New info from TransUnion & LendingTree again shows how auto-finance risk rose to close 2025

Chart courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

New information released this week from TransUnion and LendingTree showed the growing risk auto-finance providers are absorbing.

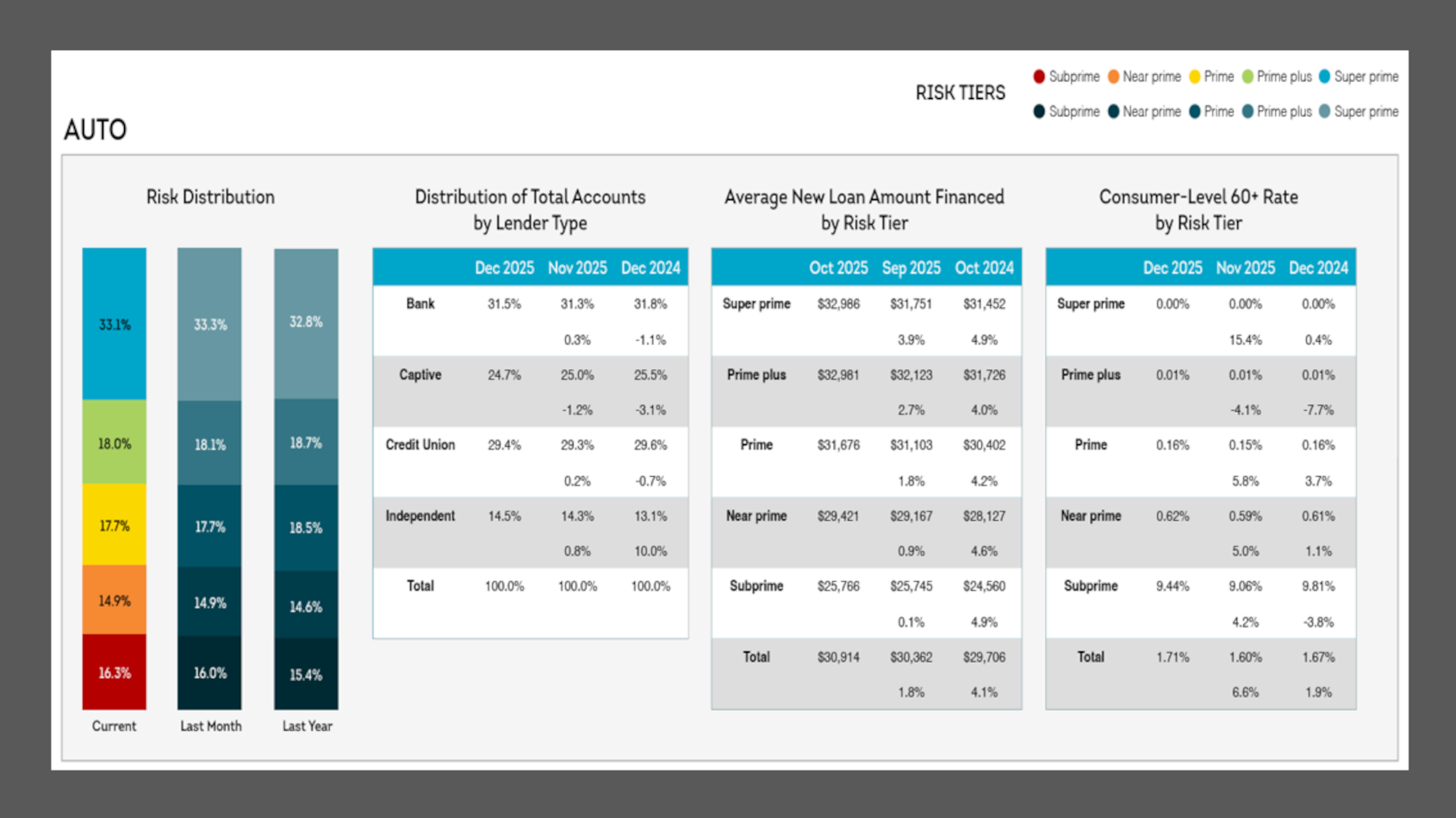

According to TransUnion’s Credit Industry Snapshot for December, the average contract amount financed in October increased to $30,914 from $30,362 in September and $29,708 in October 2024.

