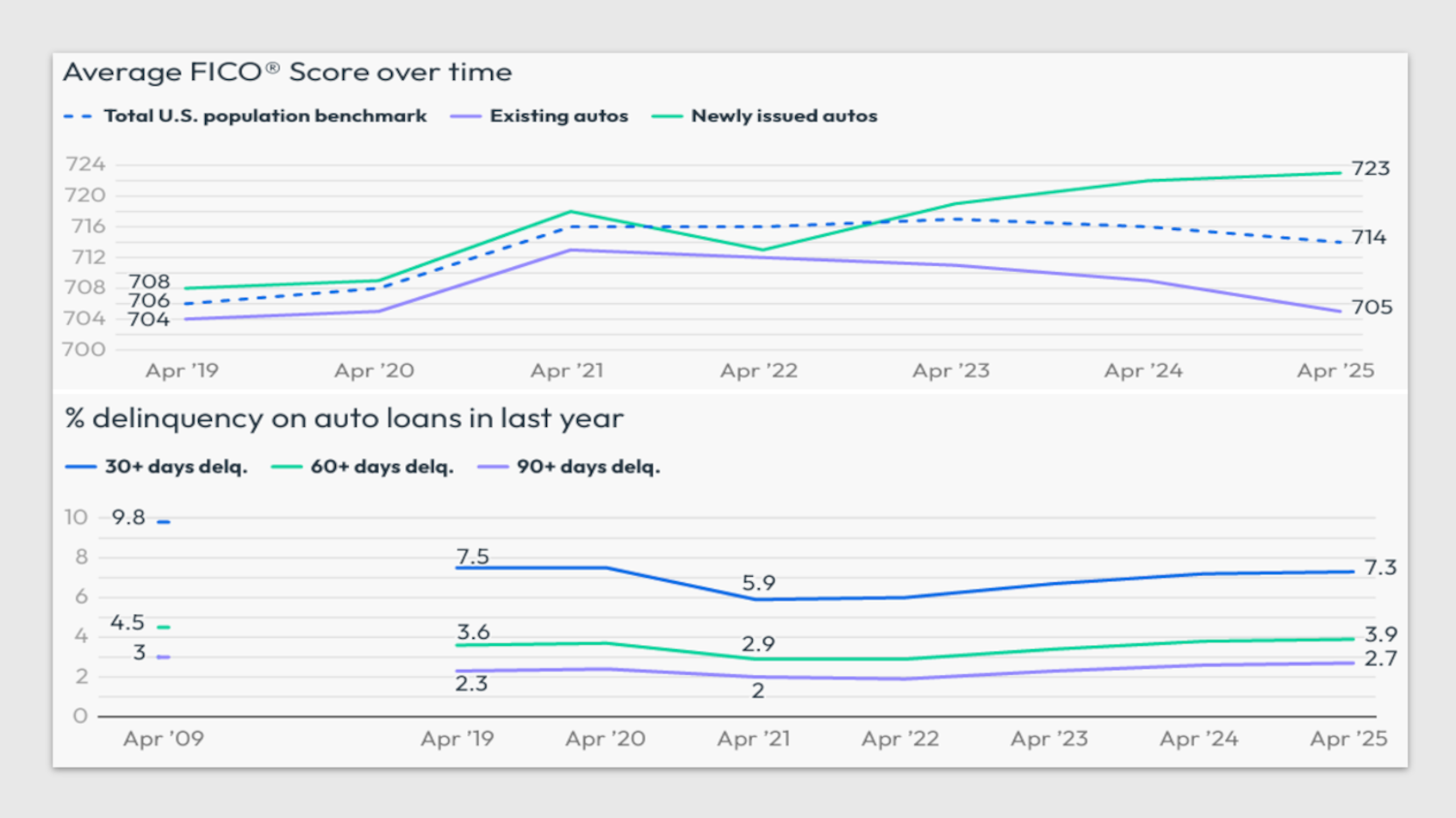

Analysts indicated the average FICO Score for newly issued auto finance loans has increased since 2022, even while the average FICO score for existing auto finance loans decreased in that period.

FICO computed there was only a 1-point difference between existing and newly issued loans in 2022, but now there is a 17-point difference as those older vintages have worse credit on average than recent vintages.

Additionally, 2022 was the only period where the average score for newly issued loans was lower than the national average, according to FICO’s new report.