Analysts reiterated data for originations has a reporting lag.

Delinquency data, however, is more current, as TransUnion reported the rate of consumers 30 days past due in December increased sequentially by 17 basis points to 4.49%. Based on the same comparison, analysts added the rate of consumers more than 60 days increased 11 basis points in December to 1.71%.

The snapshot also showed the risk tier distribution of the current industry-wide auto-finance portfolio broke down this way:

—Super prime: 33.1%, which is up from 32.8% a year earlier

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—Prime plus: 18.0%, which is down from 18.7% a year earlier

—Prime: 17.7%, which is down from 18.5% a year earlier

—Near prime: 14.9%, which is up from 14.6% a year earlier

—Subprime: 16.3%, which is up from 15.4% a year earlier

TransUnion pointed out delinquency also rose in three other major credit categories, including:

—Mortgage: Rate of consumers 30 days past due increased 8 basis points to 2.91%, the rate of homeowners who are more than 60 days past due increased 10 basis points to 1.51%, and the rate of people who are more than 90 days behind increased 7 basis points to 0.97%

—Bankcard: Rate of consumer 30 past due increased 11 basis points to 4.95%, while the 60-day rate increased 8 basis points to 3.51%, and the 90-day rate increased 9 basis points to 2.58%

—Unsecured personal loan: Rate of consumers who are 60 days or more past due increased 12 basis points to 3.99%

“TransUnion’s December 2025 Credit Industry Snapshot saw serious consumer-level delinquency rates increase across products. Meanwhile, balance growth was mixed,” analysts said in a report that accompanied the data.

“The U.S. economy ended 2025 demonstrating stability amid changing dynamics. Economic growth for the fourth quarter was expected to remain positive — supported by steady consumer activity and easing financial conditions — when official figures are released later this month,” TransUnion continued. “At the same time, the labor market cooled from the rapid pace of prior years, with the economy adding 50,000 jobs in December and the unemployment rate ending at 4.4%. While job creation slowed and layoffs increased compared to earlier periods, overall employment levels remained solid.

“Economic growth is expected to continue at a moderate pace, with gradual labor market stabilization and inflation trending lower. Consumer credit should benefit from recent reduction in interest rates, though performance will depend on household resilience and prudent risk management by lenders,” TransUnion went on to say.

Meanwhile, a study by LendingTree gave more insight into the burden consumers are carrying, especially associated with their car payments.

LendingTree’s study analyzed anonymized credit reports from 70,000 consumers with active auto loans to compare balances, interest costs, loan terms and payment burdens across generations. Some of the top findings included:

—47.5% of Americans with auto loans have terms longer than 72 months, including 39.9% with terms longer than 72 months, and 7.6% with terms longer than 84 months.

—Gen X borrowers take out the longest auto loans: 53% have terms longer than 72 months, and 7.7% have terms over 84 months.

—Gen Z is least likely to have longer loan terms, with 40% holding loans over 72 months and 5.4% holding loans more than 84 months.

—Gen X auto loan borrowers have the highest monthly payments, and are most likely to have $1,000+ car payments. Gen X average monthly payments are $594.

—9% of Gen X have auto loan payments of $1,000 more, the highest across generations.

—Overall, 5.3% of borrowers pay $1,000 or more per month.

—Millennials and Gen Xers carry the biggest balances. Average loan balances are $22,627 and $22,514, respectively. Gen Z borrowers have the smallest balances at $20,241.

Though their loans may be smaller and the terms may be shorter, LendingTree also noticed Gen Z borrowers put more of their monthly household income toward car payments than any other age group.

In its analysis, Gen Z borrowers spend 13.4% of their average $3,888 earnings on car payments each month.

LendingTree found that Baby Boomers — who are more likely to be retired and have the second-lowest monthly incomes, at $4,971 — are next-highest at 11.1%.

The study showed millennial borrowers (7.7% of their $7,674 monthly income goes to payments) and Gen Xers (7.1% of $8,338) follow behind.

“Car buyers face pressure from every angle right now — high prices, high rates, rising insurance costs and tariff uncertainty. Buyers need to shop rates aggressively, shorten loan terms when possible and focus on total cost, not just the monthly payment,” LendingTree chief consumer finance analyst Matt Schulz said in the report, which is available via this website.