Also of note, FICO shared that auto finance loans have jumped to the top of the payment hierarchy now that mortgage and student loan forbearances are no longer readily accessible.

“So, while the delinquency rates in mortgage and student loans have recently increased, the delinquency rate on auto finance loans stabilized since last year, stopping the trend of increasing auto delinquency rates that began in 2021,” analysts said in the report.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

But FICO acknowledged the auto delinquency rate is up a 24% since 2021.

“The stabilization of the delinquency rate can be partly attributed to recent vintages’ higher credit quality, and the 30-plus-day delinquency rate of 7.3% continues to be lower than the pre-pandemic figure from 2019 (7.5%) and the Great Recession figure from 2009 (9.8%),” analysts said.

“Notably, the pandemic in 2020 led to anomalies in credit reporting and behaviors due to payment accommodations and government stimulus,” they continued.

FICO also touched on how its data showed growth in outstanding balances in auto finance.

“Unlike other products (where lower-scoring consumers have seen their balances increase at a significantly higher rate than other score groups), all score groups have seen their auto finance balances increase at a similar rate since 2019,” analysts said, noting that all groups saw balances increase between 28% and 32%.

“This is slightly greater than the rate of inflation, where prices are 26% higher in 2025 compared with 2019. Regardless of score range, auto borrowers are similarly impacted by increases in car prices and are experiencing affordability challenges,” FICO went on to say.

With its scores used by 90% of top U.S. lenders, FICO highlighted that its findings can provide critical visibility into how Americans are managing credit. The report also connected how inflation, resumed student loan payments, and evolving payment priorities are reshaping credit scores and delinquency patterns nationwide.

“We created the FICO Score Credit Insights report to help the industry uncover the most impactful trends influencing consumer credit behavior,” said Julie May, vice president and general manager of B2B Scores at FICO. “This data shows how consumers are adapting — whether by prioritizing essential payments like auto loans, navigating the return of student loan obligations, or actively monitoring their credit health.

“We hope this proves to be a powerful tool for lenders, policymakers, and advocates working to support financial resilience and inclusion,” May continued in a news release.

Other key findings from the report included:

—National average FICO score at 715: The average score dipped two points from 2024 (although remained stable since FICO’s last update), driven by rising credit card utilization and a spike in missed payments, in part due to resumed student loan delinquency reporting.

—Younger consumers see bigger credit score swings: Gen Z consumers (ages 18–29) experienced the largest average FICO score decrease of any age group, down 3 points year-over-year. This group also showed a higher rate of more than 50 point score swings than the national average, reflecting greater financial volatility. A key driver is student loan debt: 34% of younger consumers hold student loans, compared to just 17% of the total population.

—K-Shaped economic recovery reflected in credit scores: The middle score range (600–749) shrank from 38.1% of the population in 2021 to 33.8% in 2025, while more consumers moved into both the highest and lowest score brackets, reflecting a K-shaped recovery.

“The data reflects a K-shaped economy, where consumers are experiencing different financial outcomes but also adapting in meaningful ways,” said Tommy Lee, senior director of predictive scores and analytics at FICO. “We’re seeing a reordering of payment priorities, with auto loans now surpassing mortgages at the top and student loans at the bottom.

“This shift highlights how consumers are making strategic choices to protect essential assets and manage their financial obligations. These insights help lenders better understand evolving behaviors and support consumers with more tailored solutions,” Lee went on to say in the news release.

Complementing the credit file analysis, a consumer survey commissioned by FICO and conducted by The Harris Poll found that some Americans have sought new credit or relied on credit to manage financial needs.

According to the survey, nearly one in four Americans (24%) say they opened a new credit card in the past year, and 13% opened a new personal loan, as a financial cushion.

When faced with job loss or income reduction in the past 12 months, nearly half of Gen Z say they relied on credit cards or Buy Now, Pay Later (BNPL) loans (48% each) to make ends meet.

Among borrowers with student loan debt, short-term credit options are especially common: 64% of Gen Z (ages 18-28) and 61% of millennial (ages 29-44) borrowers report relying on credit cards or other types of loans more heavily in the past 12 months to help cover expenses.

Encouragingly, survey results showed credit awareness is strong, as 71% of Americans say they check their credit scores multiple times per year, and 55% checked at least once in the past year to improve their financial health.

Nearly half of Gen Z (46%) and millennials (45%) say they monitor their scores monthly, suggesting a growing interest in maintaining financial health, according to the survey